Big Money in Tiny Chips : LSI Logic Is Mining a New Vein in Application-Specific Computer Circuits

- Share via

IRVINE — Today’s “smart” weapons of war are packed with bulky electronic circuit boards. So imagine the possibilities if someone could figure out a way to shrink an entire circuit board onto a thumbnail-sized microchip.

Figure that out, and you might even be able to turn a profit at a time of shrinking Pentagon budgets. And that’s just the strategy that one chip maker, LSI Logic Corp., is counting on to survive in the troubled defense industry.

As Pentagon budgets demand reductions in the cost of military hardware, defense contractors are trying to stay competitive by using custom chips, or application-specific integrated circuits. Known as ASICs, they can replace aging, bulkier electronic hardware.

Orange County contractors are among those trying such a strategy. If it succeeds, they might be less likely to leave Southern California for cheaper production sites elsewhere, officials say, because the jobs they provide will revolve around engineering rather than manufacturing.

For those reasons, the message of publicly held LSI is finding a wide audience in Anaheim this week at the Design Automation Conference, a computer design show with 125 exhibitors that drew 10,000 visitors through Wednesday. LSI, based in Milpitas, makes computerized chip-design tools and manufactures custom semiconductor chips.

LSI got 10% of its $698 million in 1991 revenue from the aerospace and defense business, and much of that came from Southern California, said MaryBeth Rotermund, director of LSI’s military and aerospace marketing.

“I’ve already booked 60% of the business that we did last year in aerospace designs,” Rotermund said. “Instead of doom and gloom in defense, we’re looking at the strongest year we’ve ever had.”

LSI’s customers include some of Orange County’s biggest military contractors: Hughes Aircraft Co. in Fullerton, Interstate Electronics Inc. in Anaheim, McDonnell Douglas Space Systems Co. in Huntington Beach, Loral Aeronutronic in Newport Beach and Rockwell International Corp. in Anaheim.

To be sure, computer-aided designs, known as CADs, don’t bring in the dollars for defense contractors that production contracts can. Greg Sheppard, an analyst at Dataquest Inc., a market research firm in San Jose, said that only a few chip suppliers will survive in the aerospace ASIC market.

“CAD tools have been around for a few years, and they won’t buoy the industry,” said Alex Lepis, a manager at Hughes Ground Systems Group in Fullerton. “But it’s clear that you have to have them to stay competitive.”

Electronic hardware used to account for perhaps 5% of a military system’s cost. But with its increasing sophistication, it now often accounts for 20% of the cost, said Bruce Entin, an LSI vice president.

That means design engineers who don’t have the best computer-aided design tools, which allow them to overhaul a faulty design on short notice, are going to become obsolete, Rotermund said.

“The defense budget continues to slide, but LSI’s business is growing at the expense of the older alternatives of packing electronics together,” said Millard Phelps, an analyst at Hambrecht & Quist investment bank in San Francisco.

Last year, Hughes Aircraft selected LSI Logic as a partner to supply all of its computer-aided design hardware. Since 1982, Hughes’ Ground Systems Group has designed more than 150 custom chips with LSI’s tools, Lepis said.

“We had one design that shrank from a package of seven circuit boards down to a single chip,” Lepis said.

One reason LSI continues to grow in the aerospace industry is that its latest design tools and production lines allow as many as 2.4 million transistors to be laid on a single piece of silicon the size of a thumbnail. That task is as complicated as putting a street map of North America on a chip.

That is more than 100 times what could be put on a one-of-a-kind custom chip a decade ago, Rotermund said. Few domestic competitors can make similar boasts, analysts say.

“It’s an age of specialization,” said Jerry Worchel, an analyst at In-Stat, a Scottsdale, Ariz., market research firm. “In the military, the reason that ASICs are growing is that they are used to upgrade old electronic equipment when you can’t afford a brand-new system.”

LSI, founded in 1981, pioneered the ASIC market. Its nearest competitors are Japanese electronic giants such as Fujitsu Ltd. LSI dominates the U.S. military market, however, because the Pentagon is wary of relying on foreign companies for military components, Worchel said.

Other domestic competitors include Motorola Inc. in Schaumburg, Ill.; VLSI Technology Inc. in San Jose; and Texas Instruments in Dallas. AT&T; Co. pulled out of the market a year ago.

In 1991, LSI posted a profit of $8 million, contrasted with a loss of $30 million the previous year. Revenue grew 6.5% to $698 million from $655 million.

LSI’s sales dominate among military ASICs chip makers, partly because LSI got an early start.

“Some projects won’t go to production, so we are trying to make money based on our engineering charges,” said Tom Smith, manager at TI’s Military Products Division in Midland, Tex.

ASIC sales were $5.9 billion worldwide last year, according to In-Stat. By 1996, ASIC sales are expected to reach $16.1 billion, surpassing those in the standard memory-chip market.

The military share of the ASIC market is also expected to grow--from $539 million in 1991 to $1.1 billion in 1996, Worchel said. That 16% annual growth rate is expected to outpace the overall consumer market for ASICs, though it will be slower than the 23% growth rate for ASICs in the computer market.

“I personally believe that the companies that survive in the dwindling aerospace business will rely on advances in technology like this,” said John Dowell, program manager for advanced development at Teledyne Systems Co. in Northridge.

Teledyne Systems, a subsidiary of Teledyne Corp., has used LSI’s design tools for several years to build a wide array of computer components such as airborne navigation or fire control computers.

At Hughes, LSI’s tools have been used to build chips for a wide range of products, including torpedoes, communications equipment, satellites and radars.

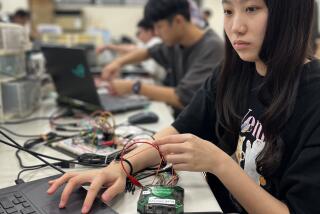

LSI customers flock to the company’s design center in Irvine, one of 50 around the world, where LSI has 15 employees. Engineers consult a library of designs that can be reused like building blocks for custom chips.

“It’s like the old Mark Twain saying,” Entin said. “Rumors of the death of the military-aerospace business have been exaggerated.”