Jeffrey Gundlach testifies he sought advice before TCW fired him

- Share via

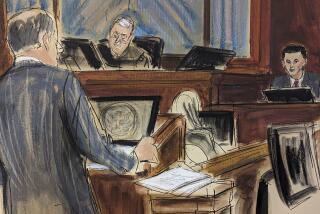

Money manager Jeffrey Gundlach testified that he met with Goldman Sachs Group Inc. before TCW Group Inc. fired him in 2009 and that he sought advice on how to improve his situation at the Los Angeles asset management firm.

Gundlach was the final witness in the trial over whether he stole TCW’s trade secrets before starting his own company or TCW fired him to avoid paying management and performance fees owed to him as the firm’s chief investment officer.

He told jurors in state court in Los Angeles on Monday that he was advised by Goldman Sachs either to arrange for better corporate governance terms so that he could stay at TCW, attempt a management buyout of TCW or negotiate his own departure. Gundlach said he hadn’t decided to leave TCW at the time of his last conversation with Goldman Sachs on Dec. 1, 2009, which was three days before he was fired.

Ten days after he was terminated, Gundlach, 51, who worked at TCW for 25 years and was named Morningstar’s fixed income manager of the year in 2006, started his own money management firm, DoubleLine Capital.

TCW sued in January 2010, alleging that Gundlach and three other former employees stole TCW’s trade secrets to start DoubleLine. TCW’s damages expert testified that the company, a unit of French bank Societe Generale, suffered $344 million in damages from Gundlach’s alleged interference with contracts and $222 million from a claimed breach of fiduciary duty.

In a countersuit, Gundlach alleged that TCW fired him to avoid having to pay management and performance fees for the distressed-asset funds that his group managed and that went “through the roof.” Gundlach seeks about $500 million.

DoubleLine’s lawyers called Gundlach, who had already testified both in TCW’s and DoubleLine’s case, to refute testimony by a Goldman Sachs banker that Gundlach had said at a November 2009 meeting that he didn’t have an employment agreement with TCW.

TCW argued that Gundlach couldn’t seek as much as $500 million for breach of contract because he didn’t have a signed contract when he was fired. Gundlach has said he had been working and was getting paid under a valid agreement made in 2007.

Closing arguments in the trial, which started July 28, are scheduled for Tuesday.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.