Orange Land Values Score Heavy Gains

- Share via

It’s easy for me to say.

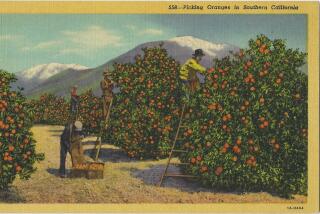

Two decades ago, when I embarked on this job, Orange County was pretty much one big orange grove on the way to San Diego.

The development binge was under way as landowners, farmers and ranchers began receiving offers they couldn’t ignore.

Their land was destined for an epic change at prices--by that era’s standards--they had never imagined.

Bluntly, a major factor was the beginning of white flight from the Los Angeles area, following the Watts riots of the summer of l965.

Vast expanses of citrus groves--and their smudge pots to fend off the cold--represented the most common denominator for the mostly rural county.

But the advent of Disneyland and the existing Knott’s Berry Farm had already changed the area’s mood and tranquility, and the amusement parks were to become worldwide household names.

By 1965, land was selling from $28,000 to $37,000 per acre, considered expensive then. Lee Sammis was the top broker for Coldwell Banker’s first Orange County office and was arranging for the purchase of up to 10 acres of land. Today, try $1 million for one acre.

He went on to become one of the Southland’s most successful developers as head of the Sammis Co., while Orange County has become one of the nation’s most rapidly growing and most affluent areas.

Planners have long described the pioneering planning and development efforts within the county as models of excellence, creating landmark projects and attracting global attention to the formation of master planned communities.

But back to 1965. Sammis had the exclusive listing on the entire property known as the Irvine Industrial Complex, covering about 236 acres.

“In those days, Collins Radio owned the 177 acres which now are Koll Center Newport. Lockheed Aircraft owned the 200 acres bordered by the Corona Del Mar (73) Freeway, Birch Street and MacArthur Boulevard, and McDonnell Douglas owned the 228 acres between Redhill Avenue and the Orange County Airport, from the San Diego (405) Freeway to the Corona Del Mar Freeway,” William R. Beck, of Coldwell Banker’s Anaheim office explained.

Additionally, McDonnell Douglas controlled 44 acres on MacArthur Boulevard which has since become Douglas Plaza.

“At that stage of the county’s growth, many envisioned that the airport would become a testing ground for the major aerospace companies in Southern California,” he said.

“However, the South Bay area and San Diego remained the focal points for the aerospace industry and the Orange County Airport area was largely bypassed, even with the significant holdings by Collins Radio, McDonnell Douglas and Lockheed.”

Eventually, those land areas were sold or ground-leased to other firms or to developers who divided the properties to suit the needs of smaller users. During the 1960s, a prime site fronting on a major street there was priced from the aforementioned $28,000 to $37,000 per acre.

With hindsight, Beck says, such prices look like incredible bargains compared to today’s asking price of $1 million-plus per acre, the result of a compounded growth rate that approximates 19% per year. Some examples:

In 1965, similarly priced land could be found in the Segerstrom family holdings, now known as the South Coast Metro area. Today, land values at Harbor Gateway, owned by that pioneer family, at Harbor Boulevard and Sunflower Avenue, are about $700,000 an acre.

In 1965, the Huntington Beach industrial area consisted of 418 acres, bounded by Bolsa Avenue, Springdale Street, Edinger Avenue and Bolsa Chica Street. Beck notes that property there could have been purchased for from $16,000 to $19,000 per acre.

The property was later acquired by Kaiser Aluminum. Its development subsidiary, Kacor, has since developed and sold most of those holdings. Industrial land there now would sell for about $600,000 per acre.

In the mid-1960s, land values closer to the border of Los Angeles and Orange counties--near the intersection of the San Diego and Garden Grove (22) freeways, were more than double the value of land farther south. In and around Garden Grove, where significant development was taking place, land prices approached $65,000 per acre. Today, land in that city is priced at about $600,000 per acre.

Just four years ago, land was priced at $272,000 per acre in the 2,200-acre Irvine Spectrum in Orange County’s red-hot southern market. Today, it’s priced from $325,000 to $890,000 per acre. According to Beck, this reflects the southeasterly growth of the county as residents and businesses follow the coastline and the freeways.

The significant increases in Orange County land prices over the past 22 years are also tied to inflation and escalating property values in the Los Angeles area, as well as the foresight and planning of such major land holders as the Irvine Co. and of the late architect, William Pereira.

What happens to land values from here on out?

“If today a typical office site in the John Wayne Airport area commands $1 million per acre, and assuming a growth rate of even 12%, well below the 19% experienced over the past 22 years, it would stand to reason that the same piece of property in the year 2000 could command approximately $4.3 million,” predicts J. Clark Booth, first vice president of Coldwell Banker and 20-year veteran of the Orange County realty market.

Granting that such a figure may seem exorbitant, he points out that prime downtown Los Angeles sites--although not directly comparable--”command up to $20 million per acre today, and in New York, one could pay more than $100 million per acre.”

And like every good salesman, and everyone else who looks back over the years, Booth thinks “Orange County is still a bargain!”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.