CURRENCY : Dollar Slides on Word of Budget Talks

- Share via

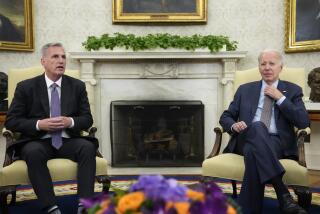

The dollar fell sharply Wednesday on news that the White House and Congressional leaders have agreed to work on a bipartisan program to cut the U.S. budget deficit.

Analysts said the move was widely expected to lead to higher taxes, which would reduce the Treasury’s borrowing needs, thereby allowing interest rates to fall. Lower U.S. rates tend to make the dollar less attractive against other foreign currencies.

Traders and currency analysts also noted that the strength of the West German mark and the Swiss franc accounted for much of the dollar’s losses, although the dollar also fell sharply against the Japanese yen.

The dollar closed at 1.6355 West German marks in New York, compared to 1.6575 Tuesday, and at 156.45 yen, off from 157.55.

The dollar traded at 1.4020 Swiss francs late Wednesday in New York, down sharply from 1.4310 francs late Tuesday. In London, the dollar fell to 1.4039 Swiss francs from 1.4332 late Tuesday.

Doug Madison of BankAmerica said cutting the deficit and the possible move to lower rates “removes a prop from the dollar short term.”

But he said it was a good news-bad news situation with the intensified effort to cut the deficit having obvious favorable economic consequences over the longer term.

“The abruptness of the drop caught people by surprise,” one trader said.

Lower U.S. interest rates could result if President Bush goes ahead with plans to seriously attack the budget deficit, possibly by raising taxes, analysts said.

“A smaller deficit means lower rates and that equals a lower dollar,” said Bob Hatcher at Barclays Bank.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.