Acting on His Vision for Gaming

- Share via

Few companies can chart the financial fluctuations of the video game industry over the last 20 years as well as Activision Inc.

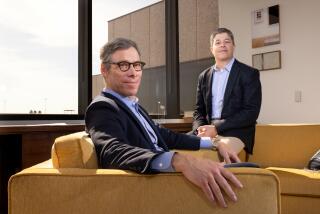

Founded in 1979, Activision rode the Atari wave until the mid-1980s, when Atari crashed, causing many to conclude that video games were a fad. With the market much diminished, Activision filed for bankruptcy in 1991. That year, a cocky 27-year-old entrepreneur, Robert “Bobby” Kotick, bought a controlling stake in Activision, reorganized the company and moved it from the Bay Area to Santa Monica.

Although the ride has been bumpy at times, Kotick recently has become the darling of Wall Street after releasing a streak of hit game titles, including “Tony Hawk Pro Skater 3,” “Return to Castle Wolfenstein” and “Spider-Man.”

With a market valuation of $1.8 billion, $280 million in cash and $786 million in annual sales, Activision has become the second-largest independent video game publisher in the United States after Electronic Arts Inc. in Redwood City, Calif. Part of Activision’s growth came from aggressive acquisitions. The company spent $47.2 million in the last eight months alone purchasing four game companies.

Boosting Activision’s--and the industry’s--momentum is the proliferation of Sony Corp.’s PlayStation 2, introduced in 2000, and Nintendo Co.’s GameCube and Microsoft Corp.’s Xbox consoles, which launched last holiday season.

Kotick, now 39, spoke a week after the Electronic Entertainment Expo, the industry’s largest trade show.

Question: Size up the console war.

Answer: The numbers speak for themselves. Microsoft and Nintendo are fighting it out for second place. Sony is presently the leader.

Q: How does that affect you as a software publisher?

A: You can’t ask for a better market environment. We’ve just had a round of price cuts on the hardware that will drive the industry further into the mass market. The reduction in price of the PSOne in particular will move the platform through at least another year. That $49 price point for the PSOne also expands our market. Now you can take that console, and the games that go with it, to Latin America, Asia and second-tier European countries that previously couldn’t afford the console.

Q: Will online gaming on the console be big business?

A: Not in the near term, but it will be one of the great growth catalysts for the next cycle. For now, you’re going to see a lot of experimentation and continued institutional learning. Look at “Tony Hawk 3” for the PlayStation 2. It has some very nice online hooks.

Q: Are people actually playing “Tony Hawk 3” online?

A: Yep. All 17 people who took the trouble to buy a modem for their PS2s. This is an industry where an add-on peripheral has never really had a lot of traction in terms of broad penetration.

There’s no question that playing games against a real person is more fun than playing against the machine. There are a number of other catalysts for online games. There’s trial and sample. Trial and sample in our industry is largely done through Blockbuster rentals or borrowing from friends. If consumers have the opportunity to sample games through digital download, the industry is likely to see greater consumption overall.

Q: Console games have captured most of the media attention over the last two years. What’s the future of games for the personal computer?

A: The PC is primarily a hobbyist’s and enthusiast’s platform. When you have properties that are appropriate for that consumer, it’s a great opportunity. It’s also a great place to cut your teeth on online gaming before going into the console. We’ve developed a lot of institutional expertise on the PC in online gaming. But the growth of the PC games market will be in the small single digits. On the other hand, it’s a more stable business in a way than consoles, which go up and down with the release of new hardware.

Q: What’s your projection of this year’s market growth?

A: Overall, the marketplace will grow 12% to 17%. For Activision, we expect to grow at the low end of that range.

Q: Why so modest?

A: When you look at our company, we’re at $786 million in revenue. That’s a big number. We’re also taking into consideration slower growth rates in Europe and a continued weak economy in the U.S. Also, we’re expecting the PC market, which constitutes 15% of our business, to grow at single-digit rates. This also is the first year of the console cycle. Remember, two out of three consoles just launched last year. The mass market opportunity won’t really start to kick in until next year and the year after.

Q: How much further do you think the industry will consolidate?

A: You haven’t seen large companies merging with large companies, or even mid-sized companies. Instead, we’ve seen consolidation in the small to mid-sized companies. For us, we’re doing transactions in the $20-million to $30-million range. We’ve been acquiring companies that either have great development track records or properties that are attractive. When you look at the landscape, there’s still plenty of opportunity for us to acquire.

Q: Are you seeing major media companies shop for game companies?

A: Yes. The most natural buyers are the big media companies such as Disney, AOL Time Warner, Viacom and Vivendi. They’ve come to realize that games have the ability to really build value in their intellectual properties. We’re in an industry that’s growing at high double digits. Media companies realize they need to seek new areas of opportunities for growth because their own rates of growth are slow to none, and ours are looking pretty good.