Univision Bid Plan Revamped by Televisa

- Share via

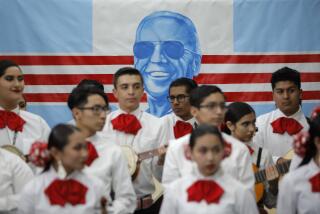

A group of investors, led by Mexican entertainment giant Grupo Televisa, inched closer late Thursday to bidding $11.2 billion for Univision Communications Inc., the largest Spanish-language media company in the U.S.

The expected offer of about $36 a share, which would require approval by Univision stockholders, capped a week of high drama in a bidding war orchestrated by Los Angeles billionaire A. Jerrold Perenchio, who controls Univision and serves as its chairman.

Perenchio had been seeking to pump up Univision’s price by playing bidders off one another. But the strategy hit a snag when some major players bailed out, throwing the sale into chaos.

Rattled investors unloaded Univision stock Wednesday and Thursday on news that three major private equity firms -- Kohlberg Kravis Roberts & Co., Blackstone Group and Carlyle Group -- bolted from Televisa’s team. On Thursday, shares of Los Angeles-based Univision closed down $1.04 to $32.80.

If Televisa succeeds in acquiring Univision, it would move the company’s 38-year-old chairman, Emilio Azcarraga Jean, closer to achieving his longtime goal of reclaiming the TV operation that his grandfather helped launch 45 years ago.

He is being joined by another Latin America mogul, Gustavo Cisneros of Venezuela, who in 1992 teamed up with Azcarraga’s father and Perenchio to buy Univision from Hallmark Cards Inc. for $550 million.

Some Wall Street analysts have speculated that the departure of the private equity firms would be problematic for Televisa because it would require its two remaining partners -- Microsoft Corp. Chairman Bill Gates’ Cascade Investment and private equity firm Bain Capital -- to chip in more money than the firms might be willing to risk.

“This would imply a combined equity check of over $4 billion for Bain Capital and Cascade Investment,” Merrill Lynch & Co. analyst Jessica Reif Cohen said Thursday in a report.

That’s because Televisa and Cisneros’ Venevision, both foreign entities, are hamstrung by U.S. rules. They can’t boost their investment in Univision because they already own 25%. Federal laws prevent them from having a bigger stake in a U.S. broadcasting company.

As of Thursday, it appeared that Cascade and Bain would be willing to dig deeper.

“They were able to come up with the money that was needed,” said Antonieta Lopez, spokeswoman for the Caracas, Venezuela-based Cisneros Group, which controls the nation’s leading TV network. “And we are very optimistic that this will be the bid that wins.”

But that depends on whether the 75-year-old Perenchio and his team are willing to sell at a lower price than they wanted.

Hopes of sparking a fierce bidding war waned Thursday with rival bidders on the verge of folding. Media maverick Haim Saban and private equity firms Texas Pacific Group, Providence Equity, Madison Dearborn Partners and Thomas H. Lee Partners were scheduled to let their offer expire this morning.

Earlier in the week, the group put a $35.50-a-share offer on the table. But Perenchio spurned it as too low. One key group member said Perenchio demanded an increase to $37 a share, which the consortium declined to do.

Saban’s group had hoped that Perenchio would accept less because it was made up of U.S. firms, according to people familiar with its strategy. That would mean fewer obstacles to winning regulatory approval, and thus the deal could close faster.

If the Televisa group prevails, regulators will probably spend months scrutinizing the deal to make certain that Univision would not be controlled by either Televisa or Venevision.

It was two decades ago that the Federal Communications Commission threatened to revoke the licenses of five TV stations, including KMEX Channel 34 in Los Angeles, after determining that they were largely controlled by Azcarraga’s father, Emilio Azcarraga Milmo. That triggered the sale of the stations, then called Spanish International Communications, to Hallmark.

Since Azcarraga and Cisneros combined forces with Perenchio to buy Univision, the partners have had a rocky marriage. Although the three each contributed $33 million of their own money, Perenchio -- who had the leverage because he was the only U.S. citizen -- received 50% of the company. (The company went public in 1996. Perenchio owns nearly 11% but has 57% voting control.)

Some Wall Street bankers have speculated that one reason the equity groups left Televisa was that it invited Cisneros to join the bidding, although members of the team cited skittishness over price.

Two sources suggested that the private equity firms were uncomfortable with a purported plan to place some of the Univision assets under the control of some of Cisneros’ children, who are U.S. citizens.

Cisneros spokeswoman Lopez, however, dismissed that theory, saying the bid came from a Venezuela-based entity, Venevision Investments, and not a U.S. affiliate.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.