Santa Monica Making Room for Booming Hotel Business

- Share via

Fueled by high occupancy rates and an upsurge in office space development, hotel construction is booming in the Westside.

In Santa Monica, where a change in political climate is allowing construction of beachfront hotels for the first time, at least six hotels are planned or under construction. Developers are hoping to make the city into an “urban resort” area for both weekend getaways and weeklong convention groups.

In Century City, a luxury hotel opened in June. This month, another hotel opens across from the Beverly Center. By 1992, other luxury hotels are expected to open in Marina del Rey, Beverly Hills and Hollywood.

Above-Average Occupancy

Despite the rash of hotel construction, consultants say there is room for all, although some older hotels may be forced to lower room rates and go after business clientele with smaller expense accounts to maintain current occupancy levels. Nightly room rates run from an average of $85 in Hollywood to $200 in Beverly Hills, according to the accounting firm of Laventhol & Horwath in the mid-Wilshire District.

Westside hotel occupancy rates, which have been above the industry national average of 70% for a few years, are expected to dip into the high-60% bracket by 1991, according to R. Britton Colbert, a partner with Laventhol & Horwath’s hotel consulting division. But they should climb back into the low-70% range after most of the hotels are open in 1992, Colbert said.

Consultants believe that occupancy levels will go back up in part because of more than 5 million square feet of commercial office development that has already been built or approved for the Westside. Commercial development means an increase in business travelers.

Local government officials, even those opposed to major development, like hotels, preferring them over office buildings because they produce income without as many traffic problems.

“If the city is trying to resolve its fiscal problems in a more environmentally benign way, then hotels are more acceptable,” said three-term Santa Monica City Councilman Dennis Zane, a slow-growth advocate.

Besides taxes on hotel rooms, overnight guests spend money on transportation, meals and entertainment. A 1986 survey of travel expenses by Laventhol & Horwath found that the average Los Angeles-area visitor spends $185 a day. Only $70 is spent on lodging, with the rest on other travel expenses, which in turn generate sales-tax revenues, and in some cities, user fees and utility taxes.

While separate statistics on travel expenses for the Westside are not available, hotel consultants say more money is spent here than in other parts of Los Angeles because of more expensive hotel rooms, restaurants and entertainment.

Consultants and developers are optimistic about a strong Westside hotel market largely because its location makes it the ideal place in the Los Angeles area to combine business and leisure travel in one trip.

“After a full day of business meetings, Westside hotels can claim proximity to shopping on Rodeo Drive in Beverly Hills, dining in fine West Hollywood restaurants and watching the sunset over the Pacific Ocean in Santa Monica,” Colbert said.

The area’s year-round moderate climate is also expected to contribute to strong hotel occupancy levels.

“It is less seasonal than an area like, say, Palm Springs, where the winters are full and the summers bring discount rates,” said J. Paul DeMyer, national director of hospitality consulting for Kenneth Leventhal & Co., an accounting firm in Century City. “The Westside, particularly Santa Monica, has a higher occupancy level during the summer, but it’s generally strong all year.”

The hotels being built are high-end, not only because they are glamorous, but because the high price of land in the Westside dictates that new hotels must charge high rates to make a profit, consultants say.

“Plain and simple, there is no way to make a middle-level hotel pencil out with the cost of land in the Westside,” said John Sipple, director of Hospitality properties for Grubb & Ellis Co. in West Los Angeles.

And if clients are going to spend more than $150 a night, they want to feel like they are getting their money’s worth, the consultants say.

Likened to Chateau

The JW Marriott at Century City, which opened in June as Marriott’s top-of-the-line West Coast hotel, likened itself in a brochure to a magnificent chateau:

“French chateau decor is a harmony of upholstered pieces in flower-soft colors, custom armoires, marble-topped desks and dramatic floor plants. Thoughtful appointments include bedside, bath and desk phones. In the spacious marble bath are fine toiletries, hair dryer, terry robe and thick over-sized towels. Deep-piled rugs, Italian marble floors, museum-quality objets d’art and rare plants give our lobby the ambiance of the living room in a magnificent chateau.”

But hotel managers also know that good service, not marble floors, is what attracts, and keeps, customers. Both the Marriott and the Ma Maison Sofitel Hotel, which opens this month across from the Beverly Center, reportedly interviewed thousands of applicants for a few hundred jobs.

“Brick and mortar is important, but this is a people business,” said Jonathan Q. Loeb, general manager of the JW Marriott in Century City. “We take care of our people so they can take care of the clients.”

“Our strength is a dedication to training and more training to have our staff happy and knowledgeable to give our clients the upmost service they deserve,” said Richard Schilling, general manager of the Ma Maison Sofitel.

“Good service is always going to be a factor,” consultant DeMyer said. “Nobody can afford to be complacent.”

“Amenities like a morning newspaper, fresh flowers and special food orders are going to make a difference,” Colbert said.

Existing hotels are stepping up service to compete. The 24-year-old Sunset Marquis and Villas in West Hollywood, for example, is not content with flowers and newspapers to keep its guests satisfied. In response to an idea from its regular clientele--many of whom are in the music, film and advertising fields--the hotel recently installed a $750,000 Synclavier Digital Audio System for use by its guests.

“There is a tremendous amount of competition,” said Jorge Plaza, the hotel’s general manager. “We have our niche. The client base is pretty much established. But we are always trying to add value to our product to keep our clientele.”

Rate Competition

The hotel boom is expected to produce intense rate competition, usually unheard of in the high-end luxury hotel market, according to consultants. Yet, the 10-year-old Westwood Marquis Hotel and Gardens is offering weekend packages through the end of the year ranging from $80 to $210 per person per night, all including limousine service within a 3-mile radius of the hotel and other amenities. Room rates normally run from $190 to $375 per night, single or double occupancy, according to Judy Bearer, the hotel’s assistant to the general manager.

The JW Marriott Hotel is offering a “Bed and Breakfast Weekend” package for $159 a night through Dec. 26, which includes a welcome gift, full breakfast for two, a shoeshine and limousine service to and from Rodeo Drive in Beverly Hills. Normal room rates are between $180 and $2,000 a night.

Even the Four Seasons Hotel just outside Beverly Hills--which along with the Bel Air, the Beverly Hills and the Beverly Wilshire are acknowledged as the top four hotels in the area--is offering a summer promotion tied to Beverly Hills’ 75th anniversary. Its Diamond Jubilee Weekend starts at $250 a night. Normal room rates range from $195 to $1,700 per night.

The Loews Santa Monica Beach Hotel hopes to get a jump on what is expected to be fierce competition in Santa Monica the old-fashioned way: It will be the first of the many new hotels in Santa Monica to open.

“The big advantage we will have will be the early jump on the competition,” said Jonathan Tish, president of Loews Hotel in New York. The hotel is scheduled to open next summer.

Tish may not need that early jump if Santa Monica, which already enjoys 85% occupancy, becomes the urban resort area that consultants and developers dream of.

“Santa Monica has name recognition that is almost worldwide,” DeMyer said.

Consultants say that after years of discouraging major development in Santa Monica, elected officials, seeing a deteriorating tax base and development all around them, relaxed their tough stance against development a few years ago.

“It was a window of opportunity,” DeMyer said.

Santa Monica Councilman Zane points to a change in the council majority in 1984 that loosened building restrictions.

Zane, who describes himself as progressive, said he reluctantly supported approval of the hotels because they create less traffic than office space.

He also said hotels create jobs and provide much-needed revenue for the city.

But Beverly Moore, executive director of the Santa Monica Convention and Visitors Bureau, said making the city a resort area is not enough. She said meeting and conference business should be at least one-third of Santa Monica’s total tourism business.

“This market is particularly significant because meeting delegates tend to convene during the off-season, and also on weekends,” Moore said. “In addition, they have the highest visitor spending patterns, at nearly $125 per day, and stay an average of three to four days in a city.”

Moore said the aging and under-used Santa Monica Civic Auditorium could be the centerpiece in attracting convention and meeting business. Because most of the existing hotels do not have meeting space, remodeling the civic auditorium to include meeting rooms and exhibition space could attract groups. In the past, however, a City Council majority has opposed remodeling the auditorium in such a way.

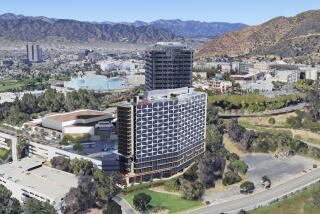

Many of the new hotels under construction or planned will be near the auditorium, which is located on Pico Boulevard between Main and 4th streets.

Both Loews Santa Monica Beach and Park Hyatt Santa Monica Beach hotels are going up on Ocean Avenue, Guest Quarters is being built on 4th street and Hotel California, a 69-room hotel, is being built on Main Street and Marine, about a mile away. Another hotel is proposed for the Colorado Place mixed-use development on Colorado Boulevard.

Existing hotels nearby include Pacific Shore Hotel on Ocean Avenue across the street from the auditorium, Holiday Inn Bayview Plaza up the street on Pico Boulevard and another Holiday Inn at Ocean and Colorado avenues.

DeMyer agrees that a renovated civic auditorium could have an impact.

He compares the situation to the Los Angeles Convention Center, where downtown hotels have complained that the car and boat shows and other 1-day or weekend attractions booked at the convention center don’t require people to stay overnight at nearby hotels.

The Santa Monica Civic Auditorium books similar, but even smaller, attractions.

Zane, for one, does not support the idea of using the auditorium to attract conventions.

“I do not think that the civic auditorium site should be devoted to conferences,” he said. “It should be devoted to cultural uses and open space. The 11 acres of the auditorium is a public trust, and they should be put to a use of the broadest public good.”

Four-term Councilwoman Christine Reed said she is generally supportive of the idea of expanding the auditorium, but she is concerned that it not lose its place as a community facility.

The future of the civic auditorium is of less concern to restaurateur Michael McCarty, who hopes to convert the Sand & Sea Club on Santa Monica Beach into a 148-room luxury hotel with room rates of $300 a night.

Other hotel developers, however, question whether McCarty will be able to command such rates because he will also have to provide public access to the beach and public locker facilities.

“Who’s going to want pay $300 a night and then have everyone walking by your room?” said one hotel developer who asked not to be identified.

In Marina del Rey, a new 300-room Ritz-Carlton is expected to bring a new level of luxury to the area, and with it a trickle-down effect for other area hotels.

“The Ritz-Carlton will have a tremendous impact on the marina,” DeMyer said. “With its marketing effort, the marina will become better known, and that in turn will bring new people to the less expensive hotels in the marina.”

Colbert said the marina, which has an 72% occupancy rate and an average daily room rate of $110, is a local secret that is ready to go public.

“Not a lot of people outside of California know about Marina del Rey,” he said. “But it’s exactly what you think about when someone thinks of California: water, sailboats and fun.”

“The Marina del Rey market is like Santa Monica in that it is attractive to people doing business throughout the Westside,” DeMyer said. “There is lot to do. It’s still a place where the girls are and where the boys are.”

Marina del Rey’s proximity to Los Angeles International Airport will also be a draw, according to Sipple of Grubb & Ellis.

“Business people now staying in hotels along Century Boulevard for two or three days would probably prefer to stay in an environment with after-business-hour entertainment,” Sipple said.

The optimism for the market is one reason consultants say that plans for another 300-room hotel, Marina Plaza, are expected to finally get off the drawing boards after years of planning by Real Property Management. Real Property Management owns three other hotels in the Marina, including the Marina Beach Hotel, which has begun an aggressive marketing program.

The Ma Maison Sofitel Hotel between Beverly Hills and West Hollywood is expected to draw from both markets, consultants say.

“We have one of the greatest locations of the city,” said Schilling, the hotel’s general manager, “and our hotel doesn’t resemble any other hotel in the city.”

Schilling hopes to capitalize on the success of the Ma Maison restaurant, which will reopen as a part of the hotel.

“ ‘Ma Maison’ means ‘my home,’ ” he said. “We have a brochure that says: ‘It began as a restaurant so good that people wanted to stay all night. Now they can.’ ”

Beverly Hills, with a 73% occupancy rate, is slated to get its first new luxury hotel since 1963. The Belvedere, with 200 rooms, is expected to be completed in 1990. It will be managed by the Peninsula Group, owners and operators of the renowed Hong Kong Peninsula Hotel.

“We spent more than 2 years studying virtually every luxury hotel in the world before we made even one drawing of the Belvedere,” said L. W. (Pete) Kempf, executive vice president of Probity International Corp., which will develop the hotel. “We designed this hotel from the inside out to cater to the most discerning business and leisure guests.”

Consultants say the Belvedere will need all the help it can get, entering probably the most competitive submarket in the Westside. It is likely to try to compete for guests with the Beverly Hills Hotel, the Beverly Wilshire and the Four Seasons.

The Belvedere may also compete for guests who normally stay in West Hollywood’s “boutique” hotels. Most are small, former apartment buildings that have been remodeled, and include Bel Age, Mondrian, Le Dufy, Le Parc, Le Reve and Valadon. West Hollywood has a 70% occupancy rate.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.