Gambling Spreads a Shadow Far From the Lights of Big Casinos

- Share via

LAKESIDE, Mont. — Bob and Robin Cook are empty nesters in their handsome hillside home, with a daughter off at college and an older son in Colorado. The younger son, Rann, lives nearby: They see him during visiting hours at the Flathead County Jail.

The Cooks reluctantly pressed charges against Rann--a “neat kid,” they say--after he stole cash and checks from them and pawned his father’s hunting rifles.

“The huge thing is the breach of trust,” says Bob Cook. “You can’t exist with someone else living in your home when you can’t trust them.”

Rann, 24, blames himself and what he calls “the devil on his back.” He has been a compulsive gambler since 1994.

Some 300 miles from tiny Lakeside, in the southern Montana ranching town of Big Timber, Vince and Audrene Kunda have met the same demon. Their 30-year-old daughter, Michelle, ran up gambling debts that induced her to steal from an aunt she was caring for.

A teacher at Big Timber High School, Vince Kunda also serves on the town council. Fellow council members don’t share his loathing for the video poker and keno machines that abound in their town of 1,500 and throughout Montana.

“It hasn’t hit their families yet,” Kunda says. “But it will. Eventually it will hit every family in this state.”

Gambling Now the National Pastime

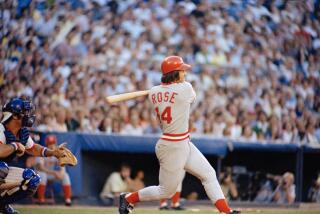

By the numbers, gambling, not baseball, is the national pastime. Most adult Americans partake. They channel more money to the legal gambling industry--$50 billion in 1998--than they spend on recorded music, movie tickets, spectator sports and theme parks combined, according to a federal study commission.

In the last 25 years, the industry expanded tenfold as state after state gave gambling official sanction. Lotteries flourish in 37 states. Casinos, once limited to Nevada and Atlantic City, have opened by the hundreds in two dozen other states--aboard riverboats, on Indian reservations, in big cities.

Montana--the Treasure State--has no lavish casinos to lure out-of-staters, but it is a national leader in what critics term “convenience gambling.”

About 17,400 video poker and keno machines are scattered across all 56 counties in 1,700 bars, restaurants and convenience stores. For most of Montana’s 885,000 residents, sampling one of gambling’s most addictive variants in these mini-casinos is as easy as buying milk.

“These machines are the teeth of the predator--the ones that chew people up,” says the Rev. Tom Grey, a United Methodist minister from Illinois who heads the National Coalition Against Legalized Gambling.

Everywhere, supporters and critics of gambling bicker over the economic benefits and social costs. Firm statistics are scarce.

But according to the federal commission, there are more than 5 million adult problem gamblers in the United States. An estimated 23,000 are Montanans, including hundreds whose severe addictions --mostly linked to 15 years of video gambling--traumatize their families with bankruptcy, divorce, domestic violence and suicide.

The affliction even hits small towns, far from big-time casinos, and spans generations. The elderly, often lonely and bored, are among the most vulnerable. So are teenagers; recent studies suggest a higher rate of adolescents than adults have gambling problems.

“It’s different from other addictions because the gambler is threatening the very survival of the family,” says Mona Sumner, director of Montana’s largest addiction treatment center, the Rimrock Foundation in Billings. “When your power is turned off and your heat is turned off and there’s no food in the house, you’re driven to do things you wouldn’t normally do.”

Tempted to Murder for Money

Phil Fortune, a 61-year-old neighbor of the Kundas in Big Timber, was driven to extremes.

Seated in a small living room decorated with a grandchild’s painting, Fortune tells of starting gambling a decade ago, stopping by casinos with his buddies after bowling.

He began gambling on his own, and for a while won frequently. “By 1992 it was a full obsession,” he says. “Gambling was the most important thing in my life.”

Fortune, an Air Force veteran and mechanic, had time to spare; complications from diabetes prevented him from holding a job. By 1995, deep in debt, he tried to kill himself, wading into the frigid Yellowstone River on the north edge of town.

“The survival instinct took over, and I started calling for help,” he says. “When they found me, there was water in my lungs and I was hypothermic.”

Desperate for money, he pondered the feasibility of killing a local man rumored to be a drug dealer, in hopes of pocketing a stash of cash.

“I told myself I’d be doing a favor to the community. But murder is murder, and it would have been cold-blooded.”

By 1996, Fortune’s credit card debts totaled $88,000. He declared bankruptcy, and--with his son paying the air fare--entered a Veterans Administration treatment program in Brecksville, Ohio.

Though he no longer gambles, scars remain. Fortune can’t afford to buy a new vehicle or expand his modest house. But his wife, Pat, has stuck by him.

“I almost ruined our family,” he says. “Most women would have left me. She loved me enough to stay.”

*

Brenda Phillips’ marriage--not always a happy one--didn’t survive her addiction.

“There was a combination of loneliness, boredom and anger,” she says during a break from her job at the Flathead County Library, not far from Rann Cook’s jail cell in the northwest town of Kalispell.

“The machines are what pulled me in,” she says. “Gambling is what I did to zone out, rather than have an affair.”

At first she was lucky. Then “I spent my paychecks. I took time away from my family and friends. I could lose thousands of dollars a week without a thought. I’d spend $2,000 to win $800.”

In 1997, after 10 years of heavy gambling, she contemplated killing herself in a car crash, but instead enrolled in Gamblers Anonymous.

Her husband, however, demanded a divorce. “He had a right to his anger,” says Phillips, 48. “On the other hand, he chose not to help me, but to punish me.”

Honor Student Turns to Crime

Gamblers Anonymous didn’t work for Rann Cook.

He was an honor student at Kalispell High School, a prizewinner in a statewide speech contest. But he began having panic attacks, thinking his heart was failing, and his parents were apprehensive when Rann headed to Montana State University in 1993.

He dropped out after one semester and came back to Lakeside, a village of 600.

In the spring of 1994, Bob and Robin Cook returned from a weekend fishing trip to discover that Rann, then 19, had pawned his father’s rifles and cashed stolen checks to raise $3,000 for his video gambling.

Rann has been in and out of state custody ever since. He tried Gamblers Anonymous and had some gambling-free stretches. But eventually there were relapses and more thefts, even from his father’s building-materials company.

“Gambling is his release from whatever battles he’s facing internally,” says Bob Cook. “He says it’s euphoric--the adrenaline rush he gets.”

Rann joined his parents last year at the legislature in Helena, supporting a proposal to provide state-funded treatment for compulsive gamblers. The bill was defeated; Montana remains one of the few states with extensive gambling but no state funding for treatment.

The parents sometimes found themselves anticipating Rann’s next deception.

“It’s hard as a parent to start thinking like a gambler--how would he do it? It’s horrible to start thinking that way,” Bob Cook says.

“I don’t know how to say ‘Rann, you’re not welcome in our house anymore.’ There’s something lovable about this kid. I can’t abandon him.”

The Cooks, devout Christians, moved to Lakeside from Colorado in 1977, attracted by the small-town atmosphere and conservative schools.

Robin Cook recalled their reaction as pocket-sized casinos--limited to 20 video machines each--began opening across Montana in the 1980s.

“When they first came out, with their blinking lights and the pawn shops cropping up everywhere, we thought, ‘It won’t affect us,’ ” she says. “And then this all came unexpectedly, like a thief in the night.”

*

Family well-being is considered a priority by Mark Staples, the affable lobbyist for the Montana Tavern Assn. and its many casino operators.

Families hurt by compulsive gambling deserve empathy and support, he says, and so do families of the thousands of Montanans whose jobs depend on gambling.

“Many of these bars and taverns were struggling,” Staples says. “Legalizing gambling was seen as a way to tax and regulate something that was happening anyway.”

The industry funds a help line linked to Gamblers Anonymous. But anti-gambling activists are organizing a petition drive to place a proposed ban on the state ballot in November; a recent newspaper poll showed public sentiment evenly divided.

The gambling industry says a ban would cause higher taxes. Ban supporters say the state and local governments could easily survive the loss of their 15% share of gambling revenue.

Staples says gambling will go on, legally or not.

“It has been a feature of the cultural landscape here since frontier days. . . . That’s the bottom line. People like doing it.”

*

Mike Evers started playing poker in the Navy during the Vietnam War. A car salesman in the university town of Missoula, he kept the extent of his video gambling problem hidden from his wife, two daughters and older sister, Shari Montana, until January 1995.

“His wife called me,” Montana recalls. “She’d found out the night before that Mike was $100,000 in debt. He’d maxed out seven credit cards.”

Evers enrolled in Gamblers Anonymous, and Montana believed recovery was possible. But in June 1995 he gambled away $2,000 in the town of Libby, returned to his motel and killed himself with a pistol shot to the head. He was 44.

“He had no money left,” says his sister, a Missoula artist. “No checks in his checkbook, no gas in his car.”

She remembers him as the star tight end on the high school football team.

“He was smart, he was handsome,” she says. “He was the golden boy.”

*

Michelle Kunda and Scott Long were among the college-bound students at Big Timber High School, Scott graduating in 1987, Michelle in 1988.

Within 10 years, both were video gambling addicts. Long, a Chippewa Indian adopted by a Billings businessman, has squandered thousands of dollars earmarked for the construction company he owns, forcing his father to intervene and restrict his check-signing powers.

Michelle now goes by her married name, Porter, but is separating from her husband and lives with her two small sons. She underwent treatment at the Rimrock Foundation and now works for a palladium mine operation in Big Timber.

“It was so easy. It was so legal,” Porter says of her gambling. “It was something where I could isolate myself, escaping from the reality of being a mother and being in not such a great marriage.

“Lying and cheating and stealing and the whole bit--I really hurt some relationships. I really hurt my parents.”

Vince Kunda calls his daughter’s gambling problem “the biggest shock in my life.”

“I’ve questioned myself--what did I do wrong?”

He helped cover her legal bills and car payments, but declines to help pay the gambling debts of $15,000.

“She’s working harder than she ever has. But it will take years to pay back her debts. . . . I don’t know if she’ll last. It scares the heck out of me.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.