Wide Shot: Inside Warner Bros.’s risky streaming movie strategy

- Share via

Humphrey Bogart’s final line in the 1941 Warner Bros. noir classic “The Maltese Falcon” — when he calls the titular statuette “the stuff that dreams are made of” — is drenched in irony.

But when Discovery Chief Executive David Zaslav debuted it as the slogan for the proposed combination of his company and WarnerMedia, it signified something different: optimism for the future and respect for the 98-year-old studio’s legacy of making such gems as “Casablanca” and “The Dark Knight.”

It was a hopeful message for a studio that has been through an extraordinary amount of upheaval. Just weeks ago, the studio learned it would be merged with Discovery, home of HGTV, Food Network and Animal Planet, only three years after it was acquired by AT&T. Meg James and I last week wrote about the challenges Discovery faces, but for now, the mood sounds fairly positive.

Not long after the surprise announcement of the Discovery-WarnerMedia merger, I spoke with Warner Bros. Pictures Group Chairman Toby Emmerich and Chief Operating Officer Carolyn Blackwood about their film strategy. Here’s the story.

This was before the town hall where WarnerMedia Chief Jason Kilar interviewed Zaslav on the Warner Bros. studio lot, and there’s clearly still a lot we don’t know about Discovery’s intentions in film (a business it hasn’t really touched in its roughly 35 years of existence).

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

I tried to frame some of the context in my story on how Warner Bros.’s film division is looking to adapt to a world where streaming is growing but theatrical releases are still key for many movies’ profitability. The executives also addressed the sharp criticism of how the same-day release plan for its 2021 movies (on HBO Max and in theaters) was disclosed to creative partners.

Here’s a key section, which clarifies Warner Bros.’s film release strategy for 2022 and the future, depending on what Discovery has in mind:

[A]s the $43-billion Discovery merger ambles toward regulatory approval next year, Warner Bros.’s risky release strategy, internally dubbed “Project Popcorn,” appears to be working. Movies such as “Godzilla vs. Kong” and “The Conjuring: The Devil Made Me Do It” have done better than expected at the box office and brought million of subscribers to HBO Max, according to executives.

“I’m both happy and relieved, because it has ultimately played out almost exactly as we hoped it would,” said Carolyn Blackwood, chief operating officer of Warner Bros. Pictures Group. “We’ve got filmmakers and talent who are now happy, we’ve got exhibitors that are happy, we’ve got audiences that are happy, and our partners at HBO Max are thrilled.”

Despite skepticism, Warner Bros. leaders had long insisted that same-day releases were a pandemic special — a 2021-only solution to the problem of COVID-19 shutting down cinemas.

Although the future of Warner Bros. under Discovery remains unclear, the studio’s strategy for next year and beyond is coming into focus. After this year, the Burbank studio will go with a half-and-half approach to its schedule, executives said. Of the roughly 20 movies Warner Bros. makes annually in the coming years, 10 to 12 will be designated specifically for HBO Max. The other 10 to 12 will launch in theaters exclusively for at least 45 days before they’re available for home viewing.

A couple of other quotes of note from my conversations that aren’t in the piece:

How will HBO Max and Warner Bros.’s DC strategy dovetail?

Emmerich: HBO Max presents a huge opportunity for DC. It allows us to make high-quality mid-budget superhero movies that reintroduce lesser-known DC titles, while also crossing over stand-out characters from our bigger films into original series.

Connecting the DC cinematic universe with Max gives our fans more ways to explore the DC multiverse and more chances to enjoy more great stories with these beloved characters.

One of the first examples of a stand-out character crossing over from film to Max is the “Peacemaker” series, which is a spin-off from James Gunn’s “Suicide Squad 2.”

Why not do day-and-date releases just for the first half of the year rather than all of 2021? After all, we seem to be getting closer to the end of the pandemic.

Blackwood: The decision was made to apply this strategy to all of the 2021 slate not only because we were unable to predict the continued impact of the pandemic, but also because of the importance and value in having and marketing a full film slate for HBO Max.

We were trying, during a very difficult time, to be decisive and provide both much-needed clarity and some protection to all the different players and stakeholders involved, and ultimately I think we did that.

Where do things stand with Christopher Nolan?

Emmerich: Only Chris Nolan knows what his next movie’s going to be, but we do hope it will be at Warner Bros.

Stuff we wrote

— After 10 years of early mornings, NBC’s Savannah Guthrie still lives for “Today.” The coolheaded co-anchor survived a turbulent decade on NBC’s morning program, which is adapting to the new TV landscape, reports Stephen Battaglio.

— More than 100 film producers recently ratified the constitution for a new union they hope will provide the kind of protections afforded by other unionized Hollywood workers. Will it succeed? asks Anousha Sakoui.

— With “In the Heights,” Jon M. Chu disrupts the movie musical. Ashley Lee explains how the “Crazy Rich Asians” filmmaker did it. And there are GIFs!

— After the pandemic ends, the streaming binge will continue, according to a survey of 1,000 consumers conducted by UTA’s consumer research division and first reported by Wendy Lee.

Number of the week

That’s the 52-week range of AMC’s share price, which, to use a technical finance-y term, is totally cuckoo bananas.

Imagine buying a bunch of AMC stock at the height of the pandemic on Jan. 1, and seeing your holdings increase by more than 2,400% as of last week. Maybe you are one of those people. If so, congratulations. Wall Street analysts, naturally, expect the shares to plunge eventually.

A brief recap.

About the time the Reddit retail trader army squeezed short-sellers and hedge funds by piling into struggling retailer GameStop, folks began doing much the same thing with equally struggling theater chain AMC.

AMC’s leadership didn’t say much about it at the time, because this was very new and new things are scary, especially when they send your stock flying in all directions like a loose balloon.

Anyway, AMC sold a lot of stock and greatly improved its cash reserves.

Then things got weirder. On its most recent earnings call, AMC’s CEO Adam Aron started treating the individual stockholders like they were his bosses, which they kind of are now that AMC’s former Chinese owner Dalian Wanda Group has unloaded almost all of its stake in the country’s largest theater chain.

Last week AMC raised $230 million by selling shares to hedge fund Mudrick Capital, which then sold the shares for a profit. AMC said it was now playing offense and kicking the tires on ArcLight locations, which is catnip for movie fans (we wrote about that here). The stock surged and AMC sold even more of it — 11.55 million shares, raising $587.4 million — on the open market.

Why exactly is everyone buying AMC, which teetered on the edge of bankruptcy throughout the COVID-19 crisis, other than the default memestock explanation (“We like the stock!”)?

My colleague Matt Pearce, in his highly entertaining essay on optimism bias, made a connection between AMC’s stock surge and Gov. Gavin Newsom’s “Wheel of Fortune”-style prize lottery for encouraging vaccinations.

Here’s Pearce: The meme-hyped stock for the struggling movie theater chain AMC is one of the hottest things out there for some reason, leading Bloomberg financial writer Matt Levine to conclude this week that “the way to understand AMC is to abandon your conscious mind for a while and just float on a sea of vague associations.”

It may not be quite the same as a lotto jackpot, but AMC is now offering a free large popcorn to shareholders, as well it should. You really can’t make this stuff up.

Hollywood production

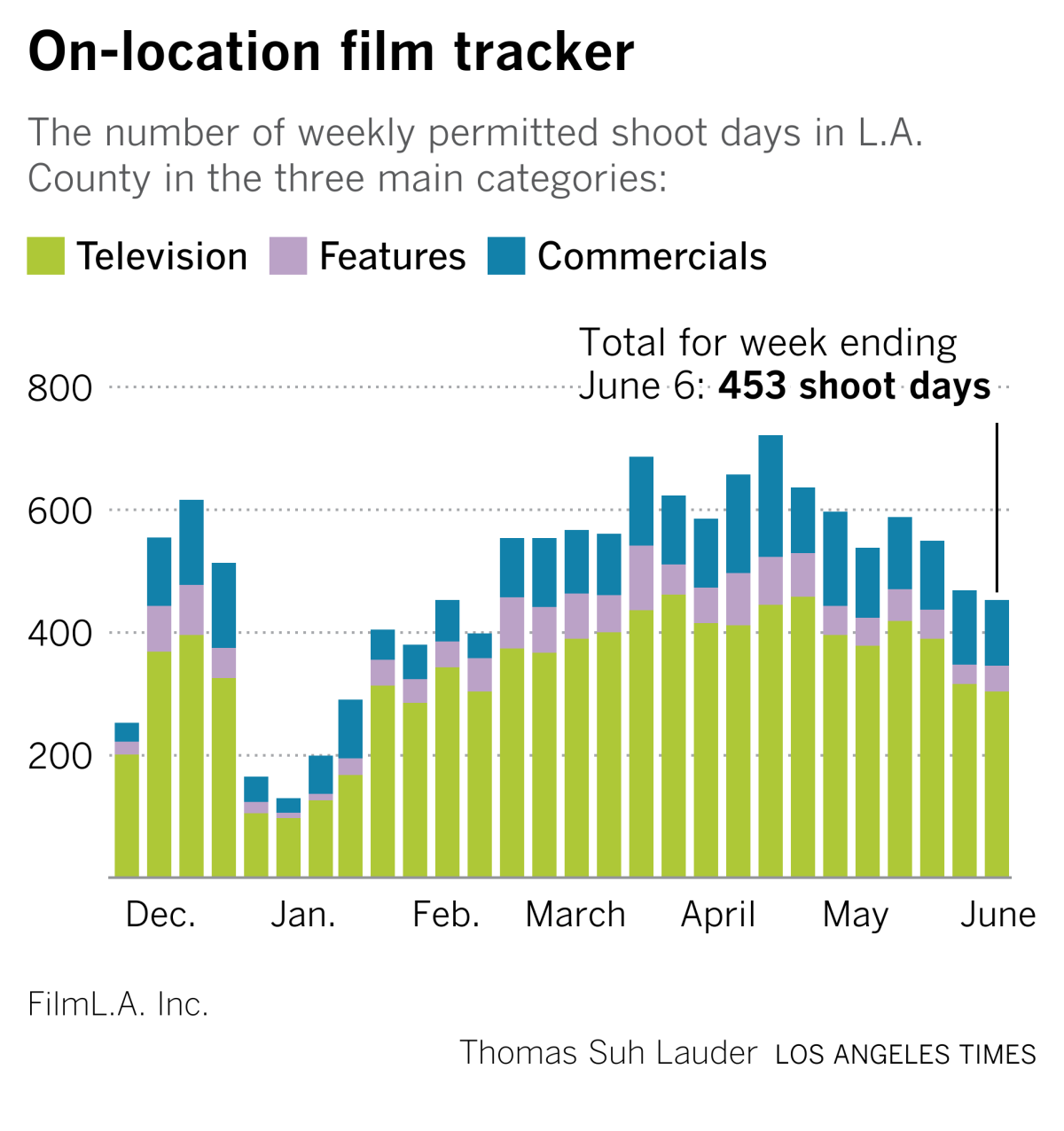

The surge in post-lockdown on-location weekly production appears to have dipped slightly since April, tallying 453 shoot days in the Los Angeles region last week, according to data from FilmLA.

More stories from the week

— “SpongeBob” and “Transformers” cost U.S. taxpayers $4 billion, study says. A new report details ViacomCBS’s use of a labyrinthine tax shelter to sell rights to its shows and films overseas. (NYT)

— Bill Ackman’s planned Universal Music deal includes his grandfather’s hit song. Great angle by Anne Steele on the deal talks that began in November. (WSJ)

Finally... two things that rock

I hope this Philadelphia punk band gets a lot more attention after its songs were featured on HBO’s “Mare of Easttown.” Its song “Drunk II” is an anthem, and its new EP “Perfect” is very punk rock.

Speaking of which, PONY (Sam Bielanski’s Toronto indie band, not the ‘90s Ginuwine banger) released a full-length album, “TV Baby,” in April, and it’s giving me nostalgic grunge-pop vibes.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.