How bank bonuses and interest payouts affect your tax bill

- Share via

With tax season in full swing, you may be consolidating the various charitable donation receipts, deductions and W-2 forms that you’ll submit to the Internal Revenue Service. But if you received any bank sign-up bonuses or earned interest on your bank balance, you may owe additional taxes you might not have planned for.

Interest rates on bank accounts, such as high-yield savings accounts, were high in 2022 because of ongoing rate increases made by the Federal Reserve. Bank sign-up bonuses and promotions have also been high, often $100 or more per account.

The IRS sees bonuses and interest as additional income, which means the government has to take its cut.

Interest from savings accounts is taxed at the same rate — ranging from 10% to 37% — as your income. If you’ve earned interest, your bank may send you a 1099-INT tax form. These forms are issued by businesses that offer interest, such as banks, and they let you know how much you owe for taxes on your earned interest.

Bank bonuses are typically taxed the same way, although you might receive a 1099-MISC form instead of, or in addition to, a 1099-INT form. Sometimes, however, banks don’t send out forms at all.

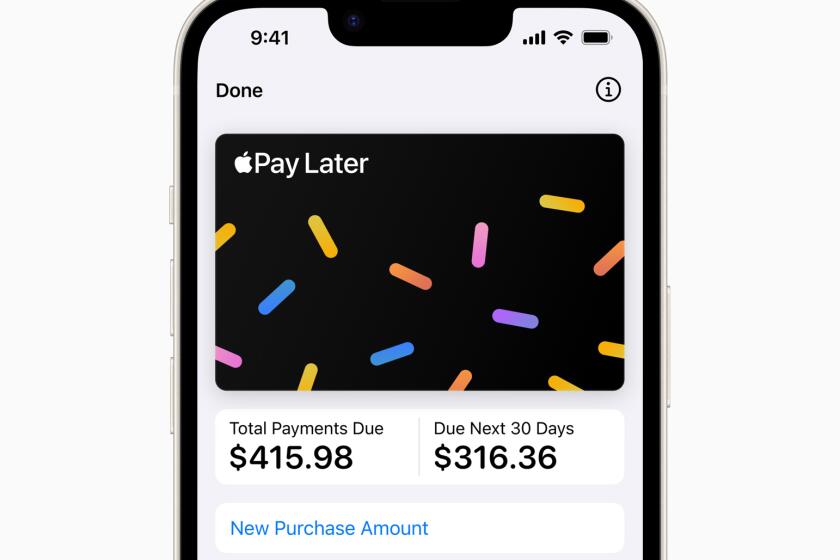

Apple announced Apple Pay Later, the latest entrant in the increasingly crowded “buy now, pay later” space. Is it “free money”? Not quite. Here’s what personal finance experts say.

“Not all financial institutions send out 1099s for bank bonuses,” said Matt Bundrick, co-founder of BankBonus.com, by email. “However, this does not relieve you from your obligation to include them on your tax return.”

If you’ve earned a bank sign-up bonus or interest but haven’t received any tax forms, you can add that income to a 1040 form, which allows tax filers to list any additional income they’ve received, such as prize winnings, jury duty pay, alimony and other non-1099 or non-W-2 earnings.

If you’re using tax software, you may be prompted to add additional income in your form submission, and the software will tell you how much you owe as a result of the information in your filing.

If you forgot to add something to your tax filing, you could reach out to the IRS to amend your tax return.

The IRS doesn’t require that taxes be paid on credit card bonuses because those bonuses are categorized as rebates on spending, not as income.

Credit bureaus pay attention to your credit utilization, or how much of your combined credit card limits you’re using. Here’s how to manage it.

Credit card bonuses typically can be earned only by spending a certain amount, usually within a time frame such as three months.

If you’re receiving a bonus or interest on your bank balance, it’s a good idea to set aside a percentage of your earnings for taxes in advance so you can cover your tax obligations. For peace of mind, it can be helpful to keep your tax money somewhere you won’t access it, such as in a separate savings subaccount set aside for taxes.

“I recommend that clients keep a log of their interest, dividends and bonuses throughout the year so as not to be surprised when they receive these statements,” Walter Russell, chief executive of financial advisor firm Russell and Co., said via email. “Some of my clients pay quarterly estimated taxes so that the tax burden is lighter come tax season.”

If you frequently open new accounts and move money among accounts to earn a bonus, you’ll probably owe more taxes because you earned more money.

Bessette writes for personal finance site NerdWallet. This article was distributed by the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

![Vista, California-Apri 2, 2025-Hours after undergoing dental surgery a 9-year-old girl was found unresponsive in her home, officials are investigating what caused her death. On March 18, Silvanna Moreno was placed under anesthesia for a dental surgery at Dreamtime Dentistry, a dental facility that "strive[s] to be the premier office for sedation dentistry in Vitsa, CA. (Google Maps)](https://ca-times.brightspotcdn.com/dims4/default/07a58b2/2147483647/strip/true/crop/2016x1344+29+0/resize/840x560!/quality/75/?url=https%3A%2F%2Fcalifornia-times-brightspot.s3.amazonaws.com%2F78%2Ffd%2F9bbf9b62489fa209f9c67df2e472%2Fla-me-dreamtime-dentist-01.jpg)