Wall Street joins global slump for stocks on Omicron jitters

- Share via

Stocks on Wall Street added to their recent string of losses Monday, joining a worldwide slump by financial markets amid worries about how badly the Omicron variant, inflation and other forces will hit the economy.

The Standard & Poor’s 500 index fell 1.1% for its third straight drop. The decline followed similar drops across Europe and Asia. Stocks of oil producers helped lead the way lower after the price of U.S. crude fell 3.7% on concerns the newest coronanvirus variant could lead factories, airplanes and drivers to burn less fuel.

Omicron may be the scariest force hitting markets, but it’s not the only one. A proposed $2-trillion spending program by the U.S. government took a potential death blow over the weekend when an influential senator said he could not support it. Markets are also still absorbing last week’s momentous move by the Federal Reserve to more quickly remove the aid it’s throwing at the economy because of rising inflation.

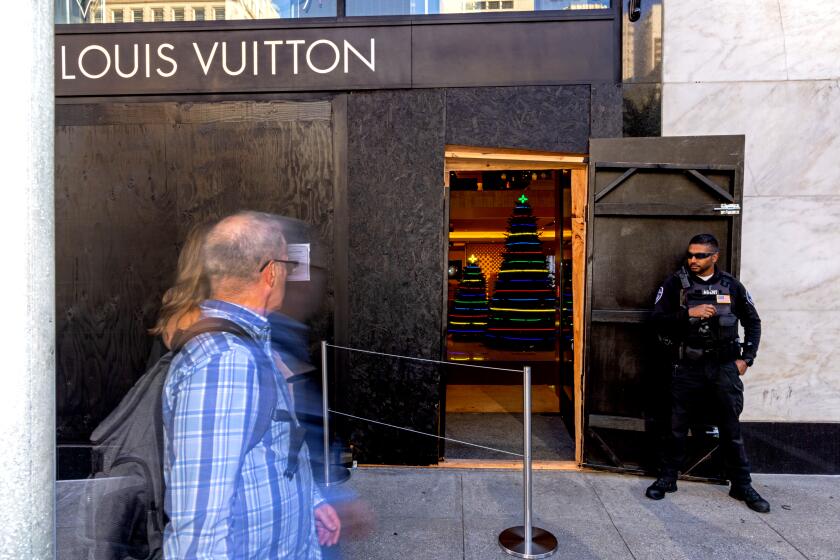

Industry groups and politicians are sounding alarms over the thefts. But in some cases, the statistics they cite are inflated or flat-out wrong.

They all combined to drag the benchmark S&P 500 52.62 points lower to 4,568.02. The Dow Jones industrial average fell 433.28 points, or 1.2%, to 34,932.16. The Nasdaq composite slid 188.74 points, or 1.2%, to 14,980.94.

Smaller company stocks fared worse than the rest of the market. The Russell 2000 index fell 34.06 points, or 1.6%, to 2,139.87. In global markets, Germany’s DAX lost 1.9% and Japan’s Nikkei 225 dropped 2.1%.

“Omicron threatens to be the Grinch to rob Christmas,” Mizuho Bank’s Vishnu Varathan said in a report. The market “prefers safety to nasty surprises.”

The Elon Musk-owned rocket company headquarters has had at least one other outbreak during the pandemic.

With COVID-19 cases surging again, leaders of governments around the world are weighing the return of restrictions on businesses and social interactions when many people seem to be sick of them.

The Dutch government began a tough nationwide lockdown Sunday, and a British official on Monday said he could not guarantee new restrictions would not be announced this week. The Natural History Museum, one of London’s leading attractions, said Monday it was closing for a week because of “front-of-house staff shortages.”

In the U.S., President Biden will announce on Tuesday new steps he is taking, “while also issuing a stark warning of what the winter will look like for Americans that choose to remain unvaccinated,” the White House press secretary said over the weekend.

Occidental Petroleum slid 3.8%, leading a long list of losing oil stocks. Producers of raw materials, technology companies and financial stocks also fell amid the Omicron worries. Steelmaker Nucor lost 5.8%, Microsoft slid 1.2% and Synchrony Financial, which offers store-brand credit cards and other financial products, dropped 5.2%.

Cruise line operators got a boost after Carnival gave an optimistic forecast for 2022, despite growing concerns about the recent rise in COVID cases worldwide. Carnival gained 3.4% for the biggest gain in the S&P 500, Royal Caribbean rose 0.3% and Norwegian Cruise Line added 2%.

Omicron’s ultimate effect on the economy is unclear. Besides weakening it by putting restrictions on businesses, another feared outcome is that it could push inflation even higher. If it leads to closures at ports, factories and other key points of the long global supply chains leading to customers, already ensnarled operations could worsen.

California’s small businesses waded through COVID to a rebound in consumer spending, only to face rising costs for supplies and wages.

Such troubles helped drive prices at the consumer level in November up 6.8% from a year earlier, the fastest inflation in nearly four decades.

But some economists argue that Omicron could have the opposite effect: If the variant leads to lockdowns or scares consumers into staying home, economic activity could slow, and with it, the surging demand that has overwhelmed supply chains and driven up consumer prices.

“There’s been a lot of pent-up demand that’s been satisfied, and I think the consumer is becoming much more price-conscious,” said Christopher Harvey, head of equity strategy at Wells Fargo Securities.

The worst-case scenario would see the economy decelerate without providing relief from already built-in inflation.

“The rapidly spreading Omicron variant appears likely to lead to a transitory winter chill,” economists Lydia Boussour and Gregory Daco of Oxford Economics wrote in a research report last week. They say the Federal Reserve could face a “delicate” task figuring out how to deal with an economic slowdown that coincides with high inflation.

The yield on the two-year Treasury slumped to 0.63% from 0.66% late Friday. That’s a sharp turnaround from its strong rise over recent months, built on expectations the Fed may begin raising short-term interest rates in 2022 to quell inflation.

The yield on the 10-year Treasury inched up to 1.42% from 1.40% late Friday.

Given high inflation that has lasted longer than expected, the Fed last week targeted an earlier end for its program to buy billions of dollars of bonds each month, which is meant to keep long-term interest rates low. Many of its members also said they expect the Fed to raise short-term rates, which would be a more impactful move, three times in 2022.

Ultralow rates engineered by central banks around the world have been one of the major reasons stocks have soared through what’s been a mostly gilded year for investors.

The S&P 500 has surged more than 21% this year with relatively few sharp price swings. Nearly every time stocks swooned a bit, bargain hunters came in to push prices back to records.

This has been one of the best years of the last century for U.S. stocks when it comes to returns adjusted for risk, according to Goldman Sachs. And the S&P 500 is still within 3.5% of its record set two Fridays ago.

— Associated Press writers Joe McDonald and Paul Wiseman contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.