Latin Markets Plunge as Pressure on Venezuelan Currency Mounts

- Share via

The question is no longer whether there will be a sharp devaluation in Venezuela, but when, according to Wall Street analysts, a prospect that sent markets plunging across Latin America on Thursday.

Though the country’s economy is only Latin America’s sixth-largest, Venezuela’s importance as an oil exporter and its recent popularity among foreign investors makes its troubles a concern for the rest of the hemisphere.

Even though Venezuelan officials said they would defend the currency against a “maxi-devaluation” and ruled out other measures such as a currency board, the growing consensus that Venezuela’s currency is due for a trim caused stocks in Caracas to plunge 9.4% to 3465.34, their lowest level since April 1996. Bond prices also fell a staggering 26%.

A Venezuelan devaluation of 15% to 25% will come “sooner rather than later,” possibly in a matter of days, said Eduardo Cabrera, Merrill Lynch chief Latin American equity strategist in New York.

Paribas economist Rafael de la Fuente said, “It’s the easy option [for Venezuela] . . . you get an automatic mechanism by which to solve their fiscal problem.”

Venezuela’s currency, the bolivar, lost 1.25 against the dollar to 574.25 on Thursday, even though the central bank bought bolivares on the open market overnight to stave off a run.

A Venezuelan devaluation would put more pressure on Brazil’s currency, which is widely perceived to be overvalued and which could become the next target of speculators. A devaluation there would have more far-reaching effects because of the size of Brazil’s economy--it is South America’s largest, and eight times the size of Venezuela’s--and the growing presence of U.S. companies there.

In Brazil, which weathered a run on its currency last October in part by raising interest rates to discourage speculators, stocks continued their free fall. Sao Paulo’s Bovespa stock index closed at 7,992, off 549 points, or 6.4%.

However, some observers point to Brazil’s $70 billion in foreign currency reserves, low interest rates and the continued flow of offshore investment to make a case that Brazil could continue to withstand devaluation pressures.

“Investors know . . . that we have the political will and strength to take whatever action to defend the currency,” said Amaury de Souza, a political scientist at the consulting firm Techne in Rio de Janeiro. But De Souza warned that Brazil’s high trade and budgetary deficits leave it vulnerable.

Stocks in Mexico, whose own slowing economy has begun to cause concern as slumping oil prices slash government revenues, closed sharply lower Thursday, as the Bolsa index lost 105.55 points, or 2.9%, to close at 3,498.81. The peso fell to a record low of 9.345 to the dollar, off sharply from its Wednesday close of 9.1970.

Argentina’s stocks also took a big hit. That country’s benchmark Merval stock index plunged 6.1% to 441.83, a three-year low, Thursday. But Argentina--whose economy is Latin America’s third-largest, after those of Brazil and Mexico, have erected several lines of defense against a devaluation, noted Juan Luis Bour, an economist with FIEL research firm in Buenos Aires.

The chief barrier is that each Argentine peso in circulation is backed by a U.S. dollar held in reserve. Under Argentine law, the government has no power over monetary policy in the sense that the currency in circulation is essentially dollars, said Santander Investment chief economist Lawrence Goodman.

“They did that to counterbalance the previous excesses of the central bank. In order for the money supply to grow, there has to be an importing of dollars from abroad,’ Goodman said.

It’s just those sorts of measures that Venezuela has failed to take. Hit by lower oil revenue, Venezuela has failed to cut its budget, whose deficit could exceed 8% of gross national product this year. Nor has it raised interest rates sufficiently or imposed other needed fiscal measures, lacking the political will.

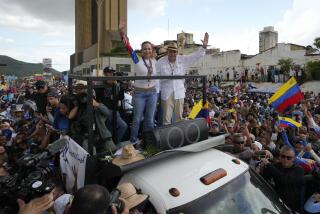

To make matters worse from the market standpoint, a populist presidential candidate, Hugo Chavez, who has made noises about not paying foreign debt and redistributing the nation’s oil wealth to the poor, is the favorite to win December’s election.

“The problem with Venezuela is that there is blood in the water. The currency is overvalued by 40%,” Cabrera said.

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Crisis in Caracas

Currency devaluation fears sent Venezuela’s main stock price index down 9% on Thursday to its lowest level since April 1996. Monthly closes and latest, in thousands:

Thursday: 3,460.64

Source: Bloomberg News

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.