Three Americans Share the Nobel Prize for Economics

- Share via

STOCKHOLM — Three American pioneers in financial economics and corporate finance won the 1990 Nobel Prize in economics today.

It was the seventh time in 10 years that the award, given by the Swedish Academy of Sciences, has gone to Americans. Since 1969, when the prize was first awarded, 18 of the 30 economics winners have been U.S. nationals.

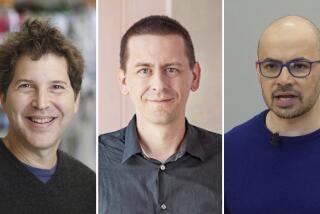

Today’s winners were Harry Markowitz of the City University of New York, Merton Miller of the University of Chicago and William Sharpe of Stanford University. They will divide the prize, worth about $700,000.

The announcement of the prize was delayed for more than 45 minutes, while the academy tried unsuccessfully to reach Markowitz, who is teaching in Japan.

Miller and Sharpe, the laureates the academy reached by telephone, were “really stunned,” said Prof. Assar Lindbeck of the Swedish Academy of Sciences.

He said they asked about the exchange rate between the dollar and the kronor.

“We all want the investments to be as efficient and good as possible in society,” said Bengt Naslund, another academy member, in explaining the award to Markowitz, Miller and Sharpe.

“All these three in different ways have contributed to giving companies such a correct guidance, telling them what capital cost they can count on for different projects which they want to invest in,” Naslund said.

“Each of them (the winners) gave one building block” to the financial market theory, Lindbeck said. “The theory would have been incomplete if one of them had been missing.”

Most of the prizewinners’ work was done in the 1950s and 1960s. Their theories began to be used in the early 1970s, Lindbeck said.

Markowitz, 63, developed a theory of how households and companies allocate their financial assets under uncertain conditions, the so-called theory of portfolio choice.

Sharpe, 56, built on Markowitz’s theory and showed how prices can be calculated for risky assets. Sharpe’s Capital Asset Pricing Model is “considered the backbone of modern price theory for financial markets,” the academy said.

The model is used in calculating the costs of capital associated with investments and takeovers. It is also used in regulating public utilities and in court cases to decide compensation to expropriated companies whose shares are not listed on stock exchanges.

Miller, 67, showed what factors determine a company’s choices in accruing debt and distributing assets.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.