Genentech Gives Investors a Dose of Strong Outlook

- Share via

NEW YORK — When it’s time to visit Wall Street, it helps to have good news.

On Friday, the top brass of Genentech Inc. told a crowd of enthusiastic investors to expect strong earnings through 2010 -- the biotechnology company’s first long-range forecast in five years.

The South San Francisco-based firm said earnings per share should climb by an average of 20% annually, a projection some analysts immediately dubbed conservative.

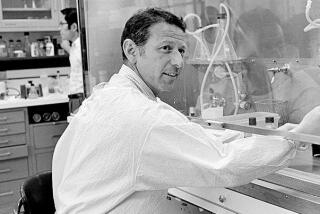

Moreover, Chief Executive Arthur Levinson said the company was aiming to become the biggest seller of cancer drugs within the next six years, leaping past rivals Amgen Inc. and Johnson & Johnson. At the same time, he said, the company intended to become a leader in drugs for immune disorders, such as asthma and psoriasis. It already has products aimed at those diseases.

“We feel we are in a very, very strong position,” Levinson said. Genentech plans to hire 1,800 people this year, many of them in production, sales and research, as the company expands promotion of its newest drugs and steps up efforts to find new ones.

Levinson told investors that the company’s goals were ambitious but that Genentech was well-positioned to achieve them. Few in the audience appeared to disagree.

Investors have nearly tripled the price of Genentech’s shares since May, when the company announced that Avastin, a much-anticipated cancer drug, had extended the lives of gravely ill colon cancer patients in a large clinical trial. Genentech won regulatory approval to sell Avastin two weeks ago, and analysts believe it is destined to become a $2-billion-a-year product.

On Friday, the company’s shares jumped as investors liked what they heard during the four-hour meeting. On the New York Stock Exchange, Genentech closed at $107.70, up $1.67.

Wall Street was little concerned that Genentech was not going to hit a goal from its last five-year plan. Levinson told investors that the firm probably would not maintain operating income at 25% of revenue through 2005 because of higher costs.

“I am not losing any sleep over that,” he said. “We could blow earnings out of the water this year and make everybody very, very happy,” but the company must invest in its future.

Analyst Geoffrey Porges of Sanford C. Bernstein & Co. said Wall Street was likely to lower earnings growth estimates, which had ranged from 30% to 40% for 2004 and 2005. Yet he didn’t think investors would lose excitement for the only big biotech firm still led by a scientist.

“They are nerds,” he said. “But it looks like that is what it takes in a science-based business.”

One of Genentech’s key strengths is its intellectual property involving three important molecular targets involved in cancer and immune diseases, Porges said. It was clear from Genentech’s presentation Friday that it was building a family of products around those, he said.

Genentech said that through 2010 it planned to seek approval for a combination of 10 new drugs and new uses for existing drugs. Half would be in cancer and the rest in immune disease.

Last year was among the most successful in Genentech’s history on the new-product front, with the approvals of Raptiva for psoriasis and Xolair for asthma.

The company said one promising area involved its cancer drug Rituxan, which is being tested in rheumatoid arthritis, lupus and other disorders. The drug destroys a kind of white blood cell that appears to play a role in each of the diseases, Genentech said.

Genentech has extensive plans for Avastin, the first drug to shrink tumors by pruning the blood vessels that feed them.

Three large human tests of Avastin are underway in patients with breast, lung and kidney cancers; if those tests are successful, the annual sales potential of Avastin should exceed the already lofty estimate of $2 billion a year, analysts said. In addition, the National Cancer Institute and academic scientists are studying Avastin for use against melanoma, prostate cancer and ovarian cancer.

Adding to Genentech’s strength in cancer drugs are Rituxan for lymphoma and Herceptin for breast cancer. The two medications accounted for $2 billion of Genentech’s total revenue of $3.3 billion last year.

Genentech’s development pipeline includes other possible cancer treatments. It is testing a drug called Omnitarg in patients with ovarian cancer and hopes to begin tests soon of a topical medication, G-024865, for basal-cell carcinoma, a type of skin cancer.

Meanwhile, Genentech is building its expertise in a third area. The company is leveraging its knowledge learned from Avastin to produce other drugs that regulate blood vessel growth. For instance, Genentech is testing a drug that closes off blood vessels for macular degeneration, an eye disorder that causes blindness. And it has successfully conducted animal tests of a drug that spurs blood vessel growth to heal wounds.

“We like to think we are rewriting the medical textbooks,” said Co-President Susan Hellmann.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.