Stock Exchanges Enlist High Tech to Stalk Insiders : Armed With Vast Data, Computers Trail Suspicious Deals, Ties Among Traders

- Share via

The increasing sophistication of inside traders and market manipulators has driven the nation’s stock exchanges to develop high-speed, high-tech tools to reconstruct the illegal flow of sensitive information between corporate officials and stock traders.

During the past five years the New York Stock Exchange and other major exchanges have been building expensive computerized systems to track suspicious trades and draw links between the individuals involved.

One New York Stock Exchange computerized program contains extensive personal data on more than half a million corporate executives. It can almost instantaneously construct a “tree” detailing an individual’s personal and professional affiliations. Through it, investigators say they can build a trail of culpability from corporate leaker to market profiteer.

The message the exchanges and securities regulators want to send to investors and corporate officials who are tempted to share secret data is simple and ominous: We know where you live, whose boards you sit on, who your fraternity brothers were and with whom you play golf.

And while NYSE and Securities and Exchange Commission officials won’t say whether this system helped identify participants in the the current insider trading scandal, they do say the system has been helpful in the past in building stock abuse cases.

Aids Prosecutions

“I can assure you that one of the reasons you’re seeing more prosecutions and more people agreeing to civil and criminal penalties is the improved surveillance techniques used by the stock exchanges in this endeavor,” said Donald Solodar, NYSE senior vice president in charge of market surveillance services.

The exchanges have high-powered computer programs that flag unusual movement in a stock’s price or trading volume. At the NYSE, this system is known as Stock Watch, and last year it spat out 70,000 instances of suspicious stock action. About 10% of those were investigated further, and 10% of this group were referred to the SEC for enforcement.

The NYSE, American Stock Exchange, Chicago Board Options Exchange and several regional exchanges also share a second program, called the Intermarket Surveillance Information System--or ISIS--which can piece together the history of every stock or option trade, including the buyer, the seller and even the floor trader who handled the sale.

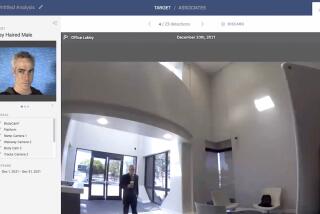

The least known and fastest growing of the computerized systems is known as ASAM, for Automated Search and Match, a NYSE computerized database with personal and company information on more than 500,000 corporate officials.

ASAM’s database has been compiled from public sources, including “Who’s Who,” the “Social Register” and Standard & Poor’s directory of corporate directors and officers. It includes an executive’s home address, club memberships, university affiliations and corporate directorships.

Extensive Information

The program has data on 44,000 corporations and 33,000 corporate subsidiaries, including nearly every company traded on the major stock exchanges. It also lists officials of many of the law firms, investment banking houses, public relations firms and even proxy solicitors and financial printers that at times have access to secret corporate data.

The rapidly expanding ASAM system enables stock exchange investigators to spot relationships between individuals that would have taken days or weeks to detect before the information was computerized, beginning in 1985.

For example, Solodar explained, if an investor bought a large block of a company’s shares a day or two before a significant merger announcement, ASAM would be called upon to spot executives of the company who might have personal or professional links with the investor.

“We look for people who live in the same ZIP Code or who graduated from Stanford within a year or two (of the trader) and begin to develop a tree,” he said. “Our experience has been that people involved in insider trading sometimes share that information with others who either live in the same area or went to same university or belong to the same club or are on a common board of directors.

“In our sleuthing we are using automated tools to try to tie together the characteristics of the buyers or sellers of shares with those whom our investigative process has learned might be involved in putting together a merger or other transaction,” Solodar said.

Solodar said he did not believe the system posed civil liberties or privacy questions because all the data were gathered from public sources. He added that the exchange has no reluctance to share the information with other stock exchanges or with enforcement officers of the SEC.

SEC Uses System

Mark D. Fitterman, an SEC market-regulation official, said the SEC uses information from ASAM in building cases against suspected stock manipulators. He said the agency has an extensive database of its own that contains some of the same information as ASAM and some confidential data from government inquiries.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.