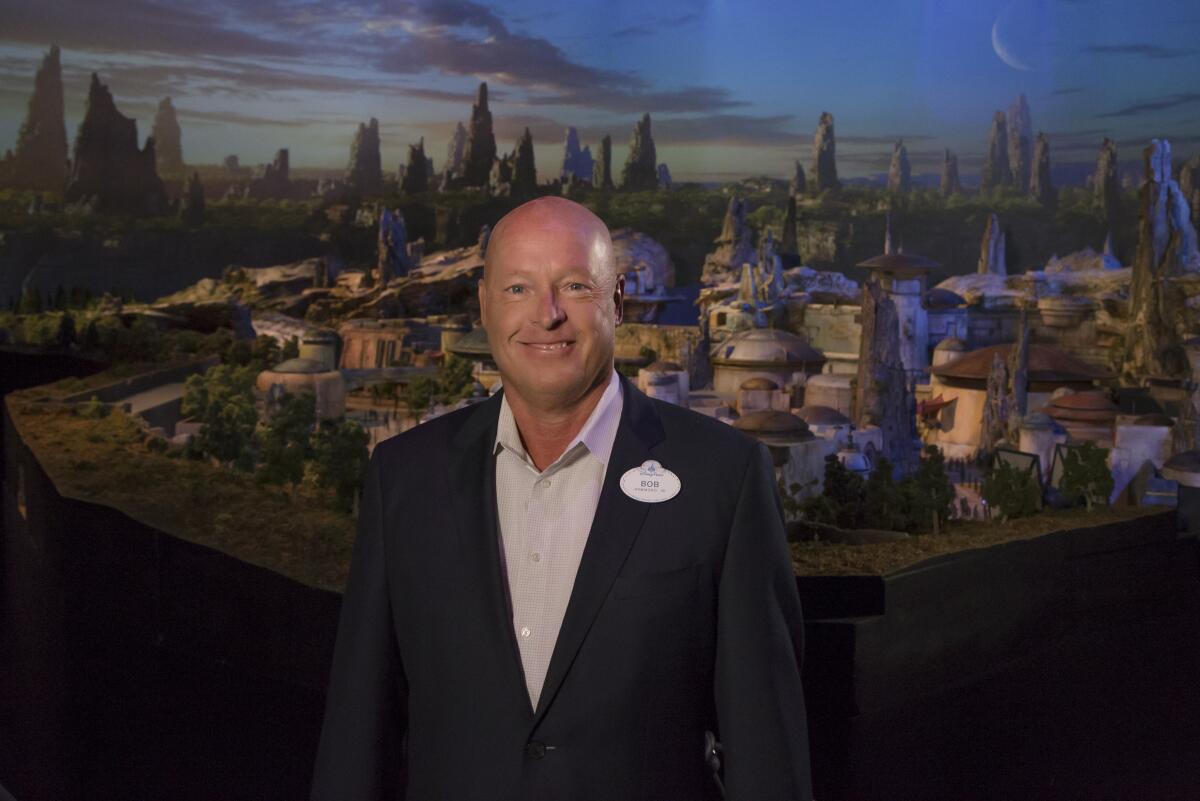

Disney’s Bob Chapek orders hiring freeze, cost cuts to make Disney+ profitable

- Share via

Bob Chapek wants Disney+ to be profitable by fiscal 2024, but meeting that goal is going to cause some pain at Walt Disney Co.

The Disney chief executive on Friday confirmed what he’d signaled in his fourth-quarter earnings call earlier this week: Cost cuts are coming to the Mouse House, in the latest example of a broader retrenchment in Hollywood as the industry tries to figure out how to make money from streaming.

In a memo to Disney executives reviewed by The Times, Chapek said he has established a “cost structure taskforce,” composed of Chief Financial Officer Christine McCarthy and general counsel Horacio Gutierrez. The company, Chapek said, has started a “rigorous review” of its spending on content and marketing, is instituting a hiring freeze and anticipates layoffs. The Burbank-based entertainment giant is also looking to limit travel to essential business trips only, with attendance at conferences needing approval from management.

The loss underscores the challenges that legacy media companies face as they spend money on new content to compete with Netflix for subscription dollars.

“We will look at every avenue of operations and labor to find savings, and we do anticipate some staff reductions as part of this review,” Chapek said in the email. “I am fully aware this will be a difficult process for many of you and your teams. We are going to have to make tough and uncomfortable decisions. But that is just what leadership requires, and I thank you in advance for stepping up during this important time.”

Chapek did not indicate how many jobs would be eliminated or when the cuts would occur. A Disney representative did not immediately respond to a request for comment.

“These efforts will help us to both achieve the important goal of reaching profitability for Disney+ in fiscal 2024 and make us a more efficient and nimble company overall,” Chapek said in the memo about cost-cutting. “This work is occurring against a backdrop of economic uncertainty that all companies and our industry are contending with.”

This comes after Disney reported results for its fourth fiscal quarter, in which Disney+ added 12.1 million subscribers. That was more than analysts expected.

However, the gains have come at a steep cost. The firm’s streaming operations — which also include Hulu and ESPN+ — lost nearly $1.5 billion during the quarter and more than $4 billion during the full year, Disney said Tuesday.

The company also reported earnings and revenue that fell short of analysts’ expectations, sending the stock tumbling the next day. Disney executives said the fourth quarter marked the “peak” of streaming losses. But executives also forecast profit growth that was slower than analysts had predicted.

“The company has to prove that their pivot to [direct-to-consumer] will be worth the price that is currently being paid,” media analyst Michael Nathanson wrote in a note to clients this week.

Disney+ now has more than 164 million subscribers. Including Hulu and ESPN+, Disney’s streaming operation has surpassed 235 million subscribers. Rival Netflix has 223 million subscribers, while Warner Bros. Discovery has a combined 95 million between HBO Max and Discovery+, which are expected to be consolidated.

Plus: What the Les Moonves-LAPD scandal means for #MeToo and why free streaming channels could be the future of broadcast TV news.

Disney is far from alone in its pursuit of cost-saving. Netflix, which operates the world’s largest streaming service, has cut hundreds of jobs and sought to slow the growth of its spending on movies and TV shows while also adding a cheaper tier supported by advertising. Warner Bros. Discovery’s David Zaslav is seeking $3.5 billion in savings from the April merger of Discovery and entertainment assets formerly held by AT&T, resulting in heavy cuts at HBO, Warner Bros. Television, Turner networks and CNN.

Traditional entertainment companies are facing increasing pressure from Wall Street to show a path to profitability for their streaming efforts. In the early ramp-up of the streaming wars, investors rewarded companies for subscriber growth, almost regardless of costs. Not anymore.

Chapek on Tuesday said he still expected Disney+ to become profitable by the end of fiscal 2024, barring a major economic downturn.

He framed the substantial losses as a necessary price for keeping Disney relevant for the long term as consumers turn away from traditional television. To make that pivot, Disney and others have also sacrificed traditional businesses that have been profitable but are either declining fast or stagnating. TV viewership is falling, cord cutting is accelerating and it’s unclear whether the box office will return in full for anything other than the biggest blockbusters.

Disney is taking additional measures to make its streaming segment profitable, raising prices for its ad-free Disney+ service while adding commercials for people who want to keep paying the current rate. Ad-free Disney+ is going up to $11 a month, a $3 increase. Ad-based Disney+ will cost $8 a month when it launches Dec. 8.

The downbeat news for Disney employees comes at the same time as its blockbuster “Black Panther: Wakanda Forever” hits theaters. The sequel is expected to open with $170 million to $200 million in ticket sales from the U.S. and Canada, making it one of the biggest movies of the year.

Here’s the full memo from Chapek:

Disney Leaders-

As we begin fiscal 2023, I want to communicate with you directly about the cost management efforts Christine McCarthy and I referenced on this week’s earnings call. These efforts will help us to both achieve the important goal of reaching profitability for Disney+ in fiscal 2024 and make us a more efficient and nimble company overall. This work is occurring against a backdrop of economic uncertainty that all companies and our industry are contending with.

While certain macroeconomic factors are out of our control, meeting these goals requires all of us to continue doing our part to manage the things we can control—most notably, our costs. You all will have critical roles to play in this effort, and as senior leaders, I know you will get it done.

To be clear, I am confident in our ability to reach the targets we have set, and in this management team to get us there.

To help guide us on this journey, I have established a cost structure taskforce of executive officers: our CFO, Christine McCarthy and General Counsel, Horacio Gutierrez. Along with me, this team will make the critical big picture decisions necessary to achieve our objectives.

We are not starting this work from scratch and have already set several next steps—which I wanted you to hear about directly from me.

First, we have undertaken a rigorous review of the company’s content and marketing spending working with our content leaders and their teams. While we will not sacrifice quality or the strength of our unrivaled synergy machine, we must ensure our investments are both efficient and come with tangible benefits to both audiences and the company.

Second, we are limiting headcount additions through a targeted hiring freeze. Hiring for the small subset of the most critical, business-driving positions will continue, but all other roles are on hold. Your segment leaders and HR teams have more specific details on how this will apply to your teams.

Third, we are reviewing our SG&A costs and have determined that there is room for improved efficiency—as well as an opportunity to transform the organization to be more nimble. The taskforce will drive this work in partnership with segment teams to achieve both savings and organizational enhancements. As we work through this evaluation process, we will look at every avenue of operations and labor to find savings, and we do anticipate some staff reductions as part of this review. In the immediate term, business travel should now be limited to essential trips only. In-person work sessions or offsites requiring travel will need advance approval and review from a member of your executive team (i.e., direct report of the segment chairman or corporate executive officer). As much as possible, these meetings should be conducted virtually. Attendance at conferences and other external events will also be restricted and require approvals from a member of your executive team.

Our transformation is designed to ensure we thrive not just today, but well into the future—and you will hear more from our taskforce in the weeks and months ahead.

I am fully aware this will be a difficult process for many of you and your teams. We are going to have to make tough and uncomfortable decisions. But that is just what leadership requires, and I thank you in advance for stepping up during this important time. Our company has weathered many challenges during our 100-year history, and I have no doubt we will achieve our goals and create a more nimble company better suited to the environment of tomorrow.

Thank you again for your leadership.

-Bob

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.