What you need to know about Broadcom’s sale to Avago Technologies

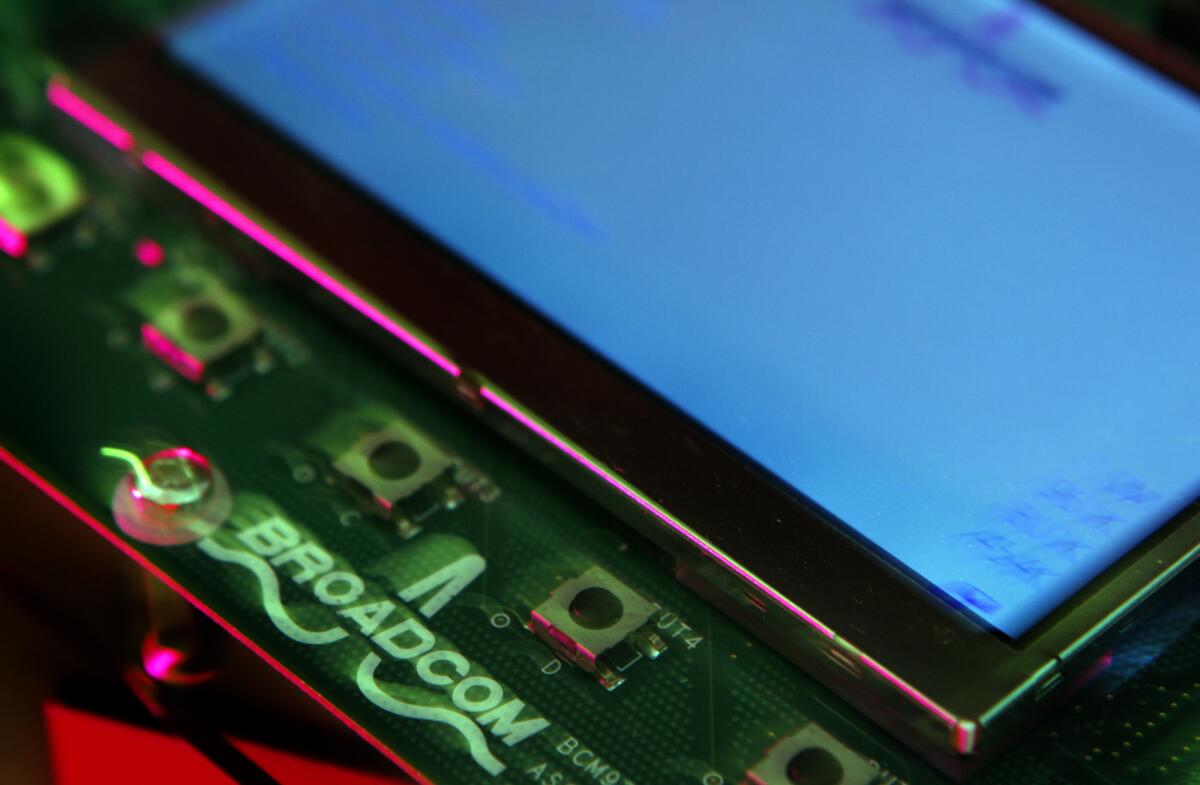

A Broadcom circuit board used in a high-definition mobile multimedia processor displayed in the company’s Irvine headquarters. Broadcom on Thursday agreed to be acquired by Avago Technologies for $37 billion.

- Share via

Avago Technologies Inc. on Thursday agreed to buy Irvine semiconductor developer Broadcom Corp. for $37 billion in cash and stock, one the largest deals in the history of the semiconductor industry.

The blockbuster deal is part of rapid consolidation in the semiconductor industry and creates a company with a combined market value of $77 billion and combined annual revenue of $15 billion.

Founded in a Santa Monica condominium in 1991 by Henry Samueli, a UCLA professor, and Henry T. Nicholas III, a star student, Broadcom now employs more than 10,000, with more than 75% of them engineers.

Why is this transaction important?

Both companies are major players in the business of supplying the infrastructure behind a range of consumer and business products, including smartphones, tablets, wireless networks and cloud computing.

Combining them is expected to lower costs to major tech companies that rely on the products, including Amazon.com Inc., Google Inc. and Apple Inc.

Will the deal result in job cuts?

Probably, with Broadcom feeling the brunt of it.

Analysts say the deal is mostly about achieving financial goals, including cost savings, and that Avago has a track record of cutting expenses and jobs after earlier deals.

The companies declined to comment on potential job cuts. A person close to the companies noted that they do not have much overlap in terms of the products, a fact that should reduce the need for job cuts.

Why is this happening now?

While the semiconductor business remains highly profitable, annual growth in recent years has slowed to single digits. Big companies, which have high capital costs, find they are able to boost profitability through economies of scale.

Plus, technology stocks have been rising for more than year, increasing the value of shares that the companies use as currency in such transactions. Companies tend to do deals while the stock is high.

What are the details?

Avago will pay $17 billion in cash and the equivalent of about 140 million shares of its stock to Broadcom shareholders, who will end up with 32% of the combined company.

For each Broadcom share, Avago would pay $54.50 or nearly half an Avago common or restricted share or any combination Broadcom holders choose.

Avago would finance the deal with $8 billion in existing cash and $9 billion in new debt. The combined company would end up with $15.5 billion in debt, including the refinancing of existing debt.

What about the new corporate campus that Broadcom is now building in Orange County?

Construction will proceed, according to a company spokesman.

Didn’t the founders have some legal trouble?

In 2008, federal prosecutors alleged that Samueli, Nicholas and two other executives hatched an elaborate scheme to secretly increase the value of employee stock options without disclosing the expense in regulatory filings as required.

A federal judge dismissed the charges in late 2009. Nicholas also was indicted in drug charges, but they were also dismissed.

Twitter: @deanstarkman

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.