Idec Chief Exec Defends Biogen Merger Decision

- Share via

Today, Idec Pharmaceuticals Corp. of San Diego is expected to complete its $5.7-billion stock acquisition of Biogen Inc. of Cambridge, Mass. The combined company, Biogen Idec Inc., would rank as the world’s third-largest biotechnology concern, behind Amgen Inc. and Genentech Inc.

Some analysts have questioned the deal, which would unite companies that each are largely dependent on a single popular drug. Idec’s Rituxan, for non-Hodgkin’s lymphoma, and Biogen’s Avonex, for multiple sclerosis, both generate more than $1 billion in annual sales, but the growth of those sales is slowing.

The two firms’ shares fell in June when the deal was announced and have not recovered. Shareholders will vote on the merger today.

But Idec and Biogen contend that their combined research-and-development budgets will lead to faster drug development and allow them to bid on promising drug candidates in the works at smaller biotechs. Biogen Idec has promised investors that by 2010 it will double the number of drugs in its development pipeline through licensing deals; the two firms have 10 drugs in clinical trials now. Biogen Idec also has pledged average annual growth in earnings per share of 20% through 2010.

Biogen Chairman and Chief Executive James C. Mullen would become CEO of the new company, and Idec Chairman and Chief Executive William H. Rastetter would be executive chairman.

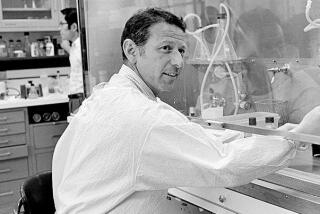

This week, The Times talked with Rastetter in his San Diego office.

Question: Why does this deal make sense, and how will you show investors that it does?

Answer: What this merger allows us to do is take Idec’s research and development budget from $150 million in 2004 to $600 million [next year]. It takes us from oncology into neurology and dermatology. It takes us from a U.S.-centered company to being a company with operations in 17 countries. It takes us from being small to being much closer to the sweet spot. We are going to show Wall Street over time that this is a winner.

Q: Why would a small company choose to license a promising drug candidate to Biogen Idec instead of its much larger rivals, Amgen or Genentech?

A: I am delighted to compete for opportunities with Amgen and Genentech. They are not any better than we are. We’ve got $2 billion in cash on our balance sheet -- that’s plenty of powder. We’ve got about as much experience in biologics manufacturing, and with the opening of our Oceanside plant we’ve got a lot more capacity. Those two guys don’t intimidate us.

Q: When did it become clear to you that Idec needed to merge with another biotech company?

A: I don’t think Idec or Biogen needed to merge. It was a matter of looking at our organizations and understanding how much more effectively we can spend our dollars. Our Oceanside plant can replace a European plant Biogen was planning. They have operations in Europe that we were planning to put in. By cutting out the stuff we don’t have to do, we can save $300 million between now and 2007. If you allocate that to R&D;, that is another $75 million each year.

Q: Idec has suffered disappointments in its drug development pipeline, and your non-Hodgkin’s lymphoma drug Zevalin has not performed well. If things had gone differently, would Idec be merging?

A: It would have been remarkably difficult for us to have quadrupled our R&D; investment. It would have required quadrupling our top line. There are going to be disappointments in this business. That is why we call it discovery.

You know, I think that our pipeline, speaking for Idec, has gotten something of a bad rap. We just did not have the money to invest in the pipeline. Now we have the cash to take these things forward. You can have a fleet of cars, but if you have no gasoline, you can’t take them very far.

Q: How do you and Jim Mullen complement each other?

A: I am not detail oriented. Jim is very detail oriented. I love to think about five to 10 years from now. He is good about thinking about this quarter or this year. I have a science background, so having drug discovery and venture investing report to me makes a lot of sense. He has an engineering background, so having manufacturing report to him makes a lot of sense. I tend to hook my golf ball and he tends to slice his -- it’s a perfect match.

Q: When Idec and Biogen announced their merger, some analysts predicted the biotechnology industry would consolidate. Is a merger wave underway in biotechnology?

A: This type of move does not make sense for everybody. Taking two teams and rolling them into one is a daunting challenge. I wouldn’t say this is the beginning of a trend.

Q: The biotech industry in San Diego hopes to evolve from being a research and development hotbed to an integrated biotechnology center. Idec established a manufacturing base here. Can biotech manufacturing take hold on a broader scale?

A: I am disappointed by the loss of the manufacturing tax credit in this state. If you want people to invest in manufacturing here, where water, labor, land and utilities are more costly, you are going to have to give them incentives to do that.

Q: Should that be on Gov.-elect Schwarzenegger’s to-do list?

A: Absolutely.

Q: A year ago, you predicted that in 10 years Amgen still would be the world’s largest biotechnology company but that Idec would rank second, edging out Genentech. And Idec would get there by developing a stable of blockbuster drugs -- products with annual sales of $1 billion or more. Do you care to revise your prediction?

A: I am not going to modify that. I am happy to take on Genentech.

Q: What about Amgen?

A: Give us 20 years to get there.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.