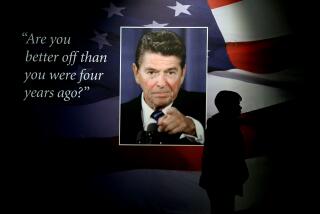

COLUMN RIGHT/ PAUL CRAIG ROBERTS : Supply-Side Prescription Was the Cure : A decade of success has proven Reagan right, no matter what the politicians try to say.

- Share via

On Aug. 13, 1981, the most controversial redirection of U.S. economic policy since Franklin D. Roosevelt’s New Deal took place as President Reagan signed into law the Economic Recovery Tax Act--his Administration’s tax-rate reduction bill.

At the time, critics of the law’s supply-side policy basis predicted that it would result in excessive consumption and debt, rising inflation, an inability to compete, deindustrialization and a dangerous dependency on foreigners. Supporters promised that better incentives would refurbish the economy, increasing productivity and restoring the economy’s ability to grow and create jobs without rising rates of inflation.

Ten years later, the facts are in. Far from supporting a gloomy picture of failure, they show resounding success. The Reagan economy gave us the longest peacetime economic expansion in our history and it did so without reigniting inflation. The inflation rate was relatively low and stable throughout the long expansion, averaging 4.7% per year from 1981-90, compared to 7.9% during the previous decade.

The financial markets saw these real developments and ignored the gloomy prognostications that sought to shake the public’s confidence in the Reagan economy. Stocks and bonds soared in value, but the political left held to the bitter end its view that the supply-side economy was a house of cards that would come crashing to the ground in the next recession.

The dire prediction of collapse was based on the belief that unprecedented levels of debt would cripple the economy with massive bankruptcies. Tales of declining savings rates and excessive leverage to finance corporate takeovers dominated the news. However, as Morgan Stanley’s chief economist, John D. Paulus, has noted, both non-financial corporations and households added to their assets more than they added to their debts, so their net worths rose rather than declined. This increase in wealth proved to be an untenable basis for predicting collapse.

There is every indication that American companies, on the whole, used the money they borrowed to strengthen their positions and become more competitive in the world economy. The Commerce Department, prompted by criticisms that government statistics were failing to detect a weakening in the nation’s industrial base, undertook a 2 1/2-year study of American manufacturing. The study was released earlier this year and shows that the 1980s were years of an almost unbelievable productivity revival in U.S. factories. During the 1970s, U.S. industrial productivity was growing at only one-third the pace of our major trading partners. In the 1980s, our productivity growth tripled, and now matches the average pace of our competitors. Far from losing competitiveness, the United States has enjoyed an unprecedented export boom and accounts for a record percentage of the exports of the seven largest exporting nations. Moreover, our factory output now accounts for 23.3% of GNP, a return to the level of the 1960s, when unrivaled U.S. factories were humming.

The picture of the United States as a nation of spendthrifts with a mortgaged future is still encountered in the popular media, but economists refute it. John Tatom of the Federal Reserve Bank of St. Louis reports that investment’s share of GNP in the 1980s “was unprecedented in the post-World War II era.” Robert Lipsey of Queens College and Irving Kravis of the University of Pennsylvania found that on a per-capita basis, the United States has a capital formation rate 25% higher than the average rate of industrialized countries. “The real bottom line,” say State Department economists William Dewald and Michael Ulan, is that the “nation has grown wealthier.”

Reagan’s critics have claimed that the 20 million new jobs created during his presidency were low-skilled and dead-end. This image of the United States as a nation of hamburger-flippers was destroyed when the U.S. Bureau of Labor Statistics reported that the percentage of new jobs in higher-skilled categories was much larger in the 1980s than in the 1970s. Janet L. Norwood, commissioner of the bureau, told Congress in August, 1988, that low-skilled jobs are “not growing as fast as those that require a lot of training.” Experts today speak of a “skills gap” created by the number of skilled jobs growing more rapidly than our educational system can train people for them.

Reaganomics showed that capitalism remained the engine of economic progress and inspired the worldwide retreat from socialism in the 1980s. Reagan earned our votes by fixing the economy. The politicians will wreck it again, but don’t despair. We can refill the supply-side prescription.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.