In Michael Lewis, Sam Bankman-Fried found his last and most willing victim

- Share via

The main hazard in telling a big story through the eyes of its main participant is the need to rely on his version as the honest truth.

Journalism schools will be able to use “Going Infinite: The Rise and Fall of a New Tycoon,” Michael Lewis’ new book about the collapse of the FTX cryptocurrency exchange and the fall of its boss, Sam Bankman-Fried, as a textbook on the imperative need to approach a subject with a healthy helping of skepticism.

To make a long story short, in this book Lewis doesn’t exercise any.

This is ... the greatest financial mania the world has ever seen.

— Zeke Faux

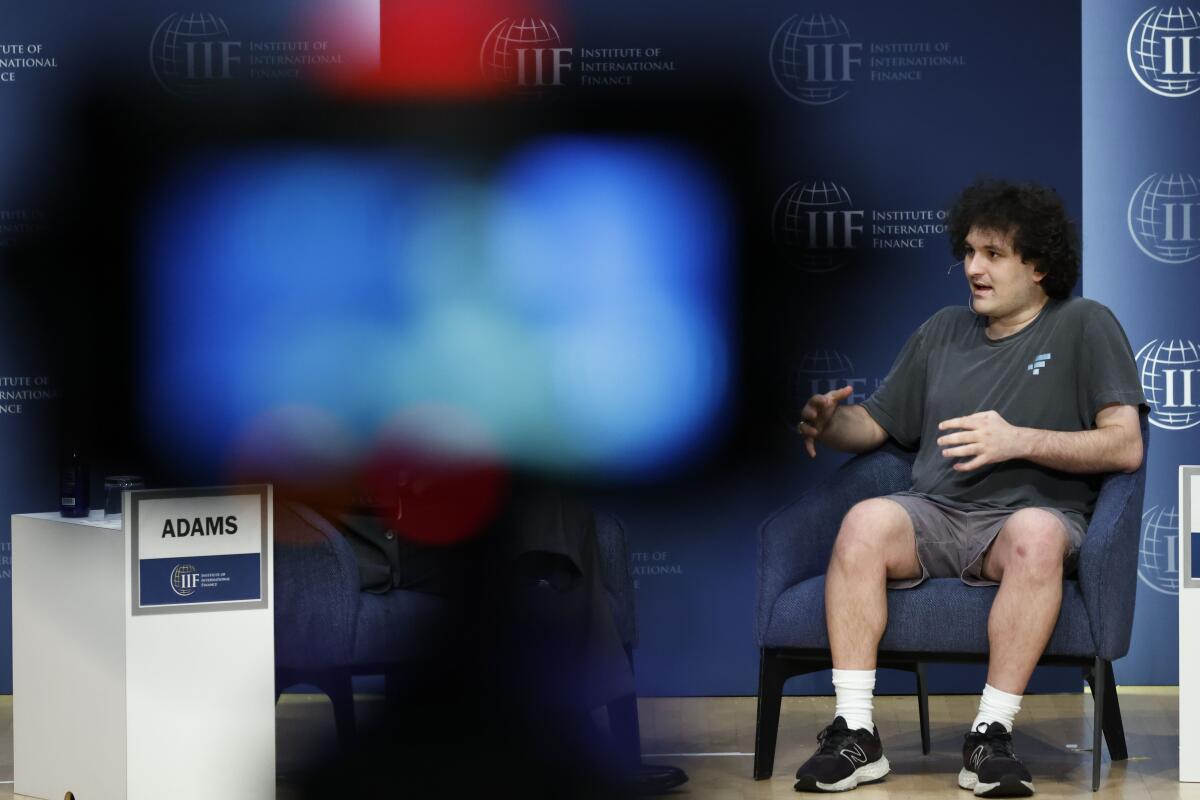

The result is what amounts to a defense brief for Bankman-Fried for his fraud trial in New York federal court, which opens Tuesday — coinciding, as it happens, with the publication date of Lewis’ book.

Fortunately, readers interested in the story of the cryptocurrency scam and Bankman-Fried’s rise and fall can turn to a much more convincing (and more entertaining) book. That’s “Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall,” by Zeke Faux, a financial investigative reporter for Bloomberg.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Faux demonstrates his incisive grasp of the story with the very first words of his prologue: “‘I’m not going to lie,’ Sam Bankman-Fried told me,” he writes. “That was a lie.”

Lewis, by contrast, opens his book with an anecdote about a long hike he took with Bankman-Fried in the hills above Berkeley in which he listened to his subject spin wild yarns about all the money he was making in crypto, “all of which, I should say here, turned out to be true.”

Well, no. Not really.

The fortune of tens of billions of dollars that Bankman-Fried bragged about to Lewis was built on quicksand — assets in the form of cryptocurrency tokens, the values of which were set by Bankman-Fried himself or by the tokens’ other promoters, based on no rational yardsticks.

The venture investors who poured millions into FTX were seduced by Bankman-Fried’s boyish torrent of gibberish so baroque they thought it must be meaningful on a level beyond anything they learned in business school. The politicians who accepted his millions in donations were seduced by his self-crafted image as an altruist of remarkable and unique benevolence and his (utterly false) claim to run a responsible crypto exchange.

Government agencies are moving to crush crypto as a hive of ‘fraud and scams.’ Congress should stay out of their way, and investors should take note.

The sports and entertainment stars — Tom Brady, Larry David, Anna Wintour — who swarmed around this shlub in cargo shorts were seduced by their need to be in on a new thing.

This torrent of nonsense didn’t snow many people who knew anything about finance and weren’t angling for a piece of his action, such as Bloomberg’s Matt Levine.

But it sure seems to have snowed the hell out of Michael Lewis, who wrote about financial schemes in “Liar’s Poker,” “Flash Boys” and “The Big Short.” In this book, he credulously quotes a venture capitalist speculating that Bankman-Fried “had a real shot at being the world’s first trillionaire.”

Lewis doesn’t say who told him so, but the absurd conjecture appeared in a slavish profile written by a freelance author for Sequoia Capital, which invested in FTX; the profile has since been scrubbed from the firm’s website, presumably out of mortification.

When it all came crashing down, the investors lost their money, the politicians had to give some of theirs back, the stars stopped returning his phone calls.

Who else suffered? Of the collapse of FTX, the criminal charges against Bankman-Fried and the entire edifice of cryptocurrency, Faux accurately writes: “This is ... the greatest financial mania the world has ever seen.”

Lewis, asked by a smirking, sycophantic interviewer named Jon Wertheim on “60 Minutes” Sunday if the FTX scam wasn’t just like Elizabeth Holmes’ hawking a fraudulent blood testing device under the Theranos name, rejected the thought.

Holmes was “supplying phony medical information to people that might kill them,” he said. “In this case, what you’re doing is possibly losing some money that belonged to crypto speculators in the Bahamas.” Then he caught himself, and added, “On the other hand, this is not to excuse.”

Notwithstanding Lewis’ churlish dismissal, the truth is that millions of innocent people, many of them small investors gulled by narratives such as Bankman-Fried’s, have lost their life savings in cryptocurrency scams.

Investment promoters are pushing people to add cryptocurrencies to their retirement plans. Here’s why that’s a lousy idea.

Reading their pleas to a judge overseeing one such collapse is heartbreaking — lives, marriages, hopes obliterated. (“Now when I go to work, I drink water and eat any scraps I can find for lunch. ... I am in deep depression and do not know if I can pull myself out of this,” wrote one.)

In telling this story, Faux has one major advantage over Lewis: Almost from the start, he had crypto’s number. “From the beginning,” he writes, “I thought that crypto was pretty dumb. And it turned out to be even dumber than I imagined.”

Faux puts meat on those bare bones by escorting his readers to many of the epicenters of the crypto scam — Miami, the Bahamas, the Philippines and more. He conducted interviews with hundreds of promoters, gamblers and victims.

As cryptocurrencies and NFTs gain popularity, addiction specialists are hearing from people whose compulsive trading resembles full-blown dependency.

He visits a vast metropolis of half-abandoned high-rises outside Phnom Penh, Cambodia, where human traffickers imprison thousands of people, injecting them with amphetamines or murdering resisters, forcing them to entice credulous victims around the world into fake romantic relationships via video chats, the goal being to steal their money via crypto investments.

He stops by a Philippine town where virtually the entire populace was enticed into playing the online game Axie Infinity to earn crypto tokens, until the edifice crashed, leaving the destitute players holding worthless crypto. (The Silicon Valley venture firm Andreessen Horowitz led a $152-million investment round in the game’s distributor.)

From the day he started his inquiry into bitcoin and the entire crypto world, Faux writes, “I had seen nothing but red flags.” Even though 15 years had passed since a pseudonymously published white paper had laid out the principles of bitcoin and launched the entire cryptocurrency craze, “Hardly anyone knew what cryptocurrencies were for. ... It was unclear why many of the coins would be worth anything at all.”

One answer he found was that the crypto world is populated by the same species of crook behind every boom-time swindle known to history: “hucksters, zealots, opportunists, and outright scammers,” many of whom became unimaginably rich, at least for a time — or at least seemed so.

Sam Bankman-Fried’s $16-billion fortune was always a myth. The mystery is why venture firms and the financial press thought it existed.

Lewis makes a cameo appearance in Faux’s book, interviewing Bankman-Fried onstage at an April 2022 conference in the Bahamas sponsored by FTX.

“The author’s questions were so fawning,” Faux observes, “they seemed inappropriate for a journalist.” Lewis told Faux that he was already planning his book but denied that FTX had paid him for his appearance.

Faux says Lewis also told him he thought U.S. regulators were hostile to crypto because they had been brainwashed or bought off by Wall Street. “You look at the existing financial system,” Faux quotes Lewis, “and the crypto version is better.”

One doesn’t need to validate the quotes, since their essence permeates Lewis’ book. Throughout “Going Infinite,” Lewis never really comes to grips with the fundamental fact of crypto: It isn’t worth anything.

Cryptocurrencies aren’t practical as currencies to buy things, they don’t have intrinsic value (their prices are based entirely on what an owner can persuade someone else to pay for them — the “greater fool” theory in action), their abundance or scarcity are entirely artificial, and the supposed interest yields bruited about by promoters are either imaginary or the product of Ponzi schemes.

Lewis doesn’t seem to believe this, or at any rate doesn’t offer his readers this necessary insight. In his only significant effort to explain how the crypto system works, he simply refers his readers to a 40,000-word Businessweek article by Levine, without making it too clear that Levine’s article, like his subsequent commentaries, explains why crypto is essentially worthless.

Lewis waves his hand at the vacuum at the heart of bitcoin: “Bitcoin often gets explained,” he writes, “but somehow never stays explained.”

Customers of the bankrupt Celsius reveal how the cryptocurrency firm’s collapse upended their lives.

His failure to see crypto clearly for what it is (or isn’t) allows Lewis to offer readers the pretense that there was value in Bankman-Fried’s FTX, or would have been, had he not been brought low by an old-fashioned “run on the bank” in which investors tried to pull their money out so quickly that their claims couldn’t be honored. That might be true, if crypto weren’t so fundamentally crooked.

In “Going Infinite,” Lewis advances the conspiracy theory he offered Faux about the hostility of the financial establishment. He’s scornful about John Ray, the experienced financial cleanup artist brought into FTX as its post-bankruptcy chief executive to untangle the mess and find whatever assets still exist to pay back customers and creditors.

Lewis paints Ray as an old fogey who simply doesn’t get it and has tried to impose old-school financial standards on new-school operations such as FTX. He implies that Ray came onto the scene with a preconception of FTX as a criminal enterprise, missing the truth that it was a new thing, comparing him to “an amateur archaeologist [who] had stumbled upon a previously unknown civilization” and can’t decode its customs or language.

Lewis quite plainly started this book project thinking he could write the definitive foundation story of cryptocurrency as “the new new thing,” to quote the title of one of his earlier books. When the thing collapsed, he was unable to shed his initial enchantment.

Some authors who discover in the midst of a project that their preconceptions are dead wrong have been able to reverse course — one thinks of Joe McGinniss’ “Fatal Vision,” which he started convinced of the innocence of murderer Jeffrey MacDonald, only to become convinced of MacDonald’s guilt and to report on his own journey toward the truth.

Lewis hasn’t traced that route, even though the truth about Bankman-Fried’s activities — that he never honored his own promises about the integrity of his accounting — stared him in the face. To the end, he treats Bankman-Fried as sort of an endearing scamp who got in over his head, essentially by an adorable habit of inattention.

He accepts the self-image of Bankman-Fried and his parents, Stanford law professors Joe Bankman and Barbara Fried, as people with “basically zero interest in money” — never mind allegations in a lawsuit filed by Ray that they profited by tens of millions of dollars from their son’s enterprise, including the purchase of luxury property in the Bahamas, or that Bankman, according to a lawsuit by FTX’s new management, complained that his salary with the company was only $200,000 rather than $1 million.

Amazingly, there are still efforts in Congress to find ways to legalize and regulate cryptocurrency, which serves no significant financial purpose known to humankind. Those efforts can only be helped by doting narratives like Lewis’.

But lawmakers — and investors and aficionados of good true-crime stories — will benefit more from Faux’s judgment that while Bankman-Fried was being lionized in public as a “benevolent prodigy,” he was in fact “secretly embezzling billions of dollars of his customers’ money and blowing it on bad trades, celebrity endorsements, and an island real-estate shopping spree to rival any drug kingpin’s.”

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.