Fears of the WTO’s Influence Are Greatly Exaggerated

- Share via

In the five years since it was established, the World Trade Organization (WTO) has acquired a prominence based more on controversy than influence. But the controversy, which came to a head at the WTO ministerial meeting in Seattle last year, is misconceived. The contest for liberalizing the global economy, the WTO’s ostensible purview, is mainly being played on turf other than that of the WTO.

In both rich and poor countries, WTO opponents--environmentalists, labor unions and farmers--fear that the international organization will accelerate the opening of global markets and cause great harm to their interests. Supporters--multinational business, high technology and finance--hope the WTO will be able and willing to accelerate economic liberalization by removing or lowering barriers to the free flow of goods, services and capital.

Both the fears of WTO opponents and the hopes of its proponents are misplaced, because they share a view of the WTO’s power that is belied by the organization’s origins, character, record and prospects.

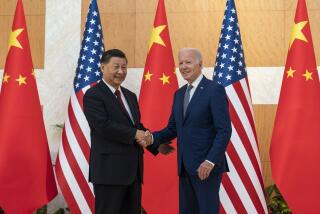

The WTO has 135 members (China is the prospective 136th, and Taiwan the 137th), a secretariat of 500 and an annual budget of about $80 million. It decides by consensus, not by vote count. The WTO’s three operating entities--the General Council, the Dispute Settlement Body and the Trade Policy Review Body--include all WTO members. When consensus is not possible, the WTO agreement allows for the possibility of majority voting, a procedure unlikely to be invoked because industrialized nations oppose it.

The WTO’s management structure contrasts with those of the International Monetary Fund and World Bank. The latter institutions have executive boards that direct the agencies’ officers. The major industrial countries are permanent participants, and voting is weighted to reflect their financial dominance. The WTO is unlikely to evolve a comparable structure, because the majority of members from the South (the less-developed countries) opposes ceding such control to the North (the developed countries). Although the organization’s new director-general, Mike Moore, a former New Zealand prime minister and trade minister, is experienced and energetic, his power will be severely limited by the constraints inherent in the WTO.

Under these circumstances, it isn’t surprising that the WTO’s efforts to resolve disputes by providing “good offices” and appointing neutral panels of experts have been of little consequence. A case in point is its efforts to resolve trade disputes between the United States and the European Union, specifically those relating to the EU’s banana-import rules and restrictions on imports of hormone-treated beef from the U.S. Washington charges that these EU restrictions are unfair, unreasonable and in violation of previous agreements.

The WTO’s review panels found in favor of the United States. But rather than comply with the ruling, the EU appealed. In response, Washington invoked sanctions under U.S. law, prompting the Europeans to file a complaint with the WTO, contending that the WTO’s authority preempted U.S. law. The complaint was rebuffed by another WTO panel.

It remains to be seen whether the EU will again appeal or comply with the WTO’s earlier ruling. If the Europeans do comply, it more likely will be because of U.S. sanctions, not the WTO.

The point isn’t that the United States “won” in its dispute with the EU; indeed, the U.S. has “lost” in other disputes. In all cases, the significance of win or lose is muted by the limited reach of the WTO’s influence and the dilatory processes by which it seeks to advance international economic liberalization.

Before one accepts what in Europe is called “liberalization fatigue,” it’s worth reflecting on another domain in which economic liberalization is proceeding with remarkable momentum: transborder mergers and acquisitions, which are largely (and perhaps fortunately) outside the WTO’s immediate ambit. Major recent instances of this activity include Deutsche Bank and Bankers Trust; Daimler and Chrysler, and DaimlerChrysler and Mitsubishi; Bertelsmanns and Random House; Renault and Nissan; Ford and Volvo; BP Amoco and Arco; Vodaphone AirTouch and Mannesmann; General Motors (or Ford) and Daewoo (potentially); and innumerable others. The pace and magnitude of these transactions represent a remarkable phenomenon with broad implications for international economic liberalization.

In 1999, the value of global transborder mergers and acquisitions increased to $798 billion, almost 50% higher than in 1998. Firms in the United Kingdom were the most acquisitive ($245 billion), followed by the U.S. ($155 billion), Germany and France ($93 billion and $92 billion, respectively). In Japan, which has been relatively impervious to such activity, mergers and acquisitions rose more than threefold, to $24 billion, including deals with 65 U.S. firms ($12.1 billion), 25 British firms ($1.6 billion) and 12 French firms ($7.7 billion). Similar transborder deals in telecommunications, mobile phones, automobiles and pharmaceuticals are pending elsewhere, involving firms in India, China, Singapore and South Korea.

To be sure, in some instances, the incentives to merge are perversely related to liberalization. The aim is to gain preferred market access without removing or reducing barriers. But, in most cases, transborder mergers and acquisitions depend on, as well as generate, increasing economic openness, the breakup of anticompetitive, restrictive entities and practices (such as the keiretsu in Japan), enhanced predictability, increased transparency and more efficient markets. Lowering barriers to imports, expanding access to export markets and opening up domestic-goods and capital markets are necessary for the acquired assets to realize their full values. Hence, acquiring and acquired companies are likely to push in these directions. Moreover, the WTO’s rules relating to “normal trade relations” among members require that concessions granted by any member to the companies of another are supposed to be granted to all members. This is what the administration is now urging Congress to grant to China permanently.

The result will advance international economic liberalization, notwithstanding the WTO’s limitations and occasional signs of liberalization fatigue. *

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.