Dissecting Democrats’ healthcare bills

- Share via

WASHINGTON — Critics of the Obama administration’s effort to overhaul the nation’s healthcare system say, among other things, that the nation cannot afford it. Here are some key questions and answers about the cost:

Last week the Obama administration announced that it expected the federal deficit to grow considerably more than it had projected six months ago. How much would Democrats’ healthcare bills increase the deficit?

There are three bills at the moment: one in the House, one in the Senate Health, Education, Labor and Pensions Committee, and one in the Senate Finance Committee that has yet to be finalized.

President Obama’s budget allocates $630 billion over 10 years to offset the cost of a healthcare overhaul. The Senate health panel’s bill would cost an estimated $615 billion over 10 years, but the finance panel is responsible for determining how to pay for that, so the bill’s potential effect on the deficit is unclear.

The estimated cost of the House bill is $1.042 trillion over 10 years. The nonpartisan Congressional Budget Office projects that after revenue-generating provisions and savings in Medicare and Medicaid, the House bill would add $239 billion to the deficit over 10 years.

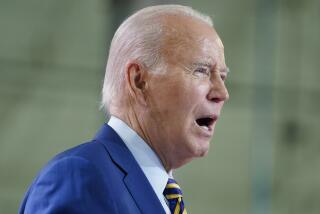

Obama has said that he will not support any bill that increases the deficit.

Would it be better for the nation’s long-term fiscal health to do nothing?

Medicare, Medicaid and Social Security account for a major portion of federal spending; no matter what, healthcare costs will continue to expand the deficit. If Congress does nothing about the healthcare system, the country is on pace to reach historic debt levels by 2046.

What makes these bills so expensive?

The bills would require that all Americans have health insurance and would help many people pay for it. For poorer people, the bills would loosen eligibility rules for Medicaid.

To help middle-class workers who cannot buy coverage, the government could subsidize premiums to be purchased on a private insurance exchange and provide insurance directly through a government-run public option. One of the Senate bills may propose using government funds to form private healthcare cooperatives that would compete with private insurers.

How would Congress pay for these proposals?

It would fine employers that didn’t offer qualifying health insurance; collect payments from employers whose workers chose insurance through the exchange rather than through the employer; and fine uninsured people who refused to buy health insurance.

But those measures wouldn’t offset the full cost, so Congress is also considering raising taxes on the wealthy or taxing high-end health plans, sometimes called “Cadillac” plans.

Streamlining Medicare’s administration could also save money -- billions, according to some proponents.

Does my healthcare plan qualify as a so-called Cadillac plan?

The term generally refers to policies whose overall premiums -- employer- and employee-paid -- total $19,000 to $25,000 a year. According to a Kaiser Family Foundation survey, the average family insurance plan costs $12,680 a year; 9% cost more than $17,000.

If co-ops would be private entities, why would government money be required to start them?

It would take years for private cooperatives to grow on their own. Federal “seed money” -- loans or matching funds -- would be needed to help co-ops maintain the state capital reserves required of insurers, supporters say.

The government would have no control over the management of the co-ops and the money would ultimately be paid back.

How can the government squeeze savings out of Medicare without cutting patient services?

The House bill proposes improving productivity, changing drug rebates, cutting the payments the government makes to hospitals that treat large numbers of Medicare patients, reducing payments to Medicare Advantage plans, and reducing the frequency of preventable hospital readmissions.

Some providers have argued that such measures would force them to cut back on the services they offer.

--

joliphant@latimes.com

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.