Ford on Fast Track: Expanding Outside, Consolidating Inside

- Share via

Ford Motor Co.’s aggressive push to acquire foreign auto makers in recent years and its new plan to buy up many of its dealerships reflects a strategy to control its business from the factory floor to the showroom on a global scale.

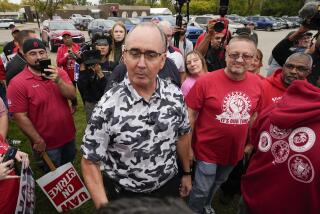

In company President and Chief Executive Jac Nasser’s words, Ford must transform itself from an automobile manufacturer to a “consumer company that happens to provide automotive products and services.”

Even while it risks alienating its independent dealers by consolidating retail operations, Ford stands to cut its vehicle costs by thousands of dollars, experts say. Such savings would come as the auto maker continues broadly expanding its share of the market.

Ford already has broken down internal boundaries and begun managing itself as a global enterprise, Nasser said in an interview Thursday in Anaheim, where he has been attending a United Auto Workers conference.

And the company has broadened its scope by acquiring Jaguar Cars and Aston Martin of Britain, agreeing to buy the car operations of Volvo of Sweden and taking a controlling interest in Japan’s Mazda Motor Corp.

The retail consolidation strategy would let the company improve its profit and give it the ability to better control its public face.

Because the dealer is the only representative of an auto manufacturer that most consumers ever see, the experience in the showroom often colors shoppers’ immediate and future buying choices.

“What Nasser is saying is that they want to be able to immediately satisfy the customer, and the only way you can do that is to control distribution,” said David Littman, senior economist and auto industry specialist at Comerica Bank in Detroit.

“By running the dealerships,” he said, “they can keep close track of the pulse of the buying public, have centralized warehousing of stock to cut inventory costs and provide instantaneous delivery of what the customers want without the bureaucratic hassles and costs of going through the independent-dealership ordering process.”

Littman estimates that Ford could save at least 15% of the price of each vehicle--an average of about $3,400--with such a system.

Centralized control also would improve the auto maker’s ability to profit from the boom in Internet commerce, Littman said.

Ford has consolidated dealer networks in several overseas markets and has been testing the idea for more than a year with pilot programs in San Diego and Tulsa, Okla. But company officials earlier this month stopped talking about test programs. The program, now called the Ford Retail Network Strategy, is policy, not a pilot, they say.

Ford’s dealers aren’t unanimously thrilled at the prospect. Although some, with key stores in important markets, could be offered huge sums to sell to a corporate venture, others could be left flapping in the breeze.

“It depends on who you are and where you are,” says Kent Hagan, president of Midway Ford in downtown Los Angeles. “I have concerns that Ford would modify the distribution system to favor company-owned dealerships over independents.”

But he said that when Ford was discussing installing a pilot retail network in the San Fernando Valley last year, he approved, “because I thought I could profit by providing a higher level of customer service than a giant corporate store.” That deal eventually fell through.

Nasser acknowledges that developing a nationwide corporate retailing system will take years because of such dealer concerns.

While that is happening, he said, Ford will continue to evolve, as it did last year by moving its Lincoln Mercury division headquarters to Southern California. It was a “difficult decision” but one that had to be made, he said during a speech Thursday to Town Hall Los Angeles, “because this is an area of the world that has one of the most creative and aspirational cultures” and Ford wanted access to it.

Already, he said, the company is seeing results from the move to Irvine in terms of more free-spirited thinking from Lincoln Mercury managers.

The drive to evolve also fuels Ford’s continuing search for greater exposure in Asian markets.

At least initially, Nasser said, Ford will concentrate on developing its Mazda franchise to get there. But he doesn’t rule out a strategic alliance with another Japanese automotive company.

Some industry watchers have suggested that Toyota Motor Corp. is too big and healthy to need a partner and that most other Asian auto makers are too small to fit Ford’s needs--leaving Honda Motor Co. as the most likely candidate if Ford does go looking.

Nasser, who has previously said he is not interested in acquiring debt-ridden Nissan Motor Co., declined to comment on other potential alliances.

Commenting on Ford’s growth in recent years--some analysts say General Motors Corp. is ahead in gross revenue only because of its nonautomotive pursuits--Nasser said beating GM in sales is not in any official game plan. It would “be great,” though, if Ford became the No. 1 auto maker in pursuit of its own goals, he said.

Ford will “continue to reinvent” itself, Nasser said, because “great companies don’t stand still.”

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Driving Change

Ford Motor Co. Chief Executive Jac Nassar is aiming to change the way the nation’s No. 2 automaker does business, partly by braodening its reach with acquisitions. A look at U.S. car and truck sales in 1998 for the company and its alliances:

Core Company

Mercury: 410,186

Lincoln: 187,121

Ford: 3.29 million

Total: 3.98 million

*

Acquisitions

Mazda: 240,546

Jaguar: 22,503

Volvo*: 101,172

*Deal pending

Sources: Autodata Corp., Ford Motor Co.

*

Times automotive writer Paul Dean contributed to this report.