Healthcare watch: How to avoid becoming a victim of Medicare fraud

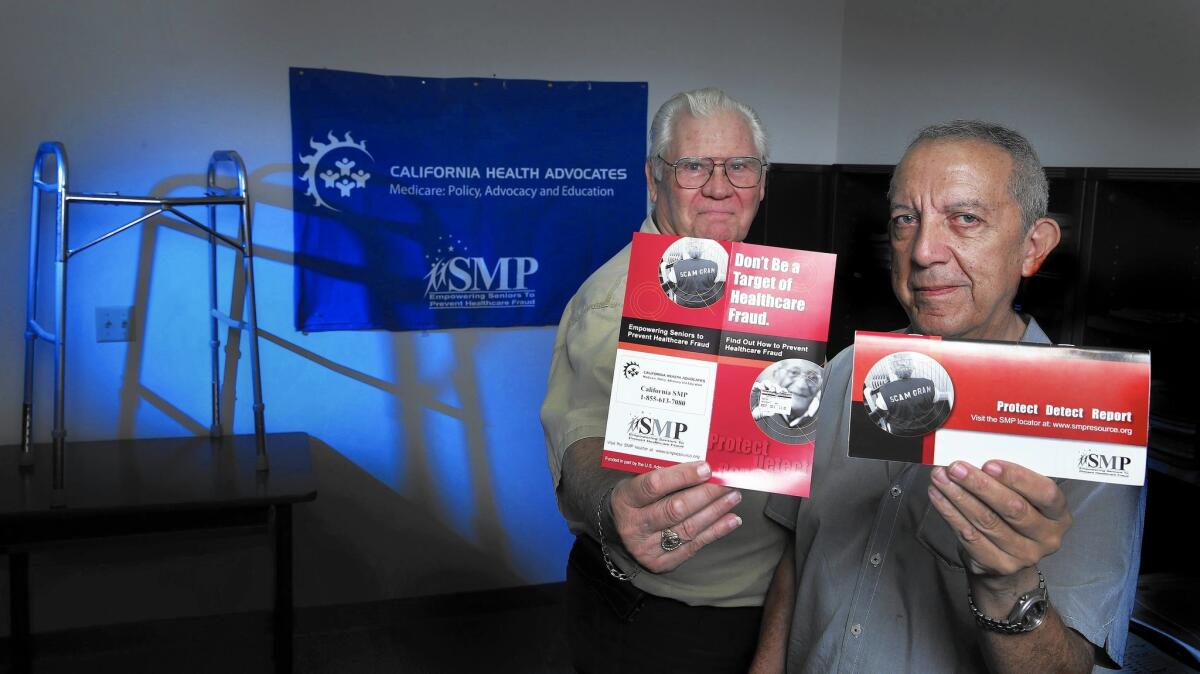

Doug Shaw, left, Southern California liaison, and Gary Molina of the Senior Medicare Patrol.

- Share via

When Marsha Kelly saw an ad in her local newspaper for a free back brace that helps seniors “reclaim their youth,” she decided to call the 800 number.

A customer service representative answered her call and asked Kelly to share her Medicare number and the name of her doctor. Then the representative asked for permission to initiate a three-way call with her doctor’s office.

“She said it looks like you qualify for the back brace, let’s call your doctor while you’re on the line,” recalled Kelly, a 72-year-old retired school administrator from Monterey, Calif.

Once on the line, the doctor’s receptionist was told that Kelly could get the back brace at no cost. All the doctor had to do was sign a form stating that Kelly had a medical need for it. All agreed, and the process was set in motion.

But shortly after the call, Kelly had second thoughts, especially after conducting a Google search. “I saw a whole bunch of articles about it, and several were calling it a Medicare scam,” she said.

Ads like the one Kelly responded to are common, especially among durable medical equipment companies, experts say.

“There is a pronounced uptick in aggressive medical firms seeking ways to harass seniors or dupe doctors’ offices into authorizing durable medical equipment that is not needed and shouldn’t be authorized in the first place,” said James Quiggle, director of communications at the Coalition Against Insurance Fraud, a Washington, D.C., nonprofit dedicated to fighting insurance fraud. “This is a big trend right now, and a lot of taxpayer dollars are at stake.”

Once a company gets your information, “the vendor then has an order for equipment they fax to the doctor with all of your personal information, hoping the doctor or office staff is so busy they’ll sign it and send it back,” said Micki Nozaki of the California Senior Medicare Patrol, which works to prevent and report healthcare fraud. Senior Medicare Patrol outreach and education programs operate nationwide.

Medicare fraud in all its forms is rampant. Though exact numbers aren’t known, the government estimates that $60 billion to $90 billion is lost each year to Medicare fraud and abuse. In California, as many as 20% of fraud allegations investigated each year by the Senior Medicare Patrol involve durable medical equipment.

Experts offer these tips to avoid becoming a victim of Medicare fraud:

Protect your Medicare number. In most cases, your Medicare number is the same as your Social Security number. Guard it the same way you would protect your financial information.

“I would avoid providing one’s Medicare number over the telephone, especially with an uninitiated phone call,” said Fred Riccardi, director of client services at the Medicare Rights Center in New York.

Don’t take the call. Anyone who calls or shows up at your door saying they are from Medicare or the federal government and asking you for personal information is almost certainly a fraud.

“A cold call is almost by definition a violation of federal law,” Quiggle said. “Don’t engage these people. They are professional hucksters, and they’re good at separating people from their money.”

Medical exam required. Alarms should ring if you’re offered medical equipment, like a knee or back brace, without any requirement that you first be evaluated by a doctor.

“Phoning in a medical exam is a surprising tactic to say the least,” Quiggle said.

Keep track of records. Reviewing the Medicare Summary Notice that Medicare sends to beneficiaries every 90 days is a good way to monitor for potential fraud. It summarizes the medical services you’ve received.

“We encourage people to review their Medicare Summary Notices and to look at the dates and the provider and to review the information about the amount charged, about what Medicare has approved and what their cost-sharing responsibility is,” Riccardi said.

You can also check your account online as often as you like at MyMedicare.gov.

If you’re covered by a Medicare Advantage plan, review the Explanation of Benefits sent to you by your insurer.

Check first with your doctor’s office to rule out a simple billing error if you see something fishy.

Report suspicious activity. If you suspect fraud, report it. Claims submitted for services or equipment that you don’t need could prevent you from getting care you might need in the future.

In addition, Nozaki said, suspicious-looking billing may cause Medicare to stop or deny payment on claims, some of which could be legitimate. That can leave you with large unpaid medical bills.

Finally, Quiggle noted, “There is no such thing as free equipment. Someone pays for it; if not the senior directly, then the U.S. taxpayer.”

Kelly, the retired school administrator, said she still can’t believe that she fell for the scam. “You hear 100 times a day ‘Don’t give your personal information to someone you don’t know,’ and that’s exactly what I did,” she said. “I consider myself educated and very astute, and I fell for it.”

Resources and links

To report fraud or suspicious activity or to get help with billing issues:

• Senior Medicare Patrol California fraud hot line: (855) 613-7080.

• The Office of Inspector General at the U.S. Department of Health and Human Services: (800) HHS-TIPS or online at: www.oig.hhs.gov

• Your local Health Insurance Counseling and Advocacy Program (HICAP): (800) 434-0222.

Twitter: @lisazamosky

Zamosky is the author of “Healthcare, Insurance, and You: The Savvy Consumer’s Guide.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.