‘Ivory Tower’ takes a disturbing look at the college-industrial complex

- Share via

Everyone these days is fretting about the high cost of college.

On Monday, President Barack Obama said he would extend a program that caps student loan monthly payments by linking them to a percentage of income. On Tuesday, he talked about college debt with young adults who use the microblogging site Tumblr. On Wednesday, Massachusetts Democratic Sen. Elizabeth Warren’s measure to let people refinance older college debt was blocked by Republicans, who called it a “political stunt.”

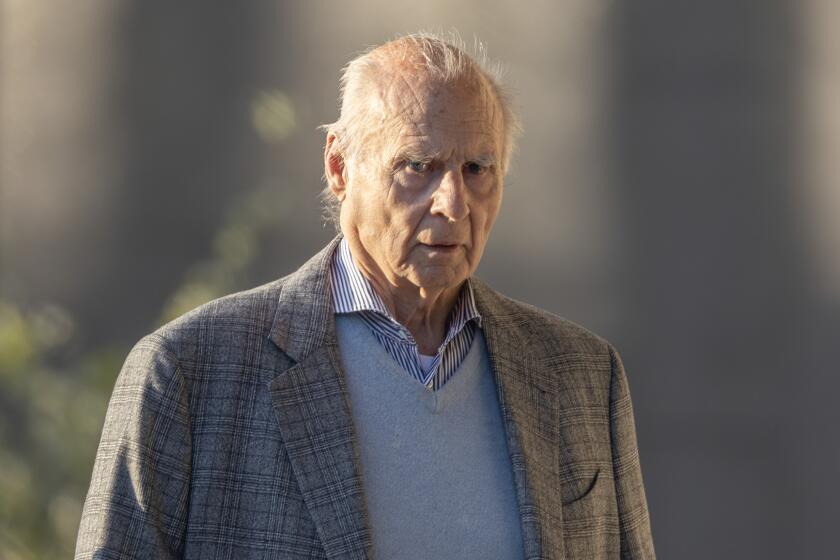

And today, director Andrew Rossi takes on the exploding college-industrial complex in his new documentary “Ivory Tower.”

“I want this for my kids,” says one mother in the film, after she has toured New York University. “It’s just too bad it costs $60,000 a year.”

I urge anyone dealing with the insanity of financing a college education to see this movie, which will spark many a conversation about how we got to this place, even if it doesn’t offer any tidy answers about how to get out. (It would be nice if every college could be like Harvard, with its $30 billion endowment, but that’s not in the cards.)

But even as we agree that college may not be for everyone, everyone should be disturbed that the cost of attending college has become prohibitive for so many. But why? Why has tuition risen so much faster than the cost of any other product or commodity in the last three decades?

“There’s a very complicated, complex set of perverse incentives that are driving everyone,” said Rossi, who graduated debt free from Yale 20 years ago, but told me he is still paying off his Harvard Law school loans. Rossi’s previous film, “Page One: Inside the New York Times” examined another institution under siege.

States have reduced funding to colleges so they can build, say, prisons. College administrators -- like their greedy chief executive cousins -- pull down insanely bloated salaries. Colleges have entered what education experts variously refer to in the documentary as “an arms race” or a “feeding frenzy” to produce better stadiums and other amenities like “wellness centers” with climbing walls and swimming pools in order to attract more students -- especially out of state students -- from whom they can extract more money.

Also, our whole philosophical approach to college has changed. At one time, it was a right; now it’s a privilege.

“There was always a tradition of really appreciating the role of higher education as a public good and an engine for social mobility,” Rossi said. “The conservative revolution completely turned that idea on its head.”

Education as a public good was enshrined in law as early as 1862, with the Morrill Act, which decreed that every state set aside land for a university. It found expression in the G.I. Bill, which provided a free college education to some two million World War II veterans. It arguably reached its apotheosis with California’s once magnificent three-tiered system of community colleges, state colleges and research universities.

The downward slide began in the late 1960s. California Gov. Ronald Reagan helped enable the sea change in the attitude toward education when he declared that the state “should not subsidize intellectual curiosity.”

“We need to put government on the sidelines,” Reagan said. “Let the people develop their own skills, solve their own problems.”

After that, graduation rates, and college attendance among the poor began a long, slow decline, and tuition fees began their shocking rise.

In the 1970s, for example, the average federal Pell Grant (which does not have to be repaid) covered 116% of in-state tuition for public colleges and universities. By 2012, the average grant covered only 42%. That led to an explosion in the student loan industry. Students loans, thanks to Congress, can never be discharged – not through bankruptcy, nor maybe even death. As long as students have easy access to loans -- private or public -- colleges don’t have proper incentives to lower their costs.

The great swath of college students -- most of whom do not graduate in four years, which means they spend even more money than those who can graduate on time -- leave college in such debt (average: $29,000) that they will have to put off doing the things that the fruits of college are supposed to help them do -- buy a car, buy a home, raise a family.

Despite widespread acknowledgment that student debt has reached crisis proportions -- $1.1 trillion overall -- there is little relief in sight, either for those already burdened by high debt or those contemplating taking it on.

There are some patchwork forgiveness programs out there for college grads who go into public service. And the president has proposed some reforms -- like rating colleges based on tuition, graduation rates, the earning power of graduates and their school debt -- but that will change nothing for those already suffering under a mountain of debt.

You know what’s really a miracle here?

Despite the fact that most young adults cannot afford to go to college, they go anyway. Last fall, according to the U.S. Bureau of Labor statistics, nearly 70% of 2013 high school graduates were enrolled in a college or university. And the ones who graduate will have an advantage. The median lifetime earnings of college graduates is $2.26 million, compared to $1.3 million for high school graduates.

So, yes, by all means, our kids should go to college.

And maybe by the time they are 40, they can think about buying a new car, or a house, or having a family. Better late than never.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.