Inquiry Looks at Links to Milken in S&L; Scandal : Thrifts: Several failed savings and loans used junk bonds issued by indicted financier Michael Milken, sources say.

- Share via

WASHINGTON — Investigators from the Justice Department and the Securities and Exchange Commission are examining links between indicted financier Michael Milken and a circle of failed and troubled savings and loans, including Lincoln Savings & Loan in Irvine, sources close to the investigations said Tuesday.

Although the exact nature of the inquiries is not clear, the sources said investigators are poring over securities transactions, loans and land exchanges between a number of thrifts and real estate holding companies.

The companies under scrutiny have been connected with Milken, who pioneered the use of high-risk, high-yield debt known as junk bonds, said the sources, who spoke on condition that their names not be used.

“They scratched each other’s backs,” said one source who has examined transactions involving all the companies under investigation. “Milken helped these thrifts and companies grow by issuing junk bonds for them, and they bought junk bonds of his other customers.”

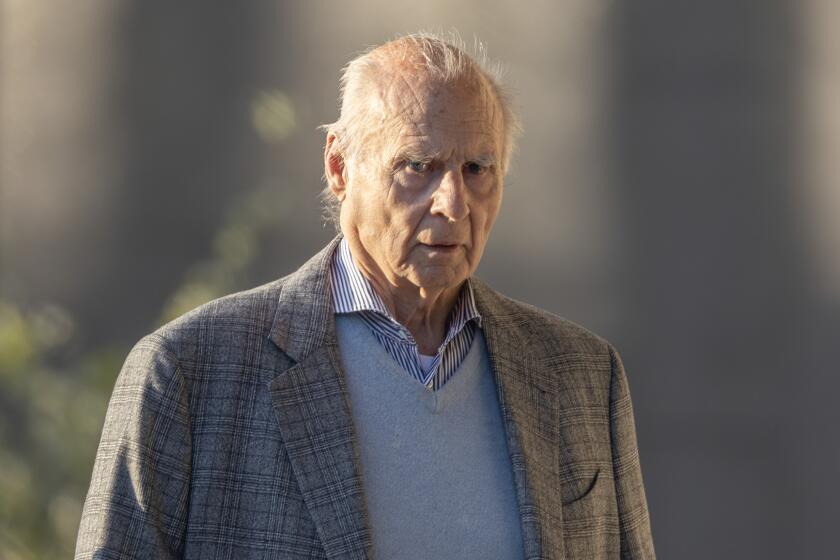

Milken, who resigned earlier this year from the Beverly Hills office of Drexel Burnham Lambert, has pleaded innocent to charges that he violated securities laws and manipulated the junk bond market to benefit himself and other insiders. He is scheduled to go on trial in March, but additional charges expected against him later this month may delay the trial.

The SEC and Justice Department declined to confirm or deny the investigations. But there have been public indications in recent weeks that their inquiry, which started several months ago with Lincoln Savings and its parent, American Continental Corp., has expanded to other companies.

In an apparent reference to the wider inquiry, SEC Chairman Richard C. Breeden told Congress last month that he had doubled the staff assigned to the Lincoln investigation and that its scope rivaled the agency’s insider trading inquiry on Wall Street.

Also last month, M. Danny Wall, who resigned Monday as the nation’s top thrift regulator, said in congressional testimony that he had asked the SEC and Justice Department to investigate “what may be a pattern” regarding Lincoln’s use of junk bonds and its possible ties to Southmark Corp. Southmark is a Dallas-based real estate and thrift company that grew rapidly on a diet of Milken-issued junk bonds before seeking bankruptcy protection.

Wall described the Southmark inquiry as “a very, very important investigation,” but he has declined to elaborate.

Another top regulator, who asked that his name be withheld, said the Office of Thrift Supervision, where Wall was the director, has turned over to the SEC and Justice Department evidence linking several institutions to a pattern of transactions that may have inflated stock values and resulted in misstated earnings reports.

The lead attorney in the government’s $1-billion civil racketeering suit against Charles H. Keating Jr. and other executives of American Continental acknowledged Tuesday that “we are investigating the relationship between Mr. Milken and Mr. Keating.”

Michael Manning, the Phoenix attorney handling the suit, declined in a telephone interview to specify the nature of the inquiry.

Among the other companies under scrutiny, according to the sources, are San Jacinto Savings, a Houston-based thrift owned by Southmark and linked to Lincoln; two defunct thrifts, Silverado Banking in Denver and Western Savings in Phoenix, and MDC Holdings Inc., a Denver real estate company that builds homes nationwide, including in Southern California.

The American Banker, a trade publication, reported Tuesday that documents on file with the House Banking, Finance and Urban Affairs Committee show that regulators expressed concern as early as the fall of 1988 over the volume of loans between Lincoln, San Jacinto, Silverado and MDC.

During the committee’s recent hearings into Lincoln’s collapse, Rep. Jim Leach (R-Iowa) suggested that Milken be subpoenaed to explain his relationship with Lincoln.

A spokesman for Milken said he would have no comment on the investigations. Calls by The Times to American Continental and Southmark were not returned.

Spencer Browne, executive vice president of MDC, said the company knew of no investigation other than one it resolved with the SEC last September without admitting any wrongdoing. The inquiry concerned the company’s record keeping and reporting for eight real estate transactions, including a land swap with Lincoln Savings that was cited in the racketeering suit against Keating and the others.

When it was closed by regulators last April, Lincoln had about $620 million of its assets invested in junk bonds. Bailing out Lincoln’s insured depositors is expected to cost taxpayers about $2 billion.

Silverado, which also owned junk bonds, was Colorado’s third-largest thrift when it was taken over by regulators in late 1988. President Bush’s son Neil served as a director until a few months before Silverado failed. Western Savings also owned substantial amounts of junk bonds, and both it and Silverado had financial dealings with MDC Holdings.

No one has been charged with any wrongdoing in the inquiries. One source said that it would be several months before investigators determine whether laws were violated.

This much is already clear: Milken had relationships with the heads of many high-flying thrifts and real estate companies.

“You find Milken prominently placed in Charlie Keating’s Rolodex,” said an investigator who has examined internal Keating business documents.

Larry A. Mizel, MDC’s chairman and chief executive, has been a Milken confidant and speaker at Drexel’s annual junk bond conference in Beverly Hills. MDC grew rapidly as a national home builder using junk bonds issued through Drexel.

Relationships between companies involved in the inquiries often involve several subsidiaries and are difficult to follow, although some details already have come out in civil suits.

The racketeering suit against Keating and six executives of American Continental claims that Lincoln will lose more than $20 million as a result of a series of unlawful loans and transactions between Lincoln affiliates and entities owned by Southmark.

The transactions involved the purchase of Detroit’s Hotel Ponchartrain by a partnership that included Keating and several family members. The lawsuit says that Southmark’s San Jacinto Savings lent the partnership $38 million as part of a scheme to conceal illegal transactions from the regulators. In exchange, the suit says, San Jacinto received fees of $1.6 million, and Southmark was granted “major concessions” by Lincoln.

Manning declined to identify the concessions granted by Lincoln, which owned a chunk of Southmark’s junk bonds. But he said he is investigating other transactions between Lincoln and Southmark.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.