LOSING THE EDGE : Asian Economies Are Octopuses in Tigers’ Clothing

- Share via

They are known as the Four Tigers: Hong Kong, Singapore, South Korea and Taiwan, lands whose unparalleled pace of economic development in the last two decades has turned them from meek kittens into ferocious predators in the world’s high-technology marketplace.

The Times/Booz-Allen survey, however, suggests that the newly industrialized Asian economies might more properly be labeled the Four Octopuses. Like the many-armed octopus, their still-evolving industries reach out in all directions to capture the technological know-how of their competitors.

Until recently, Asia’s high-technology companies have seemed content to be bottom feeders, the survey says, acquiring their technology from outside sources and relying on their relatively low-cost labor forces to compete for markets created by Japanese and American innovation.

It has been a successful strategy. Throughout the 1980s, the Asians have stood among the world’s leaders in high-tech exports, and in the last few years they have piled up huge surpluses in their high-tech trade with the United States.

But now, as did Japan before them, the Asians have recognized that they must become not just low-cost manufacturers and assemblers of other nations’ products but full-fledged producers of advanced, home-grown goods.

“They are working hard to develop substantial, indigenous industry that is capable of competing on a world basis,” said Alan D. Bickell, managing director of intercontinental operations for Hewlett-Packard, a computer firm with operations in all four nations. “The focus seems to be--and appropriately so--on moving up the technological scale and having more knowledge-based industries, as opposed to simply producing high-volume, high-quality products at low cost.”

It is probably the Japanese who have most to fear from their neighbors’ technological progress in such spheres as consumer electronics, analysts say. For better or worse, American companies already have conceded the field.

“The Japanese have largely wiped us out of the businesses that the Four Tigers are really entering into,” Bickell noted.

According to the survey, Asian industries expect for the next decade to continue to turn to other nations as their major sources of technology.

While 87% of Japanese executives and 77% of U.S. executives ranked internal development as their companies’ most important source of innovation in the 1990s, fewer than half of the other Asian executives had similar expectations. Less than half of the Asian companies, meanwhile, spend more than 1% of their revenue on research and development.

Technology Buyers

How do the Asians acquire technology? According to the survey, they are more enthusiastic than their U.S. and Japanese counterparts about licensing technology from other companies and entering alliances with foreign firms--especially joint ventures. Nearly two-thirds of the Asian companies said they were net buyers of technology over the last five years, though fewer, about half, expect to remain so for the next five years.

“They’re saying, ‘As you develop technology, we want a piece of it,’ ” said F. Stan Settles, president of the Institute of Industrial Engineers and director of planning for the Garrett Engine Division of Allied-Signal Aerospace. “What they really want is your technology, even more so than your jobs.”

But Asian managers, and the government bureaucrats who exert strong control over their economies’ development, recognize that the growth fueled by their success in low-cost production has begun to drive labor costs up. In the electronics industry, for instance, Taiwanese workers’ monthly wages jumped 50% from 1985 to 1987, and Korean workers’ wages leaped 45%, according to an analysis by the Merrill Lynch brokerage firm’s international economists.

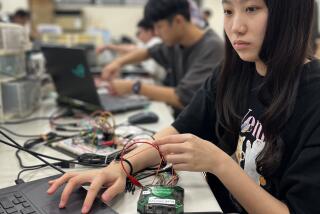

As lower-wage nations--including Malaysia, Thailand and China--begin to lure mass-production industries such as component assembly, the tigers are becoming obliged to compete in high-technology fields that require more ingenuity, such as semiconductor fabrication, software development and consumer electronics, economists say.

“If they’re going to extend the real growth rates in gross national product they’ve achieved over the last 20 years--if they’re going to sustain that through the next 20 to 40 years . . . they will have to begin to successfully compete in these higher-technology areas,” said Ronald L. Solberg, senior international economist at Security Pacific Bank in Los Angeles.

Gradually, all four of the tigers are waking up to the challenge.

In 1985, Singapore created a venture-capital fund to spur technological innovation; officials want the tiny city-state to become Asia’s software development capital. A year later, South Korea began a government-subsidized drive to become a major world competitor in computer memory systems by the year 2000.

Meanwhile, Taiwan’s government established a high-tech industrial park and began pouring investment into research in telecommunications, electronics and automation. Later this year, two Taiwanese firms are expected to demonstrate their new engineering muscle by introducing IBM-compatible personal computers. And in Hong Kong, where the colonial government has a more hands-off relationship with business, companies are nudging forward the technology of cellular radios, telephones and answering machines.

Each of the four is trying to build its base of scientific and technical knowledge as well. In the last five years, for instance, the number of South Koreans and Singaporeans studying at American universities has jumped about 150%, according to the New York-based Institute of International Education.

“Clearly, the bottom line is that there’s a substantial movement over time toward more originality of design, more knowledge-value added locally and more ability to compete directly in the world marketplace, as opposed to simply being behind the scenes as a high-quality, high-volume, low-cost manufacturer,” Hewlett-Packard’s Bickell said.

Clear Message

The tigers’ aggressiveness has a darker side. All four have raised the hackles of their competitors--especially in the United States--by pirating technology, failing to respect patents and otherwise taking advantage of their alliances with foreign firms. Nearly three-fourths of the American and Japanese executives surveyed expect piracy to be a growing problem in Asia.

Spokesmen for U.S. high-tech industries say only Singapore--concerned about the security of its own fledgling software industry--has demonstrated a firm commitment to crack down on intellectual theft. The other nations have begun tightening their laws, but seem halfhearted about enforcing them, said Linda Colancecco, manager of intellectual property issues for the Computer and Business Equipment Manufacturers Assn. in Washington.

“The fight isn’t over, because they’re still copying,” Colancecco said.

Yet the Asian executives surveyed by The Times and Booz-Allen seemed almost oblivious to an issue that has been a major bugaboo in international trade relations.

Only 41% of the Asian executives expected piracy to be a growing problem in Asia. Only 22% said the U.S. was giving away its technology to foreign competitors, compared to 49% of the U.S. executives. More than half of the Asians insisted piracy could be prevented in alliances with other companies. Barely a quarter of the American executives were so confident, and only 15% of the Japanese executives agreed.

The message seems to be that the four Asian industrial economies, by whatever means prove necessary, intend to play an ever-larger role in the Pacific technology competition. While they’ve gotten this far on the strength of others’ innovations, analysts say that is no reason to disregard them as competitors.

Play ‘Keep-Ahead’

After all, it isn’t easy to tame a tiger--or wrestle an octopus, for that matter.

“It’s sort of a conceit of the West to assume that countries that have played catch-up by imitation are capable only of second-rank status,” said Steven Quick, senior economist for the congressional Joint Economic Committee. “The evidence is that once they’ve caught up, the same skills that helped them play catch-up so well will help them play keep-ahead.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.