Suit Attempts to Upset Vote for Tax Hike to Build Jails

- Share via

Charging that a half-cent sales tax increase approved by San Diego voters last month to finance new jails and courtrooms is unconstitutional, opponents of the measure filed a lawsuit Tuesday seeking to invalidate the election and block collection of the tax.

In the lawsuit filed in Superior Court, attorney Louis Katz argues that the local sales tax increase, which county officials estimate would generate $1.6 billion for jails and courts over its 10-year life, violates Proposition 13 and other laws requiring a two-thirds vote for approval of new taxes. The sales tax measure--Proposition A on the June primary ballot--was endorsed by 50.6% of the voters.

County officials, however, said that state legislation specifies that only a simple majority vote is required for passage of Proposition A, which will raise the sales tax to 7% Jan. 1. Confident that the lawsuit will be dismissed, county administrators characterized the action as an attempt by Proposition A’s opponents to accomplish in court what they could not gain at the ballot box.

Legal Question Disputed

“The question of the 50% vote was thoroughly looked at when this was before the Legislature,” Assistant Chief Administrative Officer David Janssen said. “We’re not concerned about that point.”

No court date has been set for a hearing, but both sides predicted Tuesday that the lawsuit will be resolved before the tax’s Jan. 1 effective date.

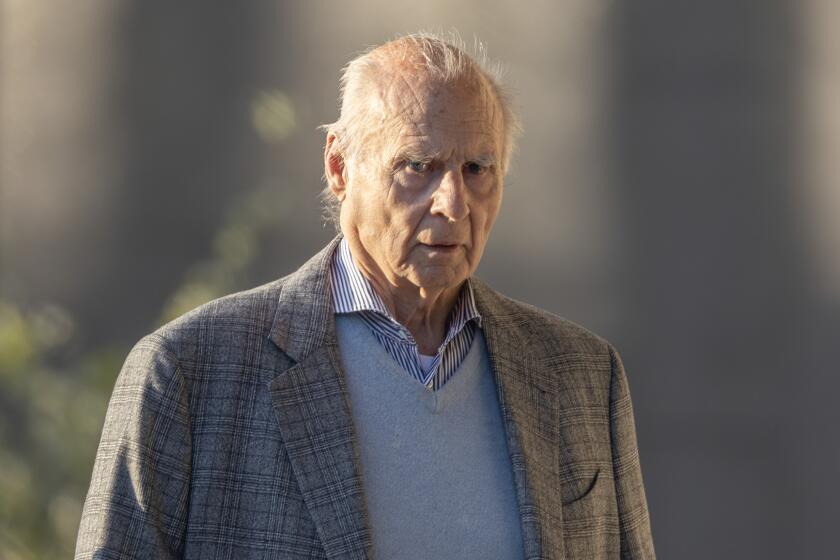

Katz filed the suit on behalf of three Proposition A opponents: Libertarian Party members Richard Rider and Pat Wright, and Steven Currie, executive vice president of United Taxpayers of San Diego, a 100-member nonpartisan group that campaigned against the measure.

In the suit, Katz describes the 1987 state legislation that set the stage for last month’s campaign as a “sham” that illegally circumvents Proposition 13, the landmark 1978 statewide tax-cutting initiative, and violates other laws requiring a two-thirds vote for imposition of taxes.

Under that state legislation, the revenues generated by Proposition A would be administered by the San Diego County Regional Justice Facility Financing Agency, a seven-member board consisting of two representatives of the Board of Supervisors, a Municipal and Superior Court judge, Sheriff John Duffy, and one member each from the City of San Diego and another incorporated city. The funds, in turn, would be spent in accord with plans developed and approved by the Board of Supervisors.

The primary purpose behind the creation of that agency, Katz contends, was to “exploit loopholes” in Proposition 13 that were created by California Supreme Court decisions exempting local agencies not authorized to levy property taxes from the two-thirds vote requirement. County and state officials sought that “back-door method” for approval of Proposition A, Katz added, after a similar five-year, half-cent jails tax on the November, 1986, ballot failed when it drew a narrow 50.7% majority, far short of the then-required two-thirds margin.

But Katz argues that Proposition A still should have been subject to the two-thirds requirement because the seven-member agency “is not an independent governmental entity,” but rather is “merely an agency and alter ego of the County of San Diego and the . . . Board of Supervisors.”

“The agency was merely a device created by local politicians to permit the county to evade the limitations of Proposition 13 and to illegally impose taxes with less than a two-thirds vote of the people,” Katz said.

Broadening that argument, Katz charges in the lawsuit that the sales-tax measure also violates Proposition 62, an initiative approved in November, 1986, that prohibits governmental entities from imposing any “special tax” for “specific purposes” without a two-thirds vote.

Matter of Semantics?

With Proposition A funds being clearly earmarked for new jail and courtroom construction and maintenance, the half-cent sales tax “is clearly subject to Proposition 62 limitations,” Katz said.

But County Counsel Lloyd Harmon argued that proceeds from the half-cent sales tax will finance “general governmental purposes” administered by the Justice Facility Agency, a semantic distinction that would again exempt it from the two-thirds requirement.

“There’s nothing new in this suit--all these questions were raised and studied before,” Harmon said. “It’s our view--and that of the Legislature’s counsel--that a simple majority was all that was required. . . . All that remains is for a court to agree.”

Similarly, county officials lightly dismissed the other major legal argument raised in the lawsuit--Katz’s contention that Proposition A violates the so-called Gann spending limit--by saying that the measure does not fall within Gann’s jurisdiction.

Libertarian Rider, however, described the county’s position as simply a “flimsy legal rationale . . . for an all-out attack” on Proposition 13 and other spending controls.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.