Could Spawn a Price War : Bonaventure Slashes Its Room Rates by Up to 23%

- Share via

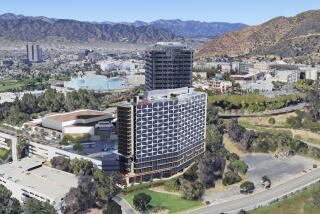

The Westin Bonaventure, the largest hotel in Los Angeles, said Monday that it has slashed room rates by as much as 23% in a bid to attract new business, fueling speculation that a room-rate war could erupt among Southland luxury hotels.

The 1,474-room Bonaventure, which has seen a sharp decline in business over the last two years, has cut its lowest single-room rate from $115 to $89, said James Treadway, the hotel’s managing director. He said the move was made to reverse a trend at the 9-year-old hotel of declining occupancy, which has fallen to 60% from 70% or higher just a few years ago.

Treadway said similar rate reductions are not planned for Westin Hotels’ 53 other locations, although the Seattle-based subsidiary of UAL Inc. did approve the rate change.

While the Bonaventure is among the first to drastically slash its rates, others are expected to follow soon, industry analysts said. When the largest hotel in an area lowers its rates, industry executives said, others generally tend to follow.

Downtown hotels have been hurt in recent years by the tremendous growth of rooms in the Los Angeles International Airport area, where four hotels have gone up in the last two years alone, and by the onslaught of new first-class rooms in Orange County. An estimated 5,000 new first-class hotel rooms have been built in the airport area since 1982, and in Orange County there are 9,000 first-class rooms with another 5,000 top-notch rooms in the building or planning stages.

For years, convention groups had two clear choices in the West: Los Angeles and Las Vegas. But Anaheim became a contender when the 1,600-room Anaheim Hilton opened next to the Anaheim Convention Center last summer. Anaheim expects a record 1 million convention delegates this year. San Francisco also is aggressively seeking convention business, and San Diego, with a new Convention Center under construction, may eventually give other California cities a run for their money.

Price is an important weapon in the battle for lucrative convention business. As convention facilities have sprouted throughout California in recent years, hoteliers have started offering deep discounts on rooms as well as other enhancements,such as free meeting space and expanded menus.

However, analysts and industry executives said the unchecked growth of hotel rooms cannot go on much longer without taking a toll in high vacancy rates. Similar gluts of first-class hotels are building in Houston, Boston, Seattle and New York, and even Palm Springs has 160 hotels and half a dozen more luxury hotels on the way.

With occupancy rates steadily declining--to a dismal 57% in downtown Los Angeles last year from 69% in 1981--something had to give. And rates were the first.

As competition intensifies, a growing number of hotels are increasingly interested in giving customers “a better sense of price value,” said Lauren Schlau, a senior consultant at Pannell Kerr Forster, a Los Angeles accounting firm.

In the Los Angeles area, Schlau noted, many executives are finding prices much more to their liking in the airport area. Average daily room rates near LAX are about 20% less than in downtown Los Angeles, according to a recent study by Pannell Kerr Forster. During the first quarter of 1985, average daily room rates downtown were $70.70 compared to $56.59 near the airport.

Airport hotels have taken “a real slice of the pie” away from downtown Los Angeles hotels, said Ted Barela, resident manager at the 1,281-room Airport Hilton. The more expensive hotels in downtown Los Angeles “will have to come down in rates to recapture lost business,” he added.

Mike Newbold, general manager at the 489-room Sheraton Grande in downtown Los Angeles, said that although there are no plans to reduce room rates at the Sheraton, “I’m sure there will be quite a reaction at some of the larger convention properties.”

Nelson Zager, general manager at the 487-room Los Angeles Hyatt Regency, said he was “taken by surprise” by the Bonaventure’s announcement. Noting that room occupancy at the Hyatt is close to 75%, Zager said he “would not be real excited about reducing room rates” right now. But he did say the rates will be reviewed.

Officials of the 700-room Biltmore in downtown Los Angeles, which is under renovation, were not available for comment.

George Scudder, general manager at the 1,012-room Airport Marriott, said other hotels may follow the Bonaventure’s lead, but not immediately. “They’ll probably wait and see what happens there first,” he said.

But the Bonaventure’s Treadway said he knows what will happen. The hotel’s estimated 300 rooms in the new $89 and $99 per-night categories “will be snapped up quickly,” he said.

Treadway said he began reviewing the Bonaventure’s rates six months ago, soon after he took the job, and discovered that discount packages were fast starting to account for most of the hotel’s bookings, indicating that customers would not stay at the regular rates. “This told me that our rates were out of line,” he said.

The lower rates would clearly differentiate the Bonaventure from Westin’s other Los Angeles property, the 1,075-room Westin Century Plaza, where single-room rates in its new tower begin at $155 per night.

The two hotels are managed by Westin but are separately owned. Mitsubishi International of Tokyo jointly owns the Bonaventure with John Portman & Associates of Atlanta. Westin’s Century Plaza is owned by Aluminum Co. of America.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.