How Clinton Cold Shoulder Is Doing Japan a Favor

- Share via

Relations seem to be worsening again between the United States and Japan. The Clinton Administration has told Prime Minister Kiichi Miyazawa to postpone his proposed visit to Washington until April--and not to come at all unless his government cuts taxes to boost Japan’s domestic economy.

It may sound odd, but America’s calculated rudeness is doing Japan a favor. Some Japanese understand that, and if you understand it, too, you can pick your way through the maze of U.S.-Japan relations today--and learn something of how the world really works.

Never a simple matter, American perceptions of Japan--and Japanese understandings of America--are at their most confused now. On the one hand, Japan’s immense trade surpluses--$107 billion in trade with the world last year, $43 billion in trade with the United States--support the image of an industrial juggernaut: skillful, unstoppable, somewhat malevolent.

But at the same time, Japan’s economy is in recession. Its once vaunted banks are on the verge of collapse, their balance sheets artificially supported by Japanese government purchases of stock on the Tokyo exchange and discouragement of major sellers of stock. In the fairy tale world, Peter Pan asked people to clap their hands so that Tinker Bell might live; in Japan today, the government is asking everyone to clap furiously to keep the economy afloat.

It won’t work. Japan is coming down from the greatest speculative bubble the world has ever seen. At its height, Japan’s land values supposedly totaled $20 trillion, or four times that of the whole United States--which is 25 times larger than Japan and more productive. As court cases and criminal convictions have revealed, Japan’s bubble was swelled by a web of illegal transactions, political payoffs and collaborations between business and organized crime.

It was an artificial market with genuine consequences: company share prices were based on bloated land values, and those shares in turn provided collateral for bank loans.

Since 1989 the government has been trying to let the air out of the bubble slowly, by hiking interest rates and restricting money supply. One result is today’s recession, which Tokyo economists, such as Richard Koo of Nomura Research Institute, predict will get worse.

Japanese stock prices have fallen almost 60% from their highs, but still are 2 1/2 times the relative value of shares in U.S. markets. Most analysts predict further declines.

While the easy money lasted, Japanese companies invested heavily to build factories and facilities. Now they are stuck with overcapacity. Profits are down or losses have begun for many prominent firms--Matsushita Electric, Nissan--and bankruptcies are rising for smaller firms.

Moreover, notes Richard Drobnick, head of an Asian economy program at USC, some of the plant and equipment is effectively worthless because it is obsolete--built for a stage in semiconductor or computer technology that now has passed. Far from being juggernauts, Japan’s big companies are candidates for restructuring.

All of that helps explain the curious pattern of Japan’s trade surpluses. Exporters are dumping goods where they can but not making much profit from the sales. And Japanese exports to the United States have declined since 1989. The trade surpluses result mostly from a lack of growth in Japanese imports. Its economy in recession, Japan is not buying U.S. goods--or much of anybody else’s either.

The foreign trade surpluses are being reinvested outside Japan, say experts in global finance. Some are going to Europe, buying the German government’s high-interest bonds, says John Mueller of Lehrman Bell Mueller Cannon, a research firm in Arlington, Va. Some investment continues to come to the United States, to expand successful automobile operations in Tennessee and Kentucky.

But the money is not finding opportunity at home in Japan because the domestic economy is underdeveloped. One of the richest countries in the world by many measurements, Japan is poor in the amenities of everyday life. Fewer than half its people have the basic sewage systems that other countries take for granted. Japan’s cities have only one-sixth the park area of Paris, one-tenth that of New York.

In part this deprivation stems from Japan’s determined effort to recover from World War II. It has been a planned economy that stressed industrial production--like the Soviet economy, but more successful because it could ship goods to the big U.S. market.

But now that system has become counterproductive. And that’s why the U.S. is urging Japan to develop a consumer economy. “Japanese young people have begun to notice what they’re missing,” says William Ouchi, professor at UCLA and expert on the business systems of the U.S. and Japan. “They need American-style furniture stores selling good stuff at reasonable prices”--instead of typical Japanese stores, which sell merchandise for 40% more than consumers pay in virtually any other country.

Yes, you say, but who is the U.S. to dictate to Japan? It is Japan’s big customer--saying that Japan can no longer live by dumping its goods on others. And it is Japan’s friend--possibly its only friend.

Japan lives in a dangerous region, in which China is emerging to lead Asia--and arming itself rapidly. Japan wonders why China wants to buy an aircraft carrier from the Russian military. And it ponders the build-up of India’s navy, and reports of nuclear weapons in North Korea. The Cold War is over and Japan may be in peril--which is why Japan faces a big decision in the ‘90s on the level of armed forces it wants and needs.

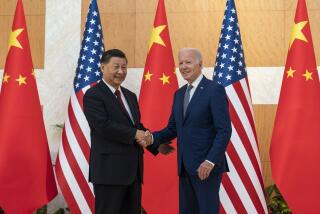

So when the new U.S. President and Japanese Prime Minister do get together, they’ll have a lot to talk about. --

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.