Hotel Ownership Has Become a Foreign Concept

- Share via

Question: What do the following hotels or hotel companies have in common? Regent Beverly Wilshire, Los Angeles; Ramada Inn and The Drake, New York; Watergate in Washington; Hotel Atop The Bellevue, Philadelphia, and the Omni Ambassador East, Chicago.

Answer: Each is owned and/or managed by a foreign company. In Chicago, in the midst of a major hotel boom, most of the new construction is for foreign-owned and/or managed hotels with names such as Nikko, Swiss Grand, Kempinski, 21 East and Four Seasons.

In Beverly Hills, the Beverly Wilshire is owned by a group of Asian investors, and the Beverly Hills Hotel by the Sultan of Brunei. The legendary Bel Air Hotel was recently sold to a Japanese company for $1.2 million . . . per room.

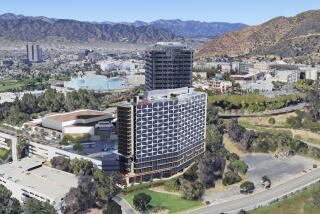

About the only major Beverly Hills hotel not owned by foreigners is the 592-room Beverly Hilton, which was bought by Merv Griffin for $100.2 million when he outbid Japanese investors in 1987.

And Beverly Hills has no monopoly on this statistic. Virtually every major hotel in Hawaii, with the exception of the Hilton Hawaiian Village (co-owned by Hilton and Prudential Insurance), is owned by Japanese investors.

“You have to accept the fact that the foreign hotels are here in a big way,” said Barron Hilton, chairman and president of Hilton Hotels Corp.

“The hotel business is a very competitive arena. In a recession environment there’s less hotel development. But the growth trends are soaring. People are becoming more mobile. New planes will be able to fly more people longer distances.

“There will be an increased demand for facilities, and a foreign clientele may feel more comfortable in a familiar environment when they travel abroad. So it doesn’t surprise me that the objective of many foreign hotels is to be established in the principal cities of the world.”

And Hilton’s Hawaiian Village property is still very much a foreign target. One offer--from a Japanese company--is rumored to have been $1 billion.

“There have been a number of overtures made asking whether we would sell,” Hilton said. “We have no interest in selling our 50% interest . . . now.”

But Hilton has not been a total holdout when it comes to unloading unprofitable properties. Recently, Hilton and Prudential Insurance, co-owners of the Hilton Turtle Bay resort, on the north side of Oahu, sold the hotel and its 800 acres to Asahi Junkin.

To be sure, it is nothing less than a foreign invasion of American hotels, an invasion that involves Germans, Swiss, Canadians, groups from Hong Kong and, of course, the Japanese.

In the last year, Hong Kong-based hotel groups have spent more than $500 million in acquiring U.S. hotels. The Mandarin hotel group (The Oriental in Bangkok, the Mandarin in Hong Kong) opened the Mandarin in San Francisco, but lost out to Donald Trump in a bid to buy The Plaza in New York.

Regent hotels, after disappointing performances in Washington (where the former Regent is now called The Grand), Albuquerque and Honolulu, are trying again. Regent bought and then totally renovated the Beverly Wilshire in Beverly Hills, and recently announced plans to build a hotel in Manhattan designed by I. M. Pei.

Next on Regent’s U.S. agenda is a possible new hotel in San Francisco, a city already overloaded with foreign hotels (Nikko, Portman, Mandarin, Meridien and others).

When the Bel Air Hotel sold for more than $100 million last month, it was a financial shot heard round the hotel world. The previous per-room purchase record was achieved when the 260-room Beverly Hills Hotel sold in 1987 for $757,000 per room.

“It was an outrageous price to pay,” said Stan Bromley, regional vice president and general manager of the Four Seasons Clift Hotel in San Francisco. “But they wanted a ‘trophy’ hotel, and they paid for it.

“By normal hotel financing standards, if it cost you $150,000 to build each hotel room, the individual rooms should rent for $150 per night--or one dollar for every thousand dollars spent. But in this case, it’s ridiculous. In order to make their money back, the new owners of the Bel Air should be charging $1,200 a night for each room. They’ll never do it.”

“He’s right,” said Atef Mankarious, president of the Rosewood Hotel Group, which manages the Bel Air. “We’ll never charge that rate. You can’t look at this hotel as normal. The new owners look at it as a work of art, like the Van Gogh painting that sold for $45 million.

“It’s one of a kind. It can’t be duplicated. It is a valuable asset as opposed to a profit center. And it will only increase in value. And we won’t tamper with it.”

The key to any new foreign ownership is whether the new owners keep the old management. In the case of the Bel Air, they have.

“When that happens,” said the Clift’s Bromley, “a hotel can maintain and even improve a good reputation, because staff morale remains high and new capital is invested into the operation.”

That is not always the case. In New York City, the old 23-story Gotham Hotel, vacant for many years, became Maxim’s de Paris Hotel. The owners soon sold the 250-room building for $127 million to the Peninsula group in Hong Kong, which changed the name to the Peninsula. Staff turnover followed, and there was a discernible lag time to train new employees. Service suffered.

“It’s a real problem,” said Patrick Board, general manager of the Mayfair Inter-Continental Hotel in London.

Last year, when the parent corporation of Inter-Continental, Grand Met, was trying to sell it, it slashed Board’s staff, and service standards at the hotel were strained.

“My staff-to-guest ratio fell apart,” Board complained. But he didn’t have to worry for long. After the Saison Group of Japan bought Inter-Continental for $2.27 billion, it allowed Board to hire more staff and make needed renovations.

“We’re now back up to speed,” Board said. (Recently, Saison sold 40% of Inter-Continental to SAS).

“We look at the Four Seasons involvement from a different point of view,” said George Schwab, chief executive of the Pierre Hotel in New York. “When we took over, we found a staff that was embroiled in confusion and set in its ways. They had also been treated as employees and not as part of a team.

“Would you believe that we actually had staff who had never been above the first floor because they didn’t think they would be allowed?”

Now Schwab encourages staffers to stay at the hotel, so they can experience the kind of service they will be expected to provide.

But a key question remains for hoteliers and guests alike: What can foreign ownership and management do to a hotel that U.S. companies can’t? And, if that results in higher room rates, will guests pay for it?

“We bring a concept and a style of service to the United States that others don’t,” said Robert Burns, president of Regent Hotels. “It’s a cultural difference that develops and then maintains a higher standard. I look at it as a combination of the high Swiss standard of hoteliers coupled with the concept of Asian service.”

It almost seems like a rhetorical question: Can you really duplicate the Asian concept of service with an American labor force?

“We think we can,” said Yasuyuki Miura, president and chief operating officer of Hotel Nikko U.S.A. “Our experience has been that if we employ Japanese people to provide Japanese service, it works. But the American labor market is different. For us, it’s a slow process.”

When Nikko acquired the Essex House hotel in New York, “We sent all the employees to Japan, and not vice versa,” Miura said. “Seeing was believing, as well as opening communication with their Japanese counterparts, front desk to front desk, housekeeping to housekeeping.”

Nikko developed “quality control circles” where staffers met to work out problems in service and efficiency.

“We’re not trying to force our style on Americans,” Miura said. “After all, 85% of our guests are American.”

“Our hotel laundries are now open seven days a week,” said Regent’s Burns. “And we’ve put stewards on the floors at the Beverly Wilshire, because that’s what we do in Hong Kong, and that’s what our guests now expect.”

And, the guests should also expect to pay for it.

“You’ll notice that these foreign hotel companies aren’t building in Kansas City,” said Bill Marriott, chairman and chief executive officer of the Marriott corporation. “They’re only doing these hotels in major international gateway cities, catering to a clientele that isn’t rate sensitive.”

In New York, for example, when the new Regent hotel is completed, average room rates will hover near $400 a night.

“The new foreign trend scares me a little,” said Jonathan Tisch, president and chief executive of Loews hotels. “A lot of these companies come in and try to steal away staff from other hotels at higher salaries.

“This, coupled with their initial capital investment, means they have to raise their room rates. But how much can they charge? How much is too high? You can ask whatever you want, but will you get it? That’s what we’re all waiting to see.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.