China Grapples With Inflation, Loan Woes

- Share via

BEIJING — The head of China’s central bank is facing his first major challenge--can he curb the flow of credit and slow the rate of inflation?

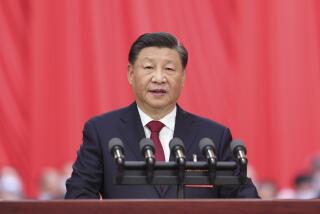

Li Guixian, governor of the People’s Bank of China, must contend with widespread public outcry over soaring prices and a divided Communist Party leadership in his attempts to slow the economy, according to Western diplomats.

A Chinese official, who asked not to be identified, said the State Council (cabinet) believed that the economy was growing too fast, and should be slowed by stemming the credit flow in the second half.

A loose monetary policy in the first half of 1988 helped industrial growth rise 17.2% from the same period last year, while inflation reached 13%.

“Banks must improve the management of loans, get money back before they re-lend and make loans strictly according to credit policy,” Li told state planners at a meeting on the worsening capital shortage, the Economic Daily reported.

“We must deal with the problem of idle equipment, overdue and dangerous loans,” he said.

Li said more than 30 billion yuan ($8.1 billion U.S.) worth of equipment lay idle and that heads of banks and bank branches would be personally responsible for loans made above their set limits.

Li, a 50-year-old Soviet-trained chemical engineer, was chosen to head of the central bank in April, replacing the tough bureaucrat Chen Muhua, who had held the post for three years.

Independence Opposed

Foreign and Chinese bankers were surprised and disappointed at the choice, as Li lacked both financial experience and political clout. One Japanese banker said the leadership picked Li because it wanted a weak bank chief.

“He has achieved nothing important up to now,” the Chinese official said. “It will be years before the central bank is independent. Too many departments oppose it.”

The central bank’s weak stature has hurt its ability to stem the credit flow. Money supply grew in the first five months of 1988, the first rise in that period since 1961.

Bank loans and money issue rose an average 25% a year from 1984 to 1987, while industrial output gained only 11%, official figures show.

Li faces formidable opponents in his bid to curb credit, among them Communist Party chief Zhao Ziyang, the country’s top economic policy-maker.

“We must control money issue but not at the expense of production,” Zhao said late last month.

A Western diplomat quoted Zhao as telling a foreign visitor that a Western-style credit squeeze was unsuitable for China.

“Zhao believes rapid economic growth necessary to create the right conditions for price reform difficult but essential to make the economy work rationally,” he said.

Li also faces opposition from industrial ministries and provincial chiefs that want easy credit for their factories.

“Manufacturers object to a rate rise and so do provincial governments because Peking gets the interest, while their taxes from profits of local companies would fall,” the Chinese official said.

But Li has allies among the leadership, including Vice Premier Yao Yilin, who believes that the economy must be stabilized and supply brought more into line with demand before further price reforms can be implemented.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.