Judge in Oil Price-Fixing Suit Cites Lack of Evidence

- Share via

A federal judge in Los Angeles said Monday that lack of evidence prompted him last week to dismiss key allegations in a suit that accused several major oil companies of conspiring in the early 1970s to fix the price of oil pumped from Long Beach tidelands.

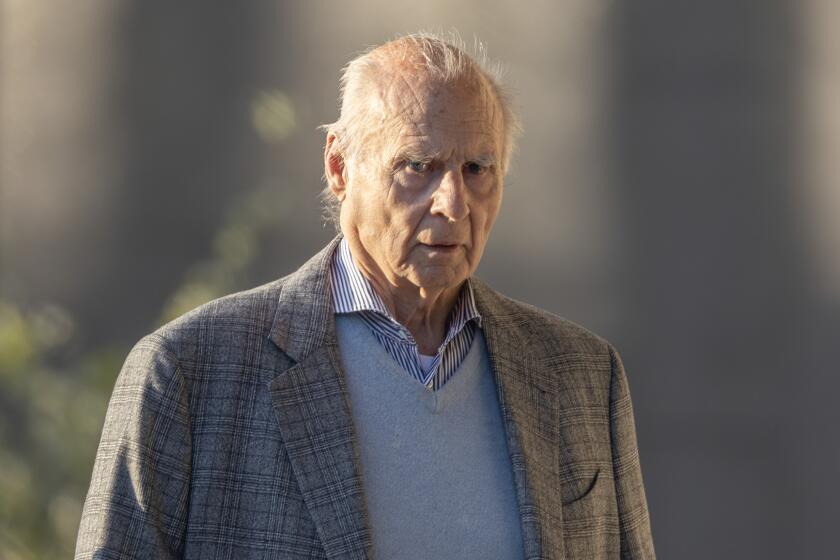

U.S. District Judge William P. Gray, elaborating in court on last Wednesday’s surprise ruling that followed nearly 10 years of extensive pretrial testimony, said attorneys for the plaintiffs--the State of California and the City of Long Beach--had failed to uncover any evidence of a conspiracy.

“The plaintiffs have not been able to develop evidence from which the finding of conspiracy can be charged,” Gray said. “You may very well want to appeal this decision. . . . I’d be amazed if you didn’t,” he added.

Attorneys for the state and city said they would await Judge Gray’s written opinion, expected early this fall, before filing an appeal.

The government lawyers had claimed that the City of Long Beach lost between $300 million and $400 million in revenue because it did not receive market value for its oil.

In an earlier opinion, Gray agreed that the defendants did pay the city less than market value for its oil during the years in dispute. However, he said he was not convinced that they had broken federal antitrust laws by doing so.

Lawyers for the state and the City of Long Beach attempted to overcome last week’s setback by arguing in court Monday that a second, even broader price-fixing suit, which claims improper pricing continued after Dec. 31, 1977, should be heard in state rather than in federal court.

Gray indicated that allegations in the second case seem similarly unsubstantiated. However, he made no ruling Monday, saying he would do so when he issues his written opinion this fall.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.