Jury Selection in Final Stages for Keating Trial : Courts: Federal civil fraud, racketeering case of former Lincoln S&L; owner and more than a dozen co-defendants could take six months.

- Share via

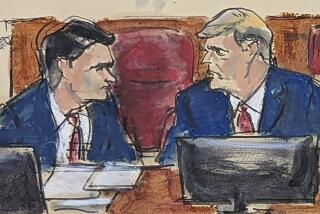

TUCSON — In a federal courtroom reconfigured to accommodate a rash of high-tech equipment, final jury selection began Monday in the civil fraud and racketeering trial of former Lincoln Savings & Loan owner Charles H. Keating Jr. and more than a dozen co-defendants.

U.S. District Judge Richard M. Bilby said his courtroom looked “ready for a rock concert.” It is equipped with side-by-side, 84-inch-diagonal high-definition projectors for showing documents and videotaped depositions, as well as with large television monitors, computers and printers.

So many lawyers are involved that only two rows of seats are left for spectators--and one row is reserved for reporters.

“This is really a fascinating case,” the judge told a panel of prospective jurors. “The trial could be the most interesting case you’ll ever hear. It’s filled with fascinating issues. And you’ll see some of the best lawyers in the country.”

The complex proceeding--a consolidation of 15 federal and state class-action lawsuits--is expected to last up to six months.

About 23,000 investors in Lincoln’s parent company, American Continental Corp., contend that they were defrauded by Keating and the lawyers, accountants, investment bankers, appraisers and other professional advisers that Keating hired.

Most of the investors were Lincoln customers who bought corporate bonds at the S&L;’s Southern California branches. They lost nearly $200 million after the Irvine thrift and its Phoenix parent collapsed three years ago. Altogether, all bondholders and minority shareholders outside of Keating’s circle lost more than $300 million.

So far, 40 defendants have settled for about $38 million in cash and guarantees to pay $32.5 million more if plaintiffs don’t recover that amount from defendants still in the case.

The investors don’t receive any money from the settlement that some defendants have made with federal regulators, such as Sunday’s $41-million deal that the Office of Thrift Supervision obtained from Kaye, Scholer, Fierman, Hays & Handler, the New York law firm that long handled American Continental’s securities work.

The federal settlements cover Lincoln’s estimated $2.6 billion in losses, a taxpayer cost that makes Lincoln the biggest thrift failure to date.

At the trial in Tucson, the court initially sent out 2,750 questionnaires to area residents seeking people able to sit for a six-month trial. The responses left 331 people available, and a second questionnaire identifying the case was sent to them to determine if they had any biases that would excuse them from jury duty.

Each person detailed answers to about a dozen questions, ranging from birthplace, hobbies, latest books read and movies seen to most-admired people and their inner feelings about the savings and loan debacle, punitive damages and jury awards of millions of dollars.

The court and lawyers on both sides reviewed those responses last week, whittling the number of prospective jurors down to about 180 people. Bilby began Monday questioning each of them to come up with a 12-person jury.

The judge asked prospective jurors a series of questions to explore their views, and told each to apply the “Golden Rule: How you would want the prospective jurors to answer these questions if your child were on trial.”

Most of the prospective jurors questioned said they had no sharp opinions on problems of the country’s savings and loans. But one man, a retired Tucson police officer had said in his questionnaire that he thought it occurred because of “greed, ego and stupidity.”

Asked to elaborate on his answer, he told the judge: “Someone was always out to make a fast buck, and it builds their ego. They think they’re better than anybody else. It just has to do with personality.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.