Assessed Value Surges 10.5% in Orange County

- Share via

Southern California’s booming real estate market has caused a 10.5% jump from last year in the assessed value of Orange County property, the biggest increase in four years and about 2% higher than county officials had expected.

Tax assessment rolls just released showed that property values in Laguna Beach jumped 40% over last year, county officials said. Yorba Linda posted the second-largest increase, 25%.

For financially strapped county and city governments, the increase in assessed values spells unexpected additional property tax revenue that in some cases will help offset projected budget deficits. But for the average property owner who did not remodel or buy a new home, property tax increases are limited to a 2% ceiling per year under Proposition 13.

County experts and real estate observers said they had predicted that the market would be active because there is a shortage of available housing in Orange County. But factors such as the slow-growth issue--which spawned an unsuccessful ballot initiative that sought to limit growth--may have heated consumer appetites even beyond the already volatile conditions, they said.

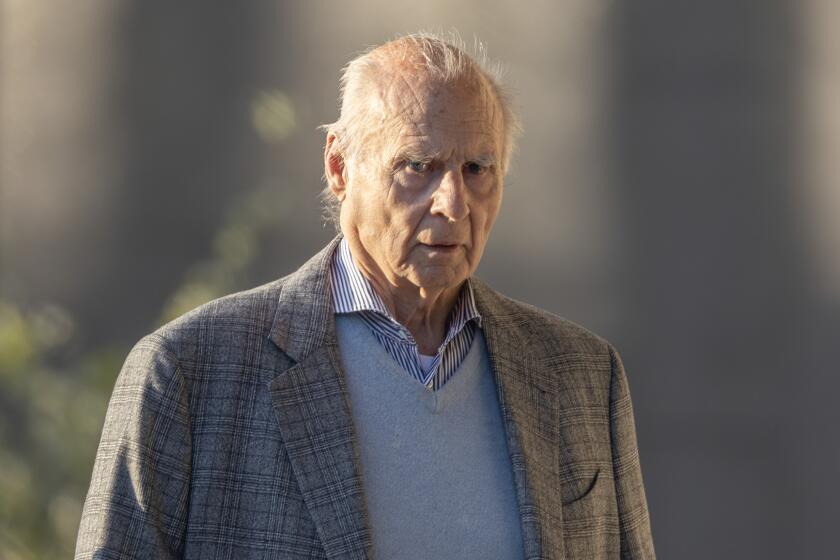

The bottom line, though, Assessor Bradley L. Jacobs said, is that the surge in property values “means Orange County is apparently a good place to store your money. And the best warehouse to store your money (in) is real estate.”

The total assessed value of property in the county was listed at $121.6 billion, up $11.5 billion from the previous year.

This was the county’s first assessment roll that listed the new city of Mission Viejo, which ranked 10th among county cities with assessed property values totaling $3.8 billion. Anaheim was the largest, with $12.1 billion. Irvine was second with $11.4 billion.

The whopping increase in Laguna Beach property values was partially because of the annexation of previously unincorporated South Laguna to the city’s tax rolls.

In Yorba Linda, city finance director Gordon Vessey attributed the 25% jump to 1,200 new homes built in the past year and a 400-unit apartment building.

“That’s good news,” Vessey said. “We’re not hurting, but that will help.”

In February, Jacobs estimated that July assessments would be up 8.5% this year, give or take a percentage point.

Looking ahead to next year, he said he still expects the market to remain healthy.

“Whether it can keep the pace of last year, I don’t know,” said Jacobs, a former economist. “But from here, it looks very healthy.”

The assessment list is used to determine the property tax rate applied for the county general fund. But it is also an indicator of what the other cities and agencies might expect.

“They’re going to have more money than they thought they were,” Jacobs said.

Jim McConnell, an analyst for the county auditor, said the increase could bring an extra $1 million to the county general fund.

The county is about $18 million short of what it needs to maintain all its staff and services for the current fiscal year. The extra money will help balance the shortfall. County officials are hoping to acquire the remainder of the amount from midyear state revenue or the sale of excess county-owned property.

Jacobs said the increase in the assessment roll is from new construction, home sales and renovations of existing properties. New homes, newly bought homes or new renovation work is taxed according to its current market value.

For the “stay-putters,” as they are called in the government--those who have kept their property for several years--Proposition 13 restricts the increase in their assessed property value to a 2% ceiling per year.

Of the 671,000 parcels in Orange County, Jacobs said just 183,000 are assessed at lower 1975 values set after Proposition 13, meaning that those properties have not been significantly altered or sold since that time. Another 253,500 parcels have a tax assessment base year between 1975 and 1978.

Last year, the county’s property assessment roll increased 9.6% above the previous year. But the jump this year was the highest since 1984, when the rolls increased 12.66%.

Jacobs said he believes that the slow-growth initiative probably spurred activity in the county.

Roger Cruzen, a spokesman for the California Realtors Assn., agreed. Earlier this week, the association announced that it had estimated the median home price in the county at $211,000, the highest in California.

“People are buying now because the market is going up, and they’re afraid they might not be able to afford to get in later; they’re moving to bigger homes because they think interest rates might be going up, and in Orange County they think the growth measure also would result in higher prices and fewer homes,” Cruzen said.

“There did seem to be more than the normal increase in prices in Orange County.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.