Three Americans Share Nobel Economics Prize

- Share via

WASHINGTON — Three American economists won the Nobel Prize on Wednesday for uncovering fundamental flaws in markets by looking closely at used-car lots, the snobbery that surrounds college education and the intricacies of insurance.

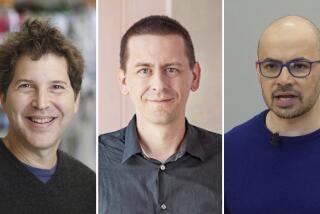

George A. Akerlof of UC Berkeley, A. Michael Spence of Stanford University and Joseph E. Stiglitz, a former Stanford professor now at Columbia University, won the Nobel Memorial Prize in Economic Sciences for describing how “asymmetric information”--what happens when a used-car dealer knows the car he’s trying to sell you is a “lemon” but you don’t--can send markets spiraling off in unexpected and sometimes devastating directions.

Recognition of the trio’s work, which many have used to justify corrective steps by government, comes as Washington prepares to play a dramatically larger role in the economy as a result of the September terrorist attacks.

At least two of the laureates suggested the choice of their work signaled the end of an era in which market outcomes were always considered optimal and government intervention uniformly troublesome.

“There’s a pendulum that swings back and forth, and I think it’s swinging back,” Spence, 58, said in a telephone interview from Hawaii.

“The competitive equilibrium model reached its high point maybe 20 years ago,” Stiglitz, also 58, said a separate interview from New York. “The choice [of the three men’s work] reflects where much of mainstream economics is today, which is that competitive equilibrium is not a useful model.”

On a personal note, winning what is widely considered the world’s most prestigious award left at least one of the recipients giddy.

“This is something that happens to other people,” 61-year-old Akerlof said in a phone interview from Berkeley. “In fact, I’m not sure this is me talking to you.”

The trio’s works “form the core of modern information economics,” the Royal Swedish Academy of Sciences said in announcing its decision, which won praise from economists across the political spectrum.

“This is not an ideological prize. Both the right and left are going to like this choice,” said N. Gregory Mankiw, a conservative Harvard economist who disagrees with many of the policy implications drawn from the three men’s work.

The work “lets us understand a whole class of market failures we had not understood,” Mankiw said. “It was path-breaking.’

To see why requires an understanding of the state of economic thought when the three began writing in the late 1960s. Then, economists believed the only job facing buyers and sellers was to hit on a price that matched supply and demand. According to prevailing theory, the correct price had the quality not just of ensuring that all goods available at the moment were sold, but also of telling economic players what to do in the future. For example, a high price told sellers to produce more goods.

As a result, so the theory went, the economy was always in “equilibrium” and headed toward its optimal level of production and consumption.

But in a 1970 academic paper, “The Market for Lemons,” Akerlof asked what happens on a used car lot when a salesman does not tell a buyer that the vehicle he or she is about to purchase is a dud, and the buyer has no way of checking. The answer is that the price has none of balancing and directing qualities required by economic theory. As the result, Akerlof said Wednesday, “it’s much more difficult to get markets to work.”

Starting with the isolated case of used cars, the Berkeley economist and his Stanford colleagues began finding more examples of market-damaging information mismatches. They also began unearthing unusual and not always economically optimal ways in which market players tried to get around them.

“We all knew there were important information imperfections in markets, but these guys put them together. They let us see the implications,” said New York University economist Lawrence J. White.

In the eyes of many economists, the principal implication is that the government should require disclosures about everything from corporate finances to appliance energy efficiency to used car histories.

“It gives government a big role in information supply,” said retired Stanford economist Kenneth J. Arrow, who won the Nobel Prize in 1972.

Of this year’s three winners, Stiglitz has gone the furthest in pushing the issue in policy circles and producing controversy in the process.

First as a member and then as chairman of former President Clinton’s Council of Economic Advisors from 1993 to 1997, and as chief economist of the World Bank from 1997 through 1999, he argued against efforts to privatize government functions such as producing uranium. He objected to U.S.-backed efforts to push developing nations into quick adoption of market methods.

He was widely seen as having been forced out of his World Bank position prematurely by administration figures such as Lawrence H. Summers, then the treasury secretary, who viewed him as insufficiently market-oriented. Since leaving, he jumped from Stanford to Columbia.

Akerlof also has done several tours in Washington, most recently as husband of Berkeley economist Janet Yellen, who succeeded Stiglitz as Council of Economic Advisors chair and as a governor of the Federal Reserve Board. Akerlof served as a council staff economist earlier in his career.

By contrast, Spence has spent virtually all of his career in academia, most of it as an administrator rather than a researcher. He was one of the youngest deans of arts and sciences at Harvard from 1984 through 1990. He was one of the longest-serving deans of Stanford Business School from 1990 through 1999. He still teaches and is a partner in a Silicon Valley venture capital firm.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.