Technical Equities Officers Must Pay Award

- Share via

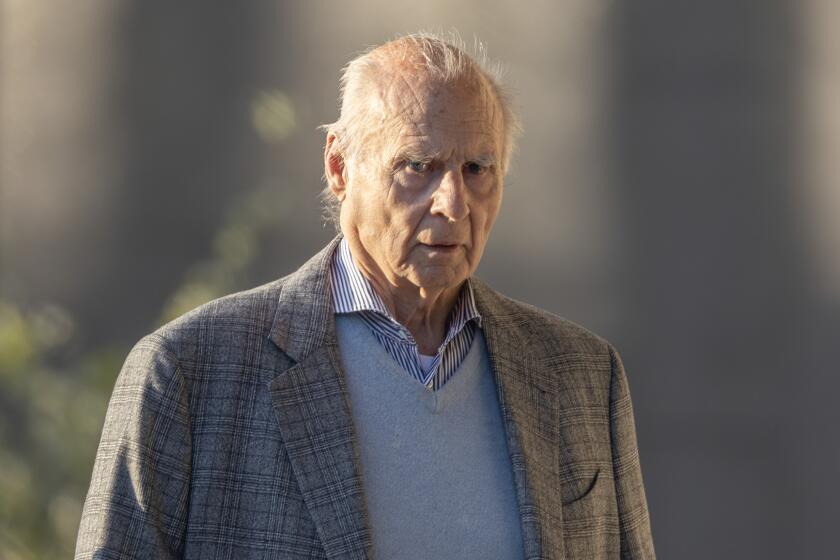

SANTA CLARA, Calif. — A judge Thursday upheld a $147-million jury verdict--the largest investment fraud settlement in California history--and scolded directors of now-defunct Technical Equities Corp.

“This involves the systematic taking of the life savings of old people,” Santa Clara County Superior Court Judge Conrad Rushing told former Technical Equities head Harry Stern and other company principals. “They did it over and over. The actions are clearly as reprehensible as any I’ve seen. The taking of the money was nothing more than theft.”

A jury ruled last month that Stern and his partner Herbert Barovsky are liable for fraud and negligence and ordered them to pay $21 million in punitive damages to each of seven investors. They also awarded $7 million in compensatory damages. Several other company officials were found liable to a lesser degree.

The seven plaintiffs were selected as test cases for some 1,000 other investors who have sued Technical Equities. Rushing is expected to rule in October on whether the ruling applies to the remaining plaintiffs or if additional trials are needed.

Joseph Cotchett, attorney for some 400 of the plaintiffs, said Friday that banks, insurance companies and others have been busy settling many of the claims out of court since the June jury ruling.

Among the investors were a number of elderly couples who trusted the charismatic Stern with their life savings. Others who lost money included wealthy doctors and big-name athletes such as San Francisco Giants pitcher Atlee Hammaker, former Los Angeles Dodgers’ pitcher Don Drysdale and several former members of the Oakland Raiders.

An estimated $150 million in investors’ money was lost when the company filed for bankruptcy protection in 1986.

Stern and former company Vice President John Lindberg earlier this month agreed to plead guilty to fraud and other charges in a plea bargain with federal prosecutors.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.