Why those working-age men who left the U.S. job market aren’t coming back

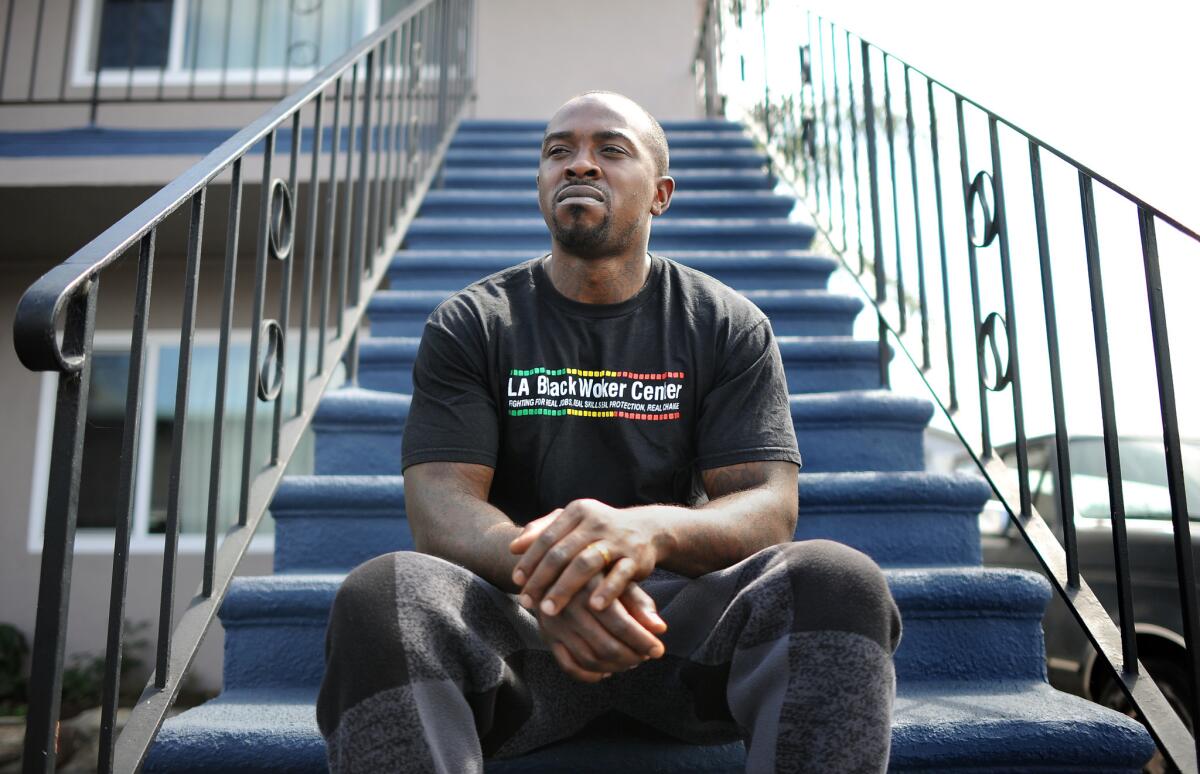

Mitchell Johnson of Hawthorne, who has been unemployed since 2012 after he completed an 11-month youth job training program, said he’s tried to get into the construction industry, but hasn’t had much luck.

- Share via

Reporting from Washington — Millions of workers who dropped out of the job market during the last economic slump were supposed to jump back in once things turned around. But more than six years after the Great Recession ended, the missing millions are increasingly looking like they’re gone for good.

The nation’s labor participation rate -- defined as the share of the working-age population that is either working or looking for work -- hasn’t budged from a 38-year-low of 62.6% this summer. And most experts don’t see an upswing on the way.

The reasons include the nation’s aging population, swelling ranks of people on disability and changing nature of jobs. But one of the biggest factors has to do with men in the prime of their work lives, particularly those with less education.

See the most-read stories this hour >>

Mitchell Johnson of Hawthorne has been unemployed since 2012, when he completed an 11-month construction training program. Married without children, the 26-year-old high school graduate blames it partly on the fact that he isn’t a union member.

Johnson says he could probably find low-wage work at a restaurant or retail store, but he is holding out for something better.

“I’m going for a career job,” he said. For now, he volunteers at a community work center and relies on sporadic side jobs, such as house painting, and his wife’s income from her job at a department store. “I got people to help me out,” Johnson said.

Labor participation for men age 25 to 54 has been declining for decades but sped up during the recession with large-scale layoffs in construction and manufacturing. Their growing withdrawal from the job market is especially worrisome because it carries significant social and economic costs.

Collectively, these trends indicate that the U.S.’s potential workforce -- and thus productive capacity -- may be considerably smaller than previously thought.

Some economists have long argued that the true unemployment figure is a few percentage points higher than the government-reported rate, currently 5.1%, because officials don’t count people as unemployed if they’re not actively looking for work.

But more and more experts are concluding that the great exodus of workers in recent years isn’t going to reverse.

SIGN UP for the free California Inc. business newsletter >>

Meanwhile, many workers who have been able to land only part-time jobs are finding that a stronger economy doesn’t necessarily lead to more work hours. The number of part-time workers wanting to work full time remains unusually high today, and there’s some evidence that this increase since the recession is largely permanent.

“There isn’t a lot of hidden slack,” said Harry Holzer, a Georgetown University professor and former chief economist at the Labor Department, referring to the pool of jobless and underutilized people ready and able to fill jobs.

What that suggests, he said, is that the official jobless rate is pretty close to the real level of unemployment.

That calculation will weigh on the Federal Reserve as it considers later this month whether to raise interest rates for the first time in nine years. The Fed’s chief, Janet L. Yellen, had often spoken about a large slack in the economy, suggesting that it was a compelling factor in maintaining the central bank’s easy-money policies.

If there are millions more jobless workers than the unemployment rate would indicate, the thinking went, the Fed could keep stimulating the economy with super-low interest rates to help absorb more of the unemployed without worrying about inflation shooting higher. The Fed’s benchmark interest rate has been pinned near zero since the depths of the recession in December 2008.

But as more time has passed, it has become harder to make a case that the slack is very big. Though economic growth has been slow and uneven, employers have added new jobs at a fairly steady and solid pace in recent years -- about 8 million since mid-2012.

The jobless rate has fallen from a high of 10% in October 2009 to 5.1% last month, very close to what many economists see as an optimum level before inflation pressures build.

Unemployment, to be sure, varies widely across the country, from 4% or lower in many towns in Iowa and Minnesota to double digits in some places in Central California. Still, the overall improvement has been impressive. This summer, there were about 63 job openings for every 100 officially unemployed persons. A few years ago, it was just 16 openings for every 100 jobless workers.

In the past, a recovering economy usually meant rising labor participation as more people gained confidence and got off the sidelines and into the job market.

But not this time. The share of the population 16 years and over in the workforce was 66% in December 2007 when the economy fell into recession, and it has ticked down every year since then to 62.6% the last three months.

If the U.S. had the same labor participation rate today as in late 2007, the nation’s workforce would be roughly 8 million larger than the July figure of about 157 million.

The severity of the Great Recession, which officially ended in June 2009, and major concurring shifts in the nation’s demographics have made it hard to predict labor trends.

Many economists, including those at the Fed, now estimate that about half of the decline in labor participation has been the result of the aging of the large population of baby boomers, the oldest of whom turned 69 this year.

Labor participation rates are lower for workers as they get closer to retirement age. And the economic downturn forced even more older workers to drop out of the labor force; anecdotal reports abound of laid-off workers taking early retirement.

At the same time, young adults have delayed their entry into the job market, further depressing labor participation. College enrollment rates were rising before the recession, and the weak recovery has pushed more people to stay in school longer while others who were laid off went back for training.

Many people not in the labor force are working off the books or at temporary jobs or as freelancers, making it difficult to track their employment status. Moreover, decades-old structural problems, including access to public transportation and affordable child care, continue to keep some workers, both male and female, from the workforce.

Berny and Dora Motto of Echo Park have been surviving on savings and unemployment benefits since he was laid off in June as a field deputy for L.A. City Councilman Bernard Parks, who was termed out of office.

Berny, 47, has a bachelor’s degree in international relations from his native El Salvador and remains very engaged in the job market; he has had interviews and is anticipating callbacks from some of them. Dora was a dentist in El Salvador but isn’t looking to go to work now. She takes care of their two young daughters at home.

“The last two months have been very, very difficult,” Berny Motto said, noting that he and his wife even considered returning to El Salvador.

Like the Mottos, many immigrants come to the U.S. for economic opportunities, and often have a higher engagement with the labor market than the native-born population. But participation rates have fallen for the foreign-born as well, as they have for almost every demographic group with the notable exception of older workers, especially those over 65.

Labor participation for women 25 to 54, which had risen steadily from the 1960s through 2000, fell back to 73.7% this summer from 75.5% in late 2007.

The drop has been sharper for men in that age group -- to 88% from 90.9% at the end of 2007. At its peak in the mid-1950s, labor participation for men in their prime working age was nearly 98%.

The drop-off of men from the workforce continues to dismay policy experts and economists.

“Those are the ones I find most surprising,” said Sophia Koropeckyj, a labor economist at Moody’s Analytics. She still expects labor participation overall to rise a bit in the coming months as employers keep adding jobs and rising earnings draw more people into the workforce.

Most economists aren’t so optimistic. The aging of baby boomers, the youngest of whom are 51 this year, will be a big drag on labor participation rates for years to come. And there’s little indication yet that the decline of men in the work world has stopped.

In a paper in 2013 titled “Wayward Sons,” MIT economist David Autor said that the U.S. economic landscape was undergoing a “tectonic shift.” While women over the decades have gained ground in education and economic measures, including labor participation, men have fallen behind, Autor noted.

That’s made men less attractive as partners, he said, and has perpetuated a vicious cycle in which children living in low-income single-parent households are headed predominantly by women, who in turn raise sons with poorer prospects for social, education and economic advancement.

NEWSLETTER: Get the day’s top headlines from Times Editor Davan Maharaj >>

“Although a significant minority of males continues to reach the highest echelons of achievement in education and labor markets, the median male is moving in the opposite direction,” he wrote in the paper with Melanie Wasserman, a graduate student.

That’s particularly worrisome in an economy driven by global competition and rapid changes in technology.

“A male high school graduate in America has almost nothing an employer is going to value,” said Holzer, the Georgetown professor, noting that many men and the U.S. economy at large would benefit from stronger vocational and technical school programs that lead to apprenticeships and other career paths.

“On average, low-income, at-risk young men don’t do as well just sitting in a classroom,” Holzer said. “I think a lot of these men would do better if we offered them high-quality work-based education.”

ALSO:

Can homeowner association board prevent owners from suing?

Personal finance Q&A: Shopping for insurance is worth the effort

Soaring student loan debt poses risk to nation’s future economic growth

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.