Bankruptcy judge approves financing for owner of O.C. Register

A bidding war may be emerging for the Orange County Register.

- Share via

A federal judge has approved a $4.5-million loan that will allow the Orange County Register to operate during bankruptcy -- setting the stage for a possible bidding war by an insider group and the owners of the Los Angeles Times and the Los Angeles Daily News.

The approval, which came Monday in U.S. Bankruptcy Court in Santa Ana, allows hedge fund Silver Point Capital to provide so-called debtor-in-possession financing to Register owner Freedom Communications, which plans to sell its assets in a court auction.

Tribune Publishing, the owner of the Los Angeles Times, which has said it expects to bid for Freedom’s assets, also had offered to fund the Santa Ana publisher through bankruptcy.

Tribune matched a previous $3-million loan offer from Silver Point, saying the hedge fund’s financing proposal had too many strings attached and would have benefited the insider group looking to purchase Freedom.

But Tribune dropped its objections when Silver Point, a major Freedom creditor, upped its loan offer by $1.5 million. In court documents, Tribune said the new loan contained “substantial improvements” and that it received assurances from Freedom, Silver Point and a committee representing unsecured creditors that a “robust and fair sale process” would occur.

In a court filing, Silver Point said its $4.5-million loan would “allow the debtors to turn their attention to marketing their assets and selling them to the best and highest bidder or bidders.”

If Chicago-based Tribune bids, it’s likely to face competition from several interested parties.

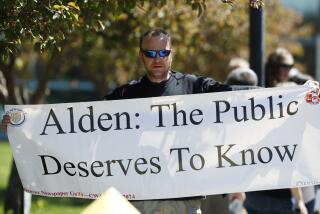

Digital First Media, the owner of the Los Angeles Daily News and the Long Beach Press-Telegram, is “very interested in being a potential bidder” for Freedom’s assets, Alan Martin, a lawyer for Digital First said Monday outside Bankruptcy Court.

Digital First announced last year that it would explore a sale of itself, but told employees in May that it was no longer looking to do so, according to a memo made public by the San Jose Mercury News, a Digital First paper.

A local investor group, led by Freedom CEO Rich Mirman, also has said it would like to bid on Freedom’s assets, which include the Riverside Press-Enterprise.

Silver Point hasn’t said it’s looking to purchase Freedom’s assets, though bankruptcy documents say it reserves the right to bid.

The exact timeline for the auction has not been set, but according to a court document the sale process is expected to wrap up in March.

Follow me on Twitter: @khouriandrew

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.