State Sues Brokerage Over Hospital Sale Role : Court: Suit claims Goldman, Sachs and a former broker violated conflict-of-interest laws during negotiations that left taxpayers potentially liable for defaulted bonds.

- Share via

State officials have accused the Goldman, Sachs brokerage firm of violating conflict-of-interest laws in its dealings with an Encino-based hospital company that subsequently declared bankruptcy, leaving taxpayers potentially on the hook for millions of dollars in defaulted bonds.

The state is suing Goldman, Sachs for more than $190 million, alleging that the firm was being paid to help sell two San Fernando Valley hospitals while one of its brokers, as a member of a state advisory committee, was urging state officials to approve a $167-million loan guarantee to finance the sale.

The lawsuit is the latest twist in the tangled financial saga of Triad Healthcare Inc., which purchased the Sherman Oaks Hospital and Health Center and a smaller Canoga Park hospital in 1990. Triad last month closed the Canoga Park facility after failing to find a buyer for it. About 250 employees lost their jobs.

Goldman, Sachs said in a brief written statement Tuesday that the state’s lawsuit was “wholly without merit” and that the brokerage’s actions had nothing to do with Triad’s financial troubles.

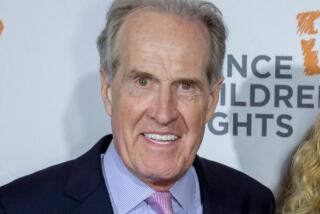

The lawsuit, filed Feb. 3 in Sacramento Superior Court by the Office of Statewide Health Planning and Development, names as defendants Goldman, Sachs and Vincent F. Forte, until recently a broker with the firm.

A Goldman, Sachs spokesman said Forte was laid off in November in a corporate cutback unrelated to Triad. Forte could not be reached for comment Tuesday.

The suit said Forte served from 1984 to 1993 on a committee that advises OSHPD’s Cal-Mortgage program, which insures loans to construct hospitals and other health-care facilities. Because of his expertise in financing health-care projects, OSHPD officials “placed special trust and confidence” in Forte, the suit said.

In August, 1990, Goldman, Sachs also was hired by Nu-Med Inc., which then owned the two hospitals, to help sell them, the state suit said. Later that month, Goldman, Sachs was hired to advise Triad on purchasing the facilities, the suit charged, adding that Forte urged Triad to apply for Cal-Mortgage insurance on $167 million in bonds to buy the hospitals.

In meetings of the state advisory committee later that year, Forte used his position to recommend that state officials approve the loan guarantee--without disclosing that Goldman, Sachs would reap a $1.5-million commission if the sale went through, OSHPD’s lawsuit claimed.

OSHPD also charged that Goldman, Sachs and Forte knew the hospitals were severely overpriced. Although the hospitals were sold for $135 million, they are now valued at only $40 million by the bankruptcy trustee, and the state cannot foreclose on them because of Triad’s bankruptcy filing, the suit said.

Triad filed for bankruptcy and stopped making bond payments in 1993, meaning that the state may have to pay off the bonds with taxpayer money to carry out its obligations as the insurer. The debacle prompted OSHPD to shut down the Cal-Mortgage program, but it was later reopened under new rules that, among other things, prohibit advisory committee members from counseling those who sit in judgment on loan applications while working on behalf of the applicants.

The OSHPD suit said Goldman, Sachs and Forte violated state laws that bar public officials from using their positions to influence a government action in which they have a financial stake. The suit, which contends that Forte was, in effect, functioning as a state official, said the defendants ultimately earned more than $4.5 million from their dealings over the two hospitals.

In its statement, Goldman, Sachs denied any wrongdoing and said Forte “conducted himself ethically” and violated no state laws in his years as an advisory committee member. The former broker disqualified “himself from discussions and decisions” involving his firm and its clients, Goldman, Sachs said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.