Cerritos, Ready to Plug into World of Cable TV, Studies Options

- Share via

CERRITOS — After spending the last few years outside the cable explosion, Cerritos is moving into the cable television market and should be ready to take bids from cable companies within a month.

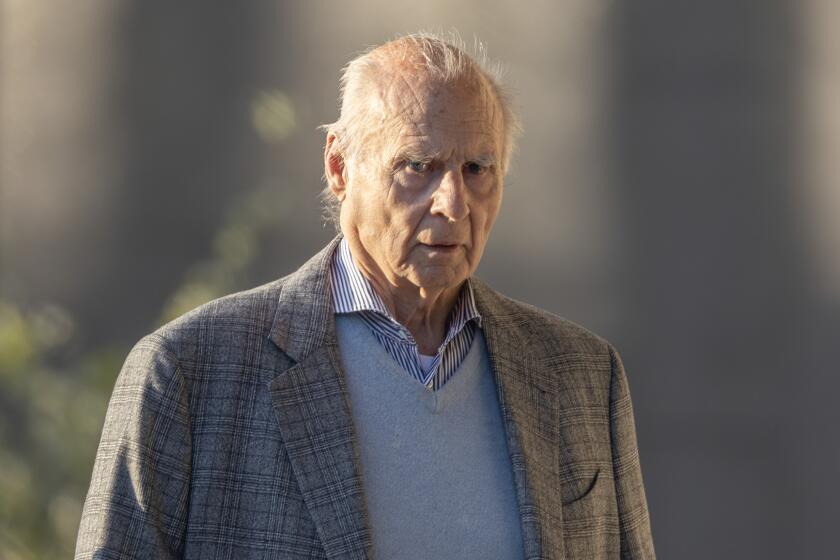

“Given a smooth sail, the City Council hopes we can begin breaking ground before the end of the year,” said John Saunders, director of internal affairs. If all continues to go well, he said, part of the system should start operating in about a year.

“I know from the experience that other areas have had that they bring areas up as they go,” Saunders said. “So there might not be an entire system until 1987, but some areas will go in in 1986.”

The next step, he said, is for the city to pass an ordinance authorizing cable television in Cerritos and enabling the council to accept bids from companies. No companies have contacted the city yet, Saunders said.

City officials want an underground system that would use conventional cables to transmit signals. It would be divided into two services, a residential system for home entertainment and an institutional system for the city and school district to use. The whole system would cost about $10.3 million to build, mainly because of the expense of laying underground cable.

Cerritos is one of the last cities in this corner of Los Angeles County to get cable service.

As a middle-class community with a relatively young and affluent population of almost 70,000, and a preponderance of single-family homes, Cerritos is a good city for a cable franchise, according to officials of the city and its industry consultant. Until this year, though, Cerritos did nothing directly toward obtaining cable.

Saunders said the city decided to wait until now because “lots of communities are having problems with their cable providers.” But he said there has been “a lot of interest in the community (for cable) in the last couple years.”

The problems cities have had range from subscriber complaints to bankruptcy. Part of the reason for these problems, cable operators say, is that cable is a new business, and most companies lack experience in running an urban cable system; meanwhile, cities and subscribers are demanding fast and efficient service.

The City of Duarte, for instance, revoked the franchise of its cable provider, Acton Cable TV, in 1983 after receiving numerous complaints from subscribers about bad service. Another company, CommuniCom, which holds the franchise for most of Los Angeles, filed for Chapter 11 bankruptcy protection against its creditors in February.

“CommuniCom had a poorly built system,” a company spokesman said, adding the system, which CommuniCom inherited from another company, was put together “by people who didn’t know how to run or build an urban system,” and assembled hastily to provide service fast.

CommuniCom’s costs were also higher than the company had planned, the spokesman said. The company was negotiating a sale to United Cable of Denver, but when negotiations broke down, CommuniCom was left with a $160-million debt.

Saunders believes, though, that by holding back, Cerritos may avoid the problems other cities have faced.

“We did do quite a lot of planning before we entered the field,” he said. “We’re not looking for just a traditional cable system.”

Nor is Cerritos looking at an inexpensive system, Saunders said. The city wants to have an interactive system installed that would allow features like pay-per-view watching, home banking and residential or business alarms.

More Costly Than Poles

The main expense, though, will be construction. Because it costs less, cable companies prefer putting lines above ground on telephone poles. An underground system, like the one Cerritos wants, can cost up to $60,000 a mile, compared to $20,000 a mile for an aerial system.

There is also the danger of damaging the city’s streets. “Every time you dig up a street, it weakens the street,” Saunders said. The city has little choice, however, because not only are 80% of its utilities below ground--meaning there are few telephone poles--city ordinances require that all new utilities be underground.

Having to dig up streets also deters cable companies, because the company, not the city, usually bears the costs of construction. “One city may say, ‘You’ve got to replace the cobblestone streets,’ and that’s more expensive than asphalt,” said John Kobara, regional manager of Falcon Communications.

A franchise that operated only in Cerritos might also make companies wary, because they would have to build administrative and technical facilities to run the system, as well as bear the brunt of laying cable. A system that imported a signal from a nearby community might be more attractive because it could simply wire Cerritos and plug into the neighboring franchise, George L. Page, an Oregon telecommunications consultant, advised the city in a written report.

Saunders agreed that the imported system would be cheaper, but that a home-based system would ensure greater quality. “We’re not tied to anything,” he said. “We will not be making a requirement that (companies) do either (type of system).”

Those factors will raise subscriber fees, Saunders acknowledged, but he said Page “did a pretty good job of being conservative” in sketching the ideal system.

Cost to Viewers Unknown

Saunders did not know how much subscribers might have to pay for the service, saying figures on construction and operation costs Page gave the city are only estimates. He also said the city has no breakdown on how much extra the interactive system will cost.

Saunders is almost certain the city will get bids, and expects that once the system is operating, 60% of the homes in Cerritos will subscribe to the service. The national average is a 35% subscription rate.

Cerritos is entering the cable field when the industry is in flux. Bill Rosendahl, regional director of corporate affairs for Group W Cable, said not all companies are expanding. Some are getting out of the market entirely, he said, while others are consolidating.

He said Group W is building up systems it acquired from other companies, as well as looking for new franchises. Kobara, on the other hand, said Falcon has stopped branching out.

“We’re not really interested in new markets in Southern California,” Kobara said. “We’re trying to make the ones we have profitable.”

There is also a “sobering amount of realism” and conservatism about which of cable’s state-of-the-art potentials--such as two-way communication--are economically feasible, Rosendahl said.

“State-of-the-art is a broad phrase, and what I like to put beside state-of-the-art is: Is it economically feasible?” he said.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.