Weapons Technology Aids in War Against Credit Card Fraud

- Share via

Technology that helps “smart” weapons find and destroy enemy targets is being used by the banking industry to find and destroy the activity of credit card thieves.

The technology enables computers to quickly build and analyze spending profiles of individual cardholders. It has given banks a sophisticated weapon against theft and counterfeiting that accounts for about $1.5 billion in losses annually.

“It’s able to learn from looking at large numbers of transactions,” said Patricia Campbell, director of marketing for HNC Software Inc. of San Diego, a company that helped develop the technology for the Defense Department and now applies it to fraud detection.

HNC’s Falcon system was promoted this week at the American Bankers Assn. Bankcard Conference at the Long Beach Convention Center, where fighting fraud emerged as a key issue for bank executives considering the growth of electronic commerce through the Internet, smart cards and other new technologies.

“Guess what? The crooks are computer-literate too,” said Susan Sylstra, executive director of the International Assn. of Financial Crimes Investigators, at a seminar attended by about two dozen bank investigators. “We’ve got to be at least as fast or faster than the ways the crooks are getting their information around.”

In defense uses, computers recognize visual profiles of potential targets such as enemy tanks. The system allows pilots and ground troops to fire in the direction of an enemy outside their range of vision and to depend on the missile to find and destroy the target.

HNC, which was spun off TRW Inc. during the 1980s, introduced the Falcon system in 1995. It and other financial and retail products now account for 65% of HNC’s business.

In addition to the advanced computer intelligence that is the basis for the Falcon system, investigators have tapped into a worldwide computer network originally created for the U.S. government. Through the network, the International Assn. of Financial Crimes Investigators manages a secure database through which members can share information about suspected fraud rings and their techniques.

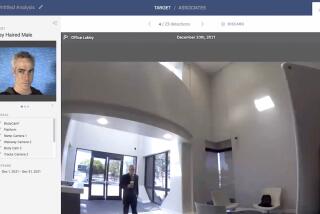

The Falcon system is used by individual banks to alert companies of possible fraud. It works by comparing card transactions to a model of typical fraudulent spending patterns and a historical profile of the cardholder’s purchases over recent months.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.