The Perils of Poor Credit

- Share via

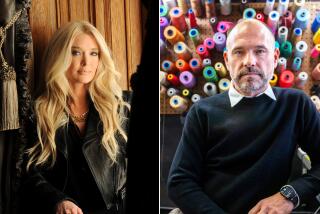

Marie Solomon, a Los Angeles resident, has been anxiously pursuing a used car dealer who is refusing to return all of the $1,500 cash deposit she and her boyfriend, Kamil Blaze, put down as part of their unsuccessful attempt to buy a Ford Aerostar van.

This may be another example of the perils endured by so-called sub prime borrowers. “Sub prime” refers to millions of Americans who have credit problems and find that borrowing costs them much more in interest than it does people with good credit--if they can get financing at all.

As recounted by Solomon and Blaze, their problems with Erlich Motors of Inglewood also appear to illustrate how people with such problems can be taken advantage of by merchants who realize they are vulnerable.

On Feb. 1, Solomon and Blaze signed a conditional sale contract to purchase the van. They say they told the salesman that Solomon is disabled by illness and that Blaze was “between jobs,” but that the salesman said this would be all right. The contract, however, called for the $5,201 financing to come with a 21.4% interest rate, far higher than most car loans. There also was a $400 trade-in on their 1982 Buick. The couple drove away with the 1993 Aerostar on Feb. 2.

But seven days later, Erlich Motors called to say that the financing had not been approved and that the couple would have to return the car.

They did, the same day, and Solomon and Blaze say they were given their Buick back, without the pink slip of ownership. The other thing that wasn’t returned was their $1,500 deposit. Since then, they say, they have been trying to recover both.

Solomon and Blaze complained to the Department of Motor Vehicles, which on March 20 wrote Erlich Motors owner Lenore Erlich that the dealership could be in violation of a state law requiring the return of such deposits.

But Erlich’s son, Barry Erlich, vice president of the dealership, wrote back two days later that it should not have to return any of the money because the buyers made false statements, specifically saying Blaze was employed even though a check by the finance company found that he had lost his job a week before.

“Erlich Motors incurred costs of $250 to the insurance company, $200 commission to the sales person, $200 to the finance company and $175 to the DMV,” Erlich stated.

The DMV then informed Solomon and Blaze they might have to go to Small Claims Court in the matter.

The costs reported by Erlich, exclusive of the insurance, which Solomon and Blaze paid themselves and kept on their Buick after they returned the Aerostar, were $575, $925 less than the deposit.

The state code says, “Any payment made by a buyer to a seller pending execution of a conditional sale contract shall be refunded [if] . . . the contract is not executed.”

It says nothing about the dealer’s expenses, but an uninvolved trial lawyer I asked about this, Bernie Bernheim, said Erlich is actually making an argument that the buyers committed fraud.

“He’d have to prove a material misrepresentation that he justifiably relied on, and that he suffered a financial loss as a result,” Bernheim declared. “It still wouldn’t justify holding the whole sum.”

DMV spokesman Evan Nossoff said that while the law says the DMV can suspend the dealer, revoke his license or rebuke him for such a violation, it can’t order him to return the customer’s money.

Such loopholes in the automotive laws are all too common, thanks to a state Legislature that is heavily lobbied by the industry.

I talked to Barry Erlich twice. Despite his letter to the DMV refusing to return any of the deposit, he told me, “I’m willing to give her [Solomon] back her money, everything but my expenses.” And he asserted the pink slip to the Buick had been returned.

He asked, “Why should I lose money on this account when her boyfriend lied to me?”

But Blaze insists he did not lie in telling the salesman he did not hold a job just then, and my checks indicated Erlich had given some bad information about his expenses.

For instance, Steve Rodriguez, of Creative Dealer Services, the finance company involved, told me it never charges anything to the dealer until the credit is approved. So, apparently, we can scratch that $200 Erlich claimed to have spent.

Also, Erlich’s mother, Lenore, showed me a receipt indicating that the dealer had paid the DMV $148, not $175.

I could not verify that the salesman’s $200 commission had in fact been paid, but even with it, Erlich’s expenses apparently were not more than $348--$1,152 less than the $1,500 deposit.

On Monday, Solomon and Blaze told me the most Erlich had ever offered to give them back was $649, and he said at the time that he didn’t have the money right then.

Erlich insisted that a copy of the conditional sale contract contained a clause saying he did not have to give back the deposit. But, under questioning, he could not point out such a clause. In fact, the contract stated that in the event of a rescission, “seller must give back to [buyer] all consideration received.”

The DMV, meanwhile, confirmed that soon after Solomon and Blaze returned the Aerostar, Erlich Motors sold it to someone else, presumably making a profit.

Lenore and Barry Erlich told me, moreover, that I was picking the wrong thing to write about concerning them. They cited trouble they have had with what they termed an unfair Inglewood Small Claims Court--the very institution to which the DMV had said Solomon and Blaze might have to turn.

Barry Erlich showed me a letter he had written the senior judge in Inglewood, Eric Taylor, complaining about a judge pro tem, Lola McAlpin-Grant, who ruled against the dealer in an auto repair case.

Later, he told me that when he went to the court, “I was the only white person there.”

Judge Taylor said he had confidence in McAlpin-Grant, and he expressed surprise that Erlich would make such a remark.

“Regardless what he may think about the color of justice, he will always get justice in this court, as everyone else will,” Taylor said.

*

Ken Reich can be contacted with your accounts of true consumer adventure at (213) 237-7060 or by e-mail at ken.reich@latimes.com.