Shenzhen New World Group buys Sheraton Universal hotel

- Share via

A Chinese real estate firm with one Los Angeles hotel in its fold closed on a deal to buy the Sheraton Universal hotel, showing a growing trust in a recovery of the hospitality industry and the rising interest of Asian investors in U.S. commercial property.

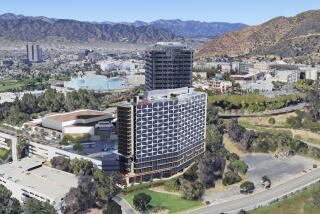

The price of the Sheraton was not disclosed, but industry experts who tracked the deal said Shenzhen New World Group Co. paid about $90 million for the 451-room inn overlooking Universal City.

That would make it a deep discount from the $122 million that previous owner Lowe Enterprises paid for the hotel at the top of the market in 2007. The Los Angeles developer and landlord also spent $25 million on improvements, but lost control of the property last year after the recession battered the travel business.

The sale of the 20-story hotel to Shenzhen New World marks the second local purchase for the mainland Chinese real estate developer, which bought the 469-room Los Angeles Marriott Downtown last year for an estimated $60 million.

Those who invested in hotels from 2005 to 2007 ended up “out of the money,” said Jim Butler, a Los Angeles hotel lawyer who helped put the Sheraton sale together.

“Overnight, properties dropped 50% or 60% in value, and cash flows fell through the bottom,” Butler said.

Shenzhen New World executives took control of the Sheraton on Wednesday. Company spokesman Ming Yu said Shenzhen would spend an additional $5 million to renovate the Sheraton’s pool area, meeting rooms and other private spaces.

Yu said the company was attracted to the hotel because it is in the heart of Los Angeles County near Universal Studios Hollywood theme park.

“It’s a great location,” he said, “and we see the hotel business getting better in the next year or two.”

The company is looking for other commercial real estate to purchase in the U.S., he said, but not necessarily more hotels.

The Universal property will continue to be operated as a Sheraton, said real estate broker John Strauss, who represented court-appointed receiver Rim Hospitality, which took over Lowe’s interest.

“There is clear evidence that the market has bottomed out,” said Strauss, a managing director at real estate services firm Jones Lang LaSalle.

Room rates are still fairly flat, but occupancy is rising, according to industry experts.

In 2009, hotel sales in Los Angeles County totaled less than $50 million, Strauss said. Last year, the total leaped to $350 million with sales of such properties as the Marriott and Hilton Checkers in downtown Los Angeles and the Sheraton Delfina in Santa Monica.

Strauss expected that sales would rise further this year. “There is a tremendous amount of offshore capital seeking long-term real estate opportunities, primarily in the gateway markets of San Francisco, Los Angeles, Seattle and Honolulu,” Strauss said.

Chinese investors should be among the leading buyers, said Butler of Jeffer Mangels Butler & Mitchell.

“The strong yuan makes our properties kind of half-priced,” he said, and the emerging Chinese middle class likes to travel.

Investors from mainland China, such as those from Shenzhen, are still less common than real estate buyers from Hong Kong and Taiwan, said real estate analyst Peter Slatin of Real Capital Analytics.

“Chinese buyers are still on a learning curve,” he said, and invest more often in real estate funds than in individual properties such as hotels.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.