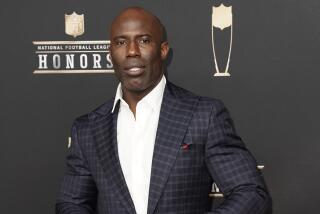

UAL Invites Marvin Davis to Rejoin the Bidding War : Airlines: The parent of United says Davis is free to resume buying shares. He had promised not to purchase more stock after making a takeover bid last summer.

- Share via

NEW YORK — UAL Corp., in an apparent effort to fend off a proxy fight, on Friday invited Los Angeles financier Marvin Davis to return to the bidding war for the company.

The company, which is the parent of United Airlines, the nation’s second-largest air carrier, said its board of directors would allow Davis to resume his purchase of UAL shares. Last summer, when he made a takeover bid for UAL, Davis signed a so-called standstill agreement barring him from buying any more UAL common stock. In return he was given permission to inspect UAL’s books.

Davis also tried to buy NWA Inc., parent of Northwest Airlines, last summer before a successful buyout was made by an investment group headed by another Los Angeles investor, Alfred A. Checchi.

It has never been disclosed how much UAL stock Davis holds, but it must be less than 5% of the total outstanding or he would have been required to file a statement with the Securities and Exchange Commission.

Neither UAL nor Davis and his spokesmen would comment Friday, and it could not be learned whether he had accepted an overture from the UAL board or if he had taken the initiative after the board on Thursday put the carrier on the auction block again.

On Monday, UAL’s three major labor unions, along with the New York investment firm of Coniston Partners, made an offer to buy UAL for a combination of cash, debt and stock in the restructured company. Most analysts estimated the value of the offer at around $4.1 billion.

UAL stock rose $5.125 on the New York Stock Exchange on Friday, closing at $157.125

The UAL board said Thursday that it would be willing to negotiate with Coniston and the unions but that the offer was too low. Coniston is UAL’s largest single shareholder, with about 11.8% of the total shares outstanding.

The board went on to say that it would consider “asset dispositions . . . proposals for the purchase of the entire company by other parties and . . . all other alternatives.”

“I have heard from arbitragers that Davis wants to make a play for the company,” Samuel C. Buttrick, airline analyst with the New York investment house of Kidder, Peabody & Co., said Friday. “With the board publicly stating that an employee offer is below value, it makes sense for them to remove legal obstacles. But I don’t know what Davis is going to do.”

Davis had bid $275 a share for UAL last August in a deal that would have been worth about $6.2 billion. But the company eventually accepted a $300-a-share offer worth $6.75 billion from a group led by the pilots union and UAL top management. British Airways would also have been an investor. However, the deal fell through in October when financing could not be obtained.

Condor Partners, a company owned by Coniston Partners, has said it plans to conduct a proxy fight to oust the UAL board at the annual meeting scheduled for April 26. It added that it would not try to arrange financing for the purchase until after a successful outcome of the proxy fight.

Keith Gollust, a principal in the Coniston firm, declined Friday to comment on the renewed involvement by Davis. But he said, “we have been urging UAL for three months to release Davis (from the standstill agreement). It is not in the interest of the stockholders to restrict anyone.”

Daniel A. Hersh, airline analyst with the Los Angeles investment firm of Bateman Eichler, Hill Richards, said: “I think there is going to be another bid (for UAL). I think the board needs to cover itself. This is a technical situation. I don’t even know if Marvin Davis is interested.”

But others think that Davis, seeing the board’s reaction to the union-Coniston offer, took the initiative.

“It looks like his advisers are stirring up the pot a bit,” said Timothy Pettee, airline analyst with the Merrill Lynch investment firm. “Whether or not he does something remains to be seen.”

Pettee said Coniston might not be unhappy if another investor offers a higher price for UAL. He noted that the value of the partnership’s investment in the airline company had been down by about $414 million at one time and is still about $100 million below the purchase price.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.