Camarillo’s Fiscal Woes Fading After 1987 Investment Disaster

- Share via

Bond brokers from around the country still call Camarillo City Hall every day looking for Donald Tarnow, the investments officer accused of single-handedly losing all the city’s money and then some in 1987.

The calls continue nearly two years after the discovery that $25 million in the city’s treasury had been wiped out, turned from assets into debts through Tarnow’s high-risk and high-stakes trading in the bond market with public funds.

“We get calls all the time from all over the country from people who worked with Camarillo in its heyday, people who knew Donald Tarnow,” said Finance Director Robert Cole, who joined the staff six months ago. “I tell them we have no money to invest today.”

And for good reason. Camarillo has almost dug itself out of what seemed a bottomless pit when the losses were revealed to stunned city residents in 1987.

The general fund is still $450,000 in the hole, but it was down $4.2 million in July, 1988. The city still owes money to its employees’ pension fund and to the fund in which developers’ fees accumulate. But two very lean years with no-frills budgets that omitted capital improvements, some maintenance tasks, and the replacement of city staff as they quit, have brought the city within sight of fiscal balance. The city expects its general fund finally to be in the black in February.

Camarillo once again can fix its roads and talk about building a long-needed police station. Officials can begin planning again for capital improvements such as widening the city streets where they intersect with Highway 101, projects that were put on indefinite hold two years ago.

And with the notable exception of the position of investments officer, jobs left empty are now being filled.

The city has controls on top of controls in the finance department, said Cole, who will return to his home city of Long Beach and a more lucrative position next month.

Two of four official signatures--no facsimiles allowed, as they once were--are required on every check that leaves City Hall. The books are balanced every day; auditors found them six months in arrears in 1987. A finance committee that includes council members, the finance director and the city manager reviews every investment decision the Finance Department makes. That contrasts with 1987 when only Tarnow knew the extent of his trading--and his losses.

A national firm audits the city’s books annually, replacing a one-man company from Thousand Oaks.

Never again will the city invest as it did in 1987, said City Manager William J. Little. An auditor’s report prepared in May, 1988, by Arthur Andersen & Co. showed that the previous year, Tarnow had moved the city’s reserves from safe but low-yielding investment instruments such as certificates of deposit, into higher-paying, long-term government securities.

With millions borrowed from the brokerage houses to increase the city’s earnings, Tarnow promised to buy interest-paying bonds weeks before the bonds were issued, the Andersen report said. When prevailing interest rates were lower on the day the bonds were issued, the city made money by selling. But the spring of 1987 brought rising interest rates and falling values for the city.

Meanwhile, Tarnow was trading furiously. With every borrowed dollar, he put the city in greater danger, according to the auditors. From December, 1986, to July, 1987, the Andersen report shows, Tarnow bought and sold nearly $1.7 billion in bonds, more than 70 times the cash available to the city.

He began selling off his holdings at losses.

He also dropped more than $3 million in what auditors found to be inappropriate investments for public funds. With a former broker named Anton Nayagan as his adviser, Tarnow bought an interest in a run-down Desert Hot Springs hotel and a convalescent hospital management company, which Nayagan ran, auditors said.

Former owners foreclosed on the city’s interest in the hotel and the hospital company is in the final stages of selling off its two hospitals in Utah, a transaction that will yield no money for the city, said Dennis Burke, a Los Angeles attorney hired by the city.

But the hospital company could wind up costing the city more money still. Attorneys are now preparing for trial the city’s defense against a lawsuit in which Union Bank claims the city owes it $1.3 million. The suit is based on promissory notes Tarnow wrote on behalf of the city to help Nayagan’s hospital company. Nayagan traded the notes in for money at Union Bank, which now wants its money from the city.

The city claims it owes the bank nothing.

The city’s efforts to collect on the losses from three brokerage houses it held responsible have nearly concluded, Burke said.

Camarillo settled the suits for a total of $700,000. United Capital Corp. of Little Rock, Ark., agreed to pay the city $550,000 as compensation for its losses. It has paid $300,000, but defaulted on its $11,000 November installment. Two other firms have agreed to pay a combined $150,000, although final papers are not yet signed.

The city’s $25-million suit against Tarnow and Nayagan will probably go to court this summer, said C. Stephen Howard, a Los Angeles attorney handling the litigation. However, Nayagan filed for bankruptcy three weeks ago in Philadelphia and is no longer a target. Tarnow, on the other hand, has about $500,000 in equity in his home in the Santa Rosa Valley and eight other real estate holdings, Howard said his search of records showed.

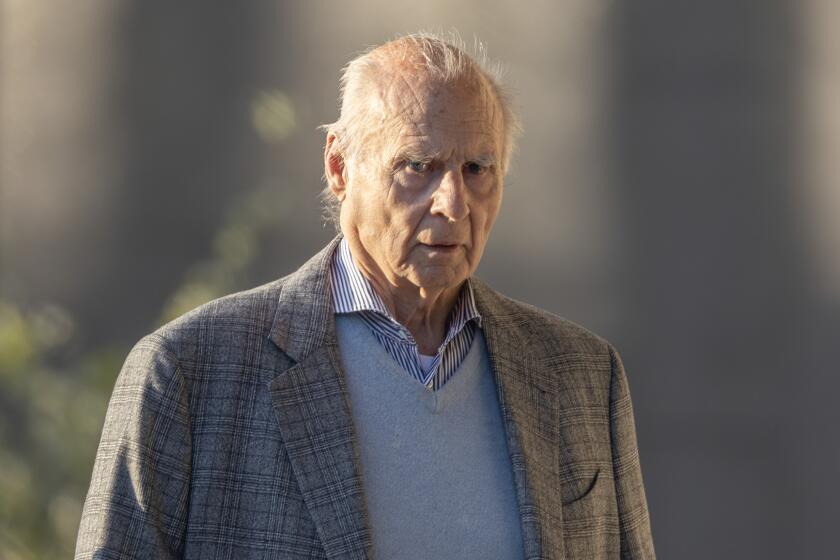

That lawsuit has Tarnow more than a little concerned, the former 18-year city employee said in an interview at his home last week.

Unlike his two former superiors at the city, Tarnow, fired two years ago this February, has not found full-time employment. Former City Manager Thomas Oglesby, who resigned in June, 1988, works as management assistant to the solid waste director at the Ventura Regional Sanitation District. And former Finance Director Larry Weaver, whose resignation came immediately after Tarnow’s dismissal, heads the finance department for Perris, a small city in eastern Riverside County. Weaver said the events in Camarillo have taught him to keep a much closer watch on his department.

But Tarnow said he works sporadically as a consultant on financial matters for local firms, where, he said, his reputation always precedes him.

“I think they recognize the name,” he said. A private and soft-spoken man, he declined to name clients, saying only that they were not municipalities.

Tarnow refused to comment on the lawsuit. But he acknowledged that even with his wife still working as a registered nurse, things have been difficult at the Tarnow house.

In earlier conversations before any suits were filed, Tarnow contended he had sought the best return on the city’s money in accordance with instructions from his superiors. Now, with a suit that threatens to take his home, he says of city officials: “I just don’t think they care.”

Tarnow says he’ll take the stand in his own defense, but finds it futile to speak up now. “It’s been my experience that what people read in the paper they accept as gospel and never forget. I just don’t think it makes any difference at this point,” he said.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.