Geithner’s new debt-limit estimate: Mid-February to early March

- Share via

WASHINGTON -- Treasury Secretary Timothy F. Geithner told Congress Monday that the U.S. would exhaust its special measures to avoid breaching the nation’s debt limit sometime between mid-February and early March.

In updating an earlier estimate of late February, Geithner stressed that it was difficult to be more precise because it is tax season. The filing of taxes causes “a significant amount of uncertainty” because the “amounts and timing of tax payments and refunds are unpredictable.”

“For this reason, Congress should act as early as possible to extend normal borrowing authority in order to avoid the risk of default and any interruption in payments,” Geithner wrote to Democratic and Republican leaders in the House and Senate.

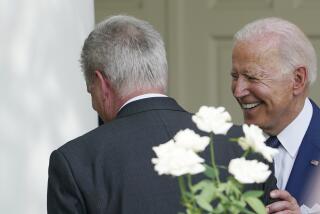

Geithner echoed President Obama’s plea to lawmakers earlier in the day not to waste any time in raising the $16.4-trillion debt limit to avoid a U.S. default on its obligations.

Gethner informed lawmakers last month that the U.S. would technically reach the debt ceiling on Dec. 31 and that the Treasury was taking “extraordinary measures” to juggle the nation’s finances to buy some more time.

In a Dec. 26 letter, Geithner said those measures should be able to create about $200 billion in additional borrowing capacity and allow the U.S. to avoid a potential default for “approximately two months.”

That estimate was uncertain because tax rates for 2013 were still up in the air as the White House and Congress worked to avoid the so-called fiscal cliff. The new estimate takes into account the changes enacted this month in a deal to extend the George W. Bush-era tax cuts for annual household income below $450,000 and other tax changes.

The extraordinary measures involve suspending sales of state and local government series Treasury securities, as well as other accounting maneuvers that also were used in 2011 when the White House and congressional Republicans battled until the last minute before raising the debt limit.

The brinkmanship led Standard & Poor’s to lower the U.S. AAA credit rating, the first downgrade in the nation’s history.

Geithner warned congressional leaders on Monday that some of the 80 million payments the government makes each month, including Social Security checks, military salaries and income tax refunds, would be threatened if the debt limit is not increased.

“If Congress does not act to extend borrowing authority, all of these payments would be at risk,” Geithner wrote. “This would impose severe economic hardship on millions of individuals and businesses across the country.”

At a news conference Monday, Obama warned congressional Republicans not to risk a default by holding the debt ceiling ransom to budget-cutting demands.

House Speaker John Boehner (R-Ohio) responded that “the consequences of failing to increase the debt ceiling are real, but so too are the consequences of allowing our spending problem to go unresolved.”

ALSO:

Treasury to take steps to keep paying bills as debt limit nears

Boehner promises Republicans he’ll fight Obama over debt ceiling

Obama warns GOP against trying to ‘collect a ransom’ in debt fight

Follow Jim Puzzanghera on Twitter and Google+.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.