Tax break for earthquake retrofitting passes California Senate

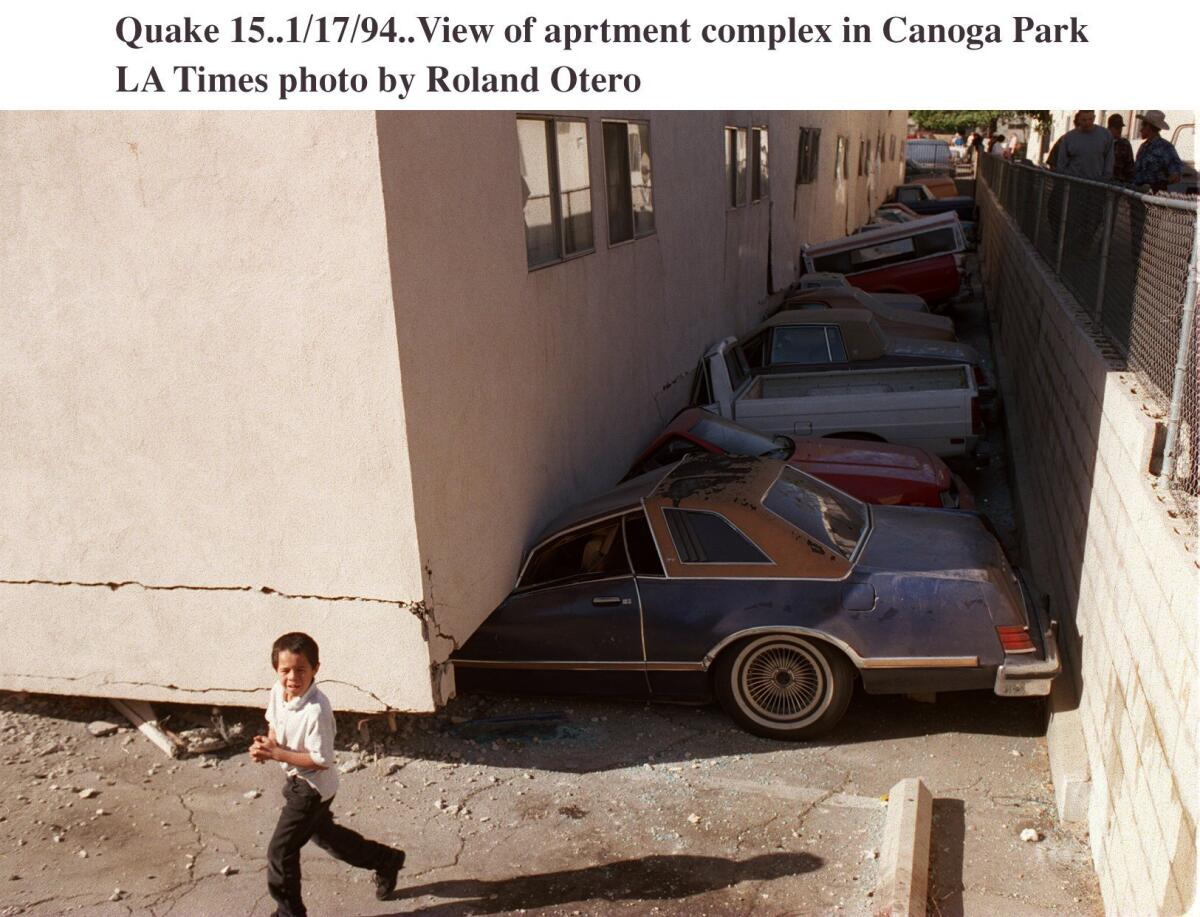

The upper stories of an apartment building in Canoga Park collapsed onto the ground floor in the 1994 Northridge earthquake.

- Share via

A proposed state tax credit for earthquake retrofits passed the Senate on Tuesday, clearing a major hurdle for a bill that would ease the burden of strengthening thousands of at-risk buildings across California.

The proposal, which passed the state Senate 37 to 1, would give property owners a 30% tax break on the cost of seismic retrofitting.

“Nothing like this has happened before,” said Assemblyman Adrin Nazarian (D-Sherman Oaks), who introduced the legislation. “I am thrilled we have moved one step closer to making California safer.”

The Assembly version of the legislation, AB 428, passed 78 to 0. But the proposal failed in June to make it into this year’s budget, calling its prospects at that time into question.

With the Senate’s approval this week, the bill is moving forward, Nazarian said.

“This is both institutions saying that we see this need,” he said.

Nazarian said the tax break would also lead to more construction jobs as more buildings get retrofitted.

“Seismic retrofitting protects property, saves lives and creates jobs,” Nazarian said. “The main objective now is to make sure that the governor deems this necessary and offers his support through his signature.”

The tax credit idea has been endorsed by the mayors of Los Angeles, San Francisco, Oakland, Berkeley and Santa Monica. In Los Angeles, Mayor Eric Garcetti has proposed new city rules that would require the retrofits of thousands of older concrete and wooden buildings.

“The physical threat of death or injury from vulnerable buildings is real,” the five mayors wrote to the Senate Budget Committee this year.

A Senate analysis of the bill cited no formal opposition.

Under the bill, the tax credit would be given to an owner over a period of five years after the retrofitting was completed. For every $100 owners spent on a qualified retrofit, they would receive a $30 break on income or corporate taxes.

Work eligible for the tax break would include retrofitting vulnerable wood-frame apartment buildings and concrete residential buildings, installing automatic gas shut-off valves, anchoring single-family homes to foundations and installing quake-resistant bracing systems for mobile homes.

See the most-read stories this hour >>

“This incentivizes residents and ... building owners to say ‘OK, well, this is an important step, this is something that I’ve been putting behind for a very long time, and now I can recoup 30% of my cost. So let me take advantage of it.’ That’s the hope that I’m working towards,” Nazarian said.

The tax credit would be in effect from 2017 through 2021 on a first-come first-served basis, according to a Senate amendment to the bill. The credit would be capped at $12 million each year, plus any carryover of unused funds from the prior year.

The bill now goes back to the Assembly, which is expected to vote this week on the Senate’s amendment. If approved, the proposal will be sent to Gov. Jerry Brown for consideration.

Follow me on Twitter for more earthquake safety news: @RosannaXia

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.