3 Americans Get Nobel Prize in Economics : Award: The trio is honored for pioneering work in applying modern economic theory to corporations and financial markets.

- Share via

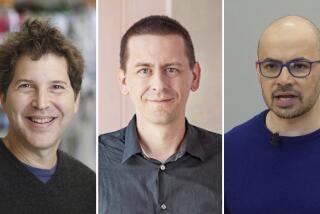

WASHINGTON — Three American economists, including a Stanford University professor whose work helped lay the foundation for creation of mutual funds and advanced the understanding of financial markets, were jointly awarded the Nobel memorial prize in economics Tuesday.

Professors William F. Sharpe of Stanford, Harry F. Markowitz of City University of New York and Merton H. Miller of the University of Chicago, will share in the $700,000 prize from the Swedish Academy of Sciences.

The three were among the first economists to apply modern economic theory to the study of corporations and financial markets.

Sharpe, 56, and Markowitz, 63, are widely credited with discovering the basic investment strategies that are now followed by virtually every money manager and large investor in the world. The two economists, who worked together earlier in their careers, developed the economic theory, based on rigorous mathematics, that showed that investors should widely diversify their stock holdings to minimize risks while maintaining high returns.

Markowitz developed the theories in the 1950s, and Sharpe refined those ideas in the 1960s in ways that made them practical for use by investors. Sharpe invented the “beta coefficient,” a mathematical index widely used by investment managers to determine how best to diversify their stock holdings.

“Sharpe’s work provided a very practical guide to portfolio diversification for the modern investor,” said Kenneth Arrow, an economics professor at Stanford and a former Nobel prize winner.

“Without Markowitz’s work, I don’t think you would have seen the growth in mutual funds that you see today,” added Howard Ross, chairman of the economics and finance department at Baruch College. “The money managers have all followed his principles.”

Markowitz, who is now a visiting professor at the University of Tokyo in Japan, said he was surprised by the award, adding that he “will be happy when the attention dies down, and I can go back to my students and to the blackboard.”

Sharpe, who was attending a conference in Arizona Tuesday, deferred to Markowitz, saying that his work only followed up on that of the older economist. “I owe him a huge debt,” Sharpe said.

Miller, meanwhile, is widely considered a pioneer in helping to develop the modern field of financial research and is one of the nation’s leading experts in the study of stock and commodities markets. Following the stock market crash in October, 1987, he issued a controversial study that challenged the Treasury Department’s contention that the growing power of Chicago’s new stock index futures markets brought on the crash.

“Miller is really a legendary figure,” said Murray Weidenbaum, director of the Center for the Study of American Business at Washington University in St. Louis, and a former chairman of the Council of Economic Advisers under former President Ronald Reagan.

In an interview Tuesday, Miller, 67, said he believes that by jointly awarding all three economists, the prize was a form of recognition for the relatively new field of finance. Until the 1950s, he noted, economists had never attempted to apply hard economic theory to the study of the behavior of corporations and stock markets.

“The fact that they gave it to the three of us shows they were honoring the whole field,” said Miller, who has taught at the University of Chicago since 1961. “We were all pioneers. We helped get the field of finance up and running. The field of finance has come of age, and this was their way of showing that we in finance are now in the mainstream of economics.”

George Stigler, Miller’s colleague at Chicago and also a Nobel winner, added that the link between the work of Miller and the other two economists is that they all pioneered the use of sophisticated analytical methods in their field. “They were all among the first to say, ‘Let’s use modern economic theory to see how corporations behave and act,’ ” Stigler said.

The economics prize was instituted in 1968 by Sweden’s Central Bank to complement the five prizes established in the will of dynamite inventor Alfred Nobel. Nobel’s original prizes in physics, chemistry, medicine, peace and literature have been awarded since 1901.

The Nobel physics and chemistry prizes are to be announced today.

Soviet President Mikhail S. Gorbachev was awarded the peace prize on Monday. Mexican poet and essayist Octavio Paz won the prize in literature, and Americans Joseph E. Murray and E. Donnall Thomas won the prize in medicine.

The prizes are presented on Dec. 10, the anniversary of Nobel’s death in 1896.

Some economists said they believe that Miller should have shared in the Nobel prize in 1985, when American economist Franco Modigliani won, primarily for work on which Miller had collaborated. Indeed, their work was known as the Modigliani-Miller propositions of corporate finance. “It would have been easy for him to have shared it with Modigliani,” said Stigler.

Miller said that when Modigliani won and he didn’t, “I thought that was it for me.”

THE THEORIES

Markowitz’s theories, developed in the 1950s and refined by Sharpe a decade later, showed how investors can diversify their stock holdings to obtain the minimum risk at a given return. Their work helped spur the success and popularity of mutual funds.

Miller disproved popular beliefs about how a corporation’s stock price is affected by the size of its dividends, and how its debt level affects its value.

WILLIAM F. SHARPE Stanford University Age: 56 born: Cambridge, Mass. education: UCLA background: Timken professor emeritus of finance, Stanford; University of Washington; UC Irvine; president, William F. Share Associates, a consulting firm; past president of the American Finance Assn.

HARRY M. MARKOWITZ

City University of New York

age: 63

born: Chicago

education: University of Chicago

background: RAND Corp., UCLA, Arbitrage Management Co., T. J. Watson Research Center at IBM.

author: Portfolio Selection: Efficient Diversification of Assets, 1959; Mean-Variance Analysis in Portfolio Choice, 1987; co-author: SIM-SCRIPT Simulation Programming Language.

MERTON H. MILLER

University of Chicago

age: 67

born: Boston

education: Harvard University, Johns Hopkins University

background: Treasury Department, Federal Reserve Board, London School of Economics, Carnegie Institute

co-author: Theory of Finance, 1972; Macroeconomics, 1974

NOBEL PRIZE WINNERS IN ECONOMICS SINCE 1969

1990: Harry M. Markowitz, William F. Sharpe, Merton H. Miller, United States

1989: Trygve Haavelmo, Norway

1988: Maurice Allais, France

1987: Robert M. Solow, United States

1986: James M. Buchanan Jr., United States

1985: Franco Modigliani, United States

1984: Richard Stone, Great Britain

1983: Gerard Debreu, United States

1982: George J. Stigler, United States

1981: James Tobin, United States

1980: Lawrence R. Klein, United States

1979: Arthur Lewis, Great Britain, and Theodore W. Schultz, United States

1978: Herbert A. Simon, United States

1977: Bertil Ohlin, Sweden, and James Meade, Great Britain

1976: Milton Friedman, United States

1975: Leonid Vitalievich Kantorovich, Soviet Union, and Tjalling Koopmans, United States

1974: Gunnnar Myrdal, Sweden, and Friedrich August von Hayek, Great Britain

1973: Wassily Leontief, United States

1972: John R. Hicks, Great Britain, and Kenneth J. Arrow, United States

1971: Simon Kuznets, United States

1970: Paul A. Samuelson, United States

1969: Ragnar Frisch, Norway, and Jan Tinbergen, the Netherlands

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.