Biotechs Fall on Stem Cell News

- Share via

Shares in biotechnology companies involved in stem cell research fell Friday amid questions about the 60 embryonic cell lines identified by President Bush.

Executives at leading stem cell firms said they did not know the whereabouts of the critical stem cell lines and were unsure that they would prove usable when found.

“I cannot confirm or substantiate that number,” said David Greenwood, chief financial officer of Menlo Park-based Geron, which funded research that lead to the discovery of embryonic stem cells at the University of Wisconsin-Madison. “It is a very large number.”

Bush, after months of deliberation, announced Thursday that the government would fund limited embryonic stem cell research. He said federal funds may be used for research on 60 stem cell lines derived from embryos that already have been destroyed. The government will not support research on existing embryos, which some abortion foes regard as human life.

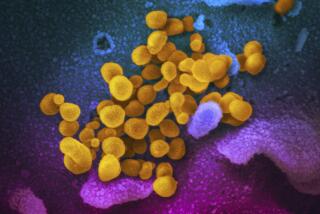

Embryonic stem cells have the ability to divide and develop, through genetic manipulation, into tissues that can be used to treat a broad range of ailments and diseases, such as spinal cord injury, Parkinson’s disease and diabetes. Stem cells also are found in adults and in fetuses, but they are not as pliable as embryonic cells.

The infusion of federal dollars is critical to biotechnology firms engaged in stem cell work. The companies themselves aren’t bound by government rules, but the firms depend on academic researchers whose institutions risk the loss of federal money if they violate government regulations.

Massachusetts-based Advanced Cell Technology has academic collaborators at Harvard University and the Mayo Clinic who are working with primate stem cells, but not human stem cells, to abide by the previous ban on embryonic stem cell research. With the change in federal policy, its academic partners may obtain access to human embryonic lines, said Dr. Robert Lanza, medical director for Advanced Cell, which is privately held.

“Academic research is very important to biotechnology,” said Thomas Dietz, an analyst with Pacific Growth Equities in San Francisco. “Biotechnology grew out of academic research. There are important links between the two.”

The accessibility of the approved stem cell lines was not immediately clear. Health and Human Services Secretary Tommy Thompson on Friday confirmed that the 60 lines exist. But biotechnology executives said it appears that the bulk of the lines are in laboratories overseas, mainly in Europe and Israel.

“We’re not sure if there are strings attached or if they are even available,” Lanza said. He said licensing fees for the cell lines could run into the “tens of thousands” of dollars for his company and potentially more if the firm commercializes its discoveries.

Lanza said he was concerned about the quality of the stem cell lines and even suggested that the president’s figure was exaggerated.

“We think 60 is very deceptive. Some of these cell lines don’t grow well and can’t be obtained without prior consent,” he said. “Everyone in the field is surprised at the number.”

Geron has access to five embryonic stem cell lines that it developed with the University of Wisconsin-Madison. Geron holds the license on two patents on the technology; that may slow progress at its competitors.

Academics who want to use Geron’s cell lines may obtain a license from the Wisconsin Alumni Research Foundation. But companies that want to turn discoveries derived from those cells into products must obtain a license from Geron, Greenwood said.

“They will need to come to us in order to go forward,” he said, noting the company has three dozen patent applications filed that cover various aspects of its discoveries.

Greenwood said the lines approved by the president are “an enabling step . . . sufficient to launch research.” He cautioned, however, that his company will enforce its patents against competitors in the United States, even if their stem cells are not from its proprietary lines.

Even so, analysts said it was premature to crown Geron the victor in the race to develop stem-cell-based treatments. The company’s patents haven’t been tested, so it isn’t clear whether they are insurmountable, they said. From a larger vantage, they added, companies that focus on non-embryonic stem cells seem to be ahead of the game.

Baltimore-based Osiris Therapeutics is in early-stage clinical trials with stem cells from bone marrow that generate bone or fat. Stem Cells Inc. of Palo Alto, which derives stem cells from fetuses, has succeeded in implanting human neural stem cells in mice, where they sprout normal human brain cells.

John McCamant, editor of the Berkeley-based Medical Technology Stock Letter, predicted companies that use adult stem cells would be first with therapeutic candidates, probably within the next two years.

Geron’s stock fell 99 cents to close at $13.95. Shares in companies working stem cells that are not derived from embryos also fell. Stem Cells fell $1.30 to $5.15, and Michigan-based Aastrom Biosciences Inc. dropped 37 cents to $1.88.